THIS will shape the future of our property markets

What is going to shape the future of our cities?

What factors are going to make some locations and certain properties outperform the averages in the future?

Now these are important questions for home owners and particularly for property investors who will want to own the type of properties that are going to grow at wealth producing rates of return in the future.

Now I know many commentators are suggesting that we can't have the same sort of capital growth in the next 10 years as we had in the last decade or so.

In fact, some are still suggesting it isn't possible for property values to keep going up much more at all.

Now I agree that the current era of lower inflation, lower wages growth and lower interest rates, is not conducive to overall double-digit capital growth like we enjoyed a few years ago.

Related article: Property market turns a corner as historic rate decision looms

Related article: Sydney suburbs where apartment prices rose MORE than houses

Related article: Fresh challenge for negatively geared investors

But rather than trying to predict exactly what future capital growth rates are going to be, what I'm going to suggest is to that as an investor you should be looking for a properties that are going to outperform the averages with regards to capital growth.

There's no doubt that the significant property price growth that we've enjoyed over the last couple of decades, particularly in our big capital cities, have come about because of two major factors.

1. Lower Interest Rates

Firstly, interest rates dropped considerably over the last decade. Ten years ago, at the time of the Global Financial Crisis the average mortgage interest rate was around 10%.

I remember the good old days when I was thrilled if my home mortgage was less than 10%.

What this means is that even if people’s income didn’t increase – the fact that interest rates dropped significantly increased their ability to service their loans allowing them to afford more expensive properties.

2. More two income households

Over the last couple of decades, we have had more two income households.

This again increased household affordability.

Especially since at the time there was more competition amongst banks keen to lend home buyers and investors money.

So, what's ahead for the future?

Let’s now look at some trends that will shape the future of our property markets.

1. Lower Interest Rates

I see a long period of low interest rates. In fact, this is likely to be the case for up to a decade.

Of course, if interest rates were to rise I'd be thrilled.

That’s because the RBA will only increase interest rates if our economy flourishes, productivity increases, inflation rises and the value of our properties boom, so they want to slow things down by raising the cost of money

2. Lower Wages Growth

Wages growth is likely to remain low in the coming years, despite strong job creation and despite our world class low unemployment levels.

This is just something that's been happening around the world where in general, despite high employment and jobs growth wages is minimal.

What this means is the average Australia is not going to be taking more money home in their pay packet and despite us being told that inflation is low, most people are not getting as much bang for their buck.

It seems that after paying higher petrol prices, higher energy prices and the increased cost of living, they just don’t have as much money left over.

Major changes to the workplace ahead

I also see some major workplace changes ahead with fewer higher paying jobs and more lower paying jobs.

That’s because many currently existing jobs will often be done better by fewer people in the future.

Automation and artificial intelligence will take the place of many workers while offshoring of manufacturing will mean the jobs of many others will be made redundant.

A recent US study showed that 47 per cent of existing jobs could be obsolete by 2030 and the demand for some 40% of the other remaining jobs are likely be halved over the next decade.

Most of these job losses are expected in the higher and especially middle-income wage brackets.

Similarly, in Australia research by StartupAUS suggests that technology “will kill 40 per cent of Aussie jobs by 2030”.

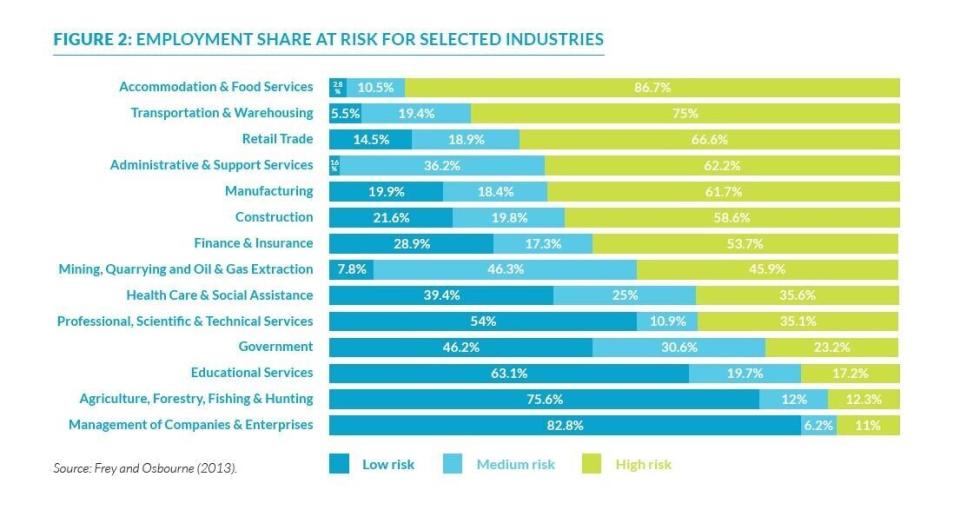

Jobs in the hospitality and tourism, transport, retail and administration sectors in Australia are most at risk from technology and automation over the next 10 to 15 years, potentially putting the jobs of nearly five million workers on the chopping block.

What will happen to the middle class?

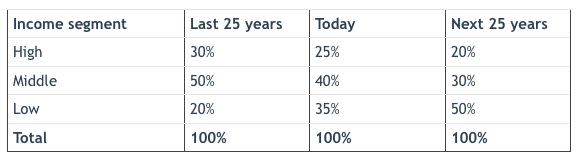

This means we're going to get a further hollowing out of the middle class which is well explained in the following table from Michael Matusik which outlines Australian jobs by major household income segments.

The past stats are facts, whilst the forecasts are those of Matusik based on his research of emerging trends.

Distribution of Australian jobs by income segment

Matusik believes that looking forward, the jobs that will grow in demand will be those than cannot be done better and/or more cost efficiently by an algorithm.

What does this mean for property?

So where are property values going to increase at above average rates of capital growth in the future?

Clearly that’s going to be in locations where people's wages are growing faster than the average, meaning their disposable income should be higher than average.

Now every 4 years the Census dissects every municipality by many statistics and one of them is income growth.

If the trends I mentioned above occur, it’s very likely that future income growth will be lower in the outer suburbs of our capital cities meaning there will be limited opportunity for people to pay more for their homes there.

And it will be much the same in many parts of regional Australia

Now I'm not talking about investors… I'm talking about the homeowners, who in general drive our property markets and who make up the bulk of purchasers in our outer suburbs and regional Australia.

Fewer homeowners being able to afford to pay more means properties in those areas are unlikely to significantly increase in value.

On the other hand, in those municipalities where wages growth is considerably higher than average, the local residents will have more disposable income than average.

This means they will have the ability to buy bigger fancier cars, larger televisions and also afford bigger more expensive homes.

Plus, they’ll have the cash to renovate their houses improve increase the value of their properties.

Now this is not a social argument

If what I’m suggesting will actually transpire (and I’m sure it will) it could lead to many social problems. But that’s out of the realm of our discussion today.

The big takeaway is…

With many jobs disappearing in the future and generally lower wages growth there will be minimal impetus for property value growth in many suburbs of Australia.

And lowering interest rates won’t help as much this time around - the flow through effect of the low interest rates has all but gone.

Sure, lending more freely by easing serviceability criteria will help, but remember if people’s wages won’t increase much, they just won’t be able to service loans.

So as always….

Demographics will drive our property markets

Those areas where people will have job security, higher wages growth and multiple streams of income will be locations where people will be able to afford and also be prepared to pay more for their properties.

These will be the established you inner and middle ring suburbs of our capital cities, and in particular locations close to amenities, public transport and the lifestyle choices these more affluent Australians want to (and can afford to) enjoy

Then of course as an investor you’ll need to select the right properties in those locations - investment grade properties that will appeal to owner occupiers who will push up the value of similar properties.

This is the type of property that will outperform in the future.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance