Those Who Purchased UUV Aquabotix (ASX:UUV) Shares Three Years Ago Have A 99% Loss To Show For It

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So consider, for a moment, the misfortune of UUV Aquabotix Limited (ASX:UUV) investors who have held the stock for three years as it declined a whopping 99%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the ride hasn't got any smoother in recent times over the last year, with the price 90% lower in that time. The falls have accelerated recently, with the share price down 50% in the last three months. Of course, this share price action may well have been influenced by the 22% decline in the broader market, throughout the period.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for UUV Aquabotix

UUV Aquabotix recorded just AU$330,818 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that UUV Aquabotix can make progress and gain better traction for the business, before it runs low on cash.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some UUV Aquabotix investors have already had a taste of the bitterness stocks like this can leave in the mouth.

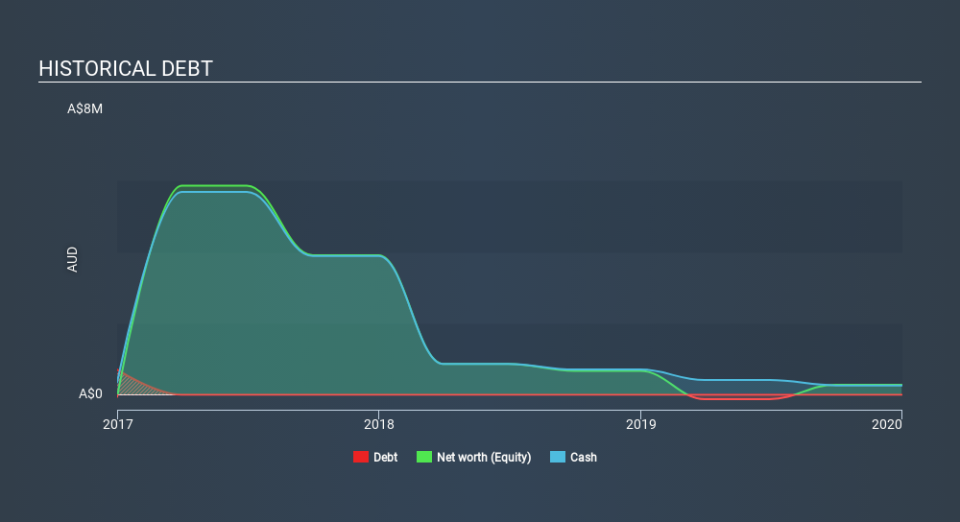

UUV Aquabotix only just had cash in excess of all liabilities when it last reported. So it's prudent that the management team has already moved to replenish reserves through the recent capital raising event. The cash situation might not explain why the share price is down 81% per year, over 3 years. You can click on the image below to see (in greater detail) how UUV Aquabotix's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

UUV Aquabotix shareholders are down 90% for the year, falling short of the market return. Meanwhile, the broader market slid about 11%, likely weighing on the stock. The three-year loss of 80% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand UUV Aquabotix better, we need to consider many other factors. For instance, we've identified 4 warning signs for UUV Aquabotix (3 make us uncomfortable) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance