Those who invested in Experience Co (ASX:EXP) three years ago are up 99%

While Experience Co Limited (ASX:EXP) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 18% in the last quarter. But over three years, the returns would have left most investors smiling To wit, the share price did better than an index fund, climbing 96% during that period.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Experience Co

Because Experience Co made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Experience Co actually saw its revenue drop by 18% per year over three years. The revenue growth might be lacking but the share price has gained 25% each year in that time. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

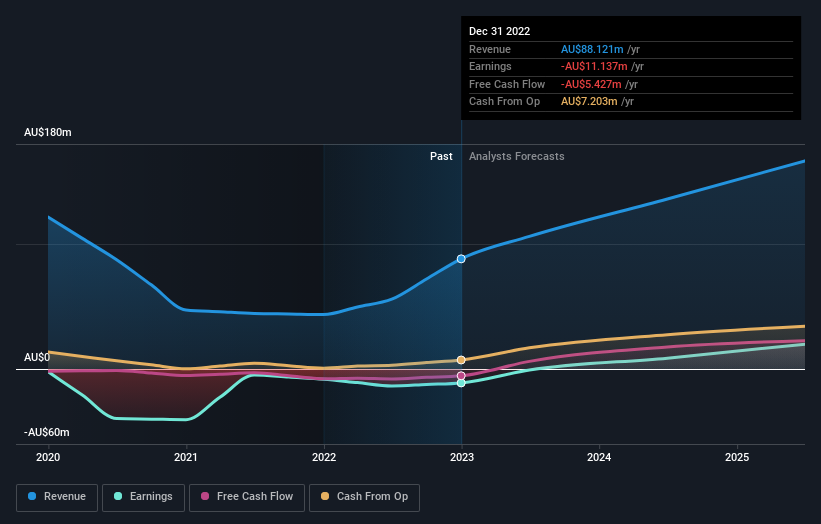

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Experience Co's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Experience Co's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Experience Co's TSR of 99% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Experience Co has rewarded shareholders with a total shareholder return of 18% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Before spending more time on Experience Co it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance