Three Premier UK Dividend Stocks Offering Yields From 4.4% to 9.9%

Amid a backdrop of subdued global cues and political turbulence in Europe, the UK stock market has experienced a challenging period, with the FTSE 100 marking its fourth consecutive weekly loss. In such uncertain times, investors often look for stability and consistent returns, qualities typically found in premier dividend stocks.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.22% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.62% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 6.56% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.23% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.07% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.74% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.66% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.19% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.08% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.55% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Shoe Zone

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shoe Zone plc is a UK-based footwear retailer with a market capitalization of approximately £80.90 million.

Operations: Shoe Zone plc generates its revenue primarily through its footwear retailing activities, totaling £166.74 million.

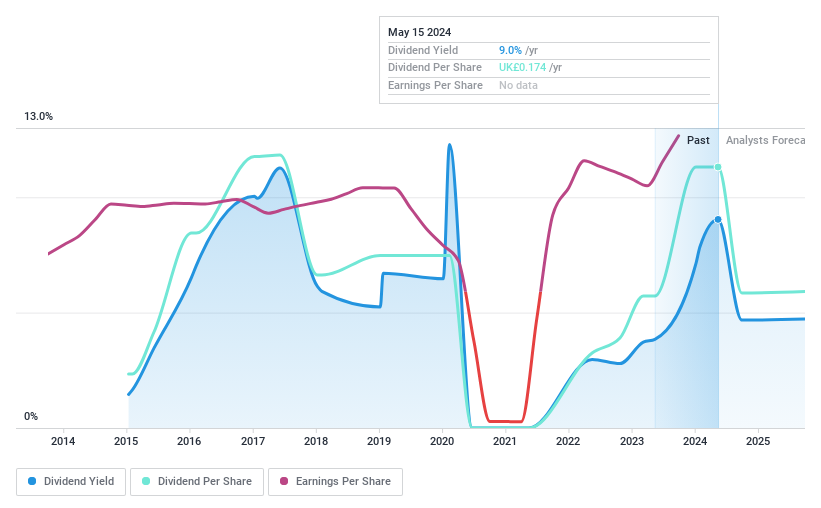

Dividend Yield: 9.9%

Shoe Zone plc recently confirmed an interim dividend of 2.5 pence per share, payable on 14 August 2024, demonstrating a commitment to shareholder returns despite its unstable dividend history and forecasted earnings decline of 18.4% annually over the next three years. The dividends are well-covered by both earnings and cash flows, with payout ratios at 35.8% and 30%, respectively. However, the company's dividend track record is marred by volatility and a short history of less than ten years in consistent payouts.

M&G Credit Income Investment Trust

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M&G Credit Income Investment Trust plc focuses on investing in a diverse portfolio of public and private debt and debt-like instruments, with a market capitalization of approximately £139.51 million.

Operations: M&G Credit Income Investment Trust plc generates its revenue primarily from financial services in closed-end funds, totaling £15.36 million.

Dividend Yield: 8.1%

M&G Credit Income Investment Trust plc has shown a recent uptick in profitability, reporting a net income of £13.31 million for 2023 after a loss the previous year, and declared an interim dividend of 2.15 pence per share, payable on May 24, 2024. Despite this progress and a competitive price-to-earnings ratio of 10.5x below the UK market average, the trust's dividend history remains relatively unstable with significant fluctuations over its short five-year payout period. The dividends are currently supported by earnings with an 84.8% payout ratio and further backed by cash flows at a cash payout ratio of 57.4%.

Morgan Sindall Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Sindall Group plc is a UK-based construction and regeneration company with a market capitalization of approximately £1.19 billion.

Operations: Morgan Sindall Group plc generates its revenue from several key segments: Fit Out (£1.11 billion), Construction (£966.60 million), Infrastructure (£886.70 million), Partnership Housing (£837.50 million), Property Services (£185.20 million), and Urban Regeneration (£185.30 million).

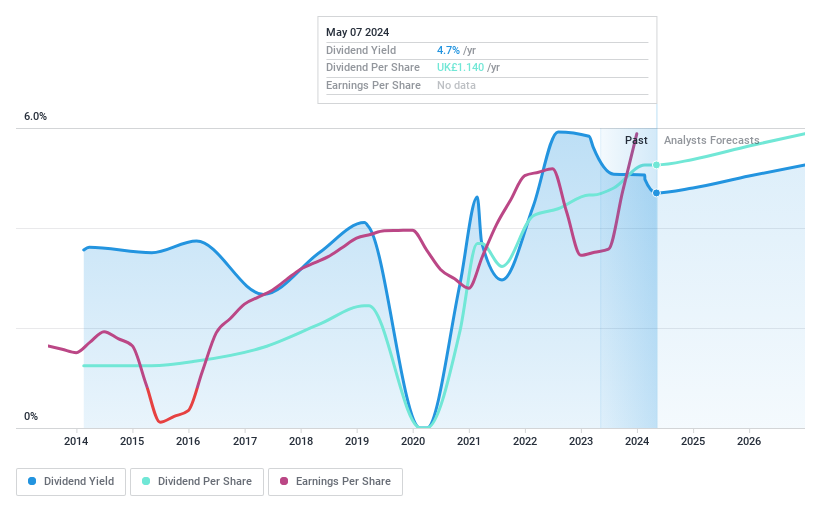

Dividend Yield: 4.4%

Morgan Sindall Group plc has demonstrated a mixed track record in dividend reliability, with payments showing volatility over the past decade despite recent increases, including a final dividend of 78 pence for 2023 approved at their AGM on May 2, 2024. The dividends are moderately covered by earnings and cash flows with payout ratios of 44.8% and 29.1% respectively. However, its dividend yield of 4.43% trails behind the top UK payers. The company's stock is trading at a significant discount to estimated fair value, suggesting potential undervaluation relative to its financial performance and market position.

Summing It All Up

Click through to start exploring the rest of the 57 Top Dividend Stocks now.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:SHOE LSE:MGCI and LSE:MGNS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance