Those Who Purchased Brookside Energy (ASX:BRK) Shares Five Years Ago Have A 99% Loss To Show For It

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Imagine if you held Brookside Energy Limited (ASX:BRK) for half a decade as the share price tanked 99%. And we doubt long term believers are the only worried holders, since the stock price has declined 29% over the last twelve months. It's down 9.1% in the last seven days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Brookside Energy

With just AU$1,119,718 worth of revenue in twelve months, we don't think the market considers Brookside Energy to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Brookside Energy will discover or develop fossil fuel before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Brookside Energy has already given some investors a taste of the bitter losses that high risk investing can cause.

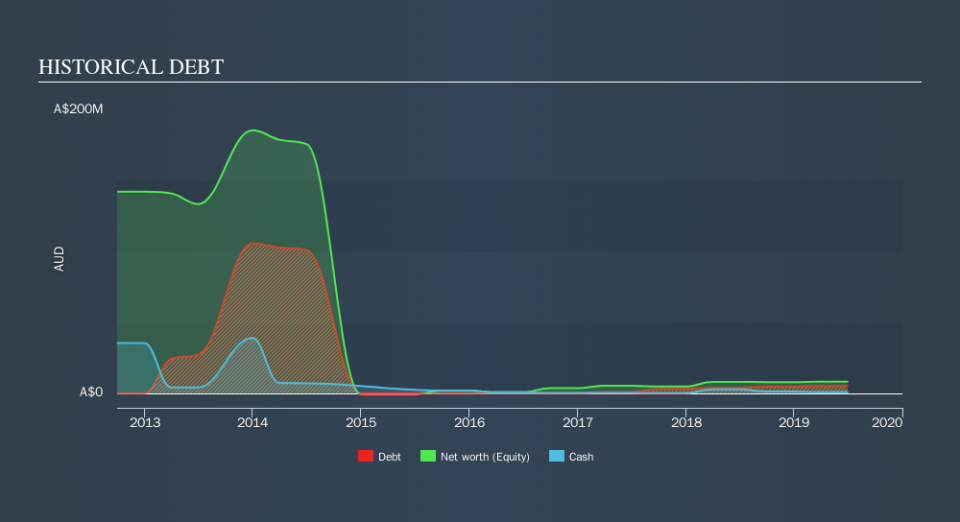

Brookside Energy had liabilities exceeding cash by AU$4,511,094 when it last reported in June 2019, according to our data. That makes it extremely high risk, in our view. But with the share price diving 65% per year, over 5 years, it's probably fair to say that some shareholders no longer believe the company will succeed. The image below shows how Brookside Energy's balance sheet has changed over time; if you want to see the precise values, simply click on the image. The image below shows how Brookside Energy's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

While the broader market gained around 12% in the last year, Brookside Energy shareholders lost 29%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 65% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance