Those who invested in SDI (ASX:SDI) three years ago are up 25%

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, SDI Limited (ASX:SDI) shareholders have seen the share price rise 12% over three years, well in excess of the market return (3.8%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 13% in the last year , including dividends .

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for SDI

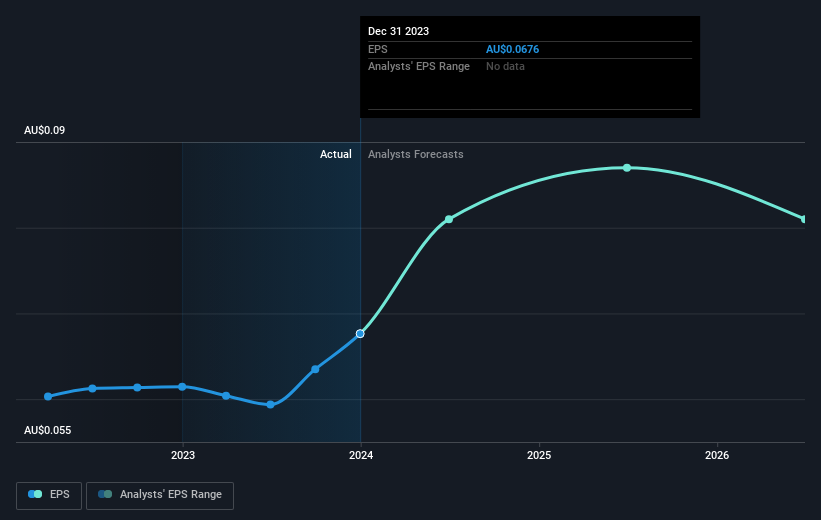

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, SDI achieved compound earnings per share growth of 15% per year. The average annual share price increase of 4% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that SDI has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of SDI, it has a TSR of 25% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that SDI shareholders have received a total shareholder return of 13% over the last year. Of course, that includes the dividend. That's better than the annualised return of 4% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for SDI you should be aware of.

But note: SDI may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance