Here's what's next for Aussie property prices

Wouldn’t it be great to know what’s ahead for our property markets?

Sure lots of “commentators” have given their market forecasts for 2018, but what do they base them on?

While some undertake detailed research, others seem to use “gut feel” based on their experience and yet others have vested interests used to confirm the properties they’re peddling.

Also read: 10 most expensive Aussie properties in history

So let’s be honest…no one really knows what’s ahead for property – there are so many individual markets and so many variables involved.

However recently ANZ Bank have built a new model which in their words: “accurately forecasts housing prices over a longer-term.”

Now before I go into details of this model…

I’ll give you the bottom line:

According to the new ANZ model, house price growth will slow but still remain positive in the first half of the year (around 1% year on year growth), then property values will pick up in the second half of 2018 growing around 2% for the year as a whole.

Also read: Property prices have peaked in this market

If this is correct, the next few months will give property investors and home buyers a window of opportunity to get into the market as the ANZ forecasts that growth will accelerate to around 4% in 2019.

Source: CoreLogic RP Data, ANZ Research

How are property market forecasts made?

According to the ANZ “existing tools are simple and effective for near term views.”

The common leading indicators (those that provide information about likely future changes in house prices) which are currently being used include: –

Auction clearance rates – these are a good indicator of consumer sentiment and, as you can see from the graph below, are an accurate tool for forecasting movements in house prices in the short term.

Auction clearance rates versus house prices

Source: CoreLogic RP Data, ANZ Research

Credit impulse –which measures the change in new credit issued as a percentage of the gross domestic product (GDP).

Of course it makes sense that the change in the growth rate of new lending (credit) should signal a change in house prices.

Credit impulse versus house prices

Source: RBA, ABS, ANZ Research

According to the ANZ:

“These tools work because they effectively summarise the key demand and supply factors in the housing market. The problem is that they only provide short-term signals about the change in house prices — a matter of three to four months in both cases.

“To forecast house prices beyond the near term, we need to consider the likely drivers of supply and demand and anticipate their impact on house prices.”

So what’s this new forecasting model all about?

The ANZ explain their model as “an error correction model which is simple and captures the main dynamics of housing price movements then makes the link between prices and economic conditions explicit.”

The ANZ back tested the model’s accuracy by producing two-year forecasts on a rolling basis from 1995 to 2017 and comparing them to actual prices.

The graph below looks pretty impressive to me…

Source: CoreLogic RP Data, ANZ Research

What does the model predict for the future?

IN THE MEDIUM TERM, PRICES WILL KEEP RISING — JUST

The ANZ model predicts that housing price growth will continue to slow in the near term, bottoming out at 0.8% year on year in the second quarter of 2018 and gradually pick up thereafter.

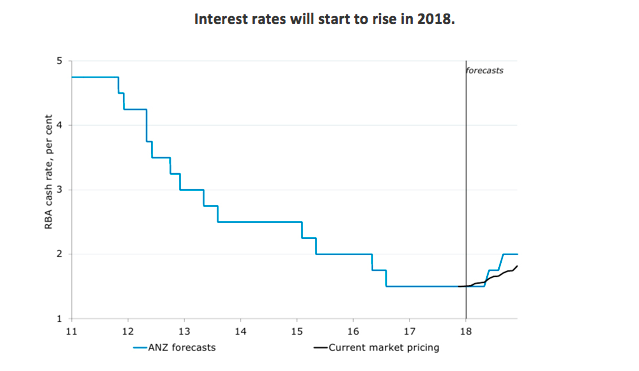

When they released this model a few weeks ago the ANZ expected our economy to improve with GDP accelerating to around 3%, with the unemployment rate edging lower causing the RBA to hike interest rates twice in 2018, and this will have a dampening effect on property prices in 2018, particularly in the second half of the year.

Following the RBA’s February statement, the ANZ does not now expect any rise in interest rates in 2018. Presumably this is even more positive for property.This forecast also assumes an uptick in wage growth.

Source: RBA, Bloomberg, ANZ Research

Construction activity will be a drag on prices in the first half of 2018 according to the model.

Roughly 200,000 dwellings are now under construction around Australia, which “is enough oncoming supply to dampen price growth.”

ANZ anticipateincome growthwill have a small positive impact on home prices in 2018.

BEYOND THE MEDIUM TERM

Looking further ahead, the ANZ model predicts that housing price growth will improve in 2019 forecasting 4% growth.

The ANZ are not expecting the RBA to change interest rates in 2019, “so the drag on price growth from 2018’s hikes is likely to be short lived.”

They also expect a mild slowdown in new construction in 2018, which in turn will be positive for dwelling prices in 2019.

Construction activity set to slow

Source: ABS, ANZ Research

The bottom line:

Despite all the research done by large organisations like the ANZ and other institutions, most economists get their property forecasts wrong.

You see…the fundamentals are easy to monitor – things like population growth, supply and demand, employment levels, interest rates, affordability and inflationary pressures.

The problem is that one overriding factor that the experts have difficulty quantifying is investor and consumer sentiment and these are major drivers of our property markets

Humans are funny: we tend to extrapolate the present into the future.

When things are booming we think the good times will never end and when the market mood is glum, we have difficulty seeing the light at the end of the tunnel.

Think about it…

When property markets are booming and stories of investors seemingly making large gains overnight abound, people want to jump on the bandwagon and cash in; often at a time when the market is near its peak.

Conversely when the media reports falling property prices or an impending housing crash, many investors become scared and sit on the side lines, believing the end of property is nigh and things will never improve, when in reality much of the risk has been removed from the market.

Other emotional traps include becoming overconfident, wishful thinking and ignoring information that conflicts with your current views.

In other words, many investors create their own “reality.”

It seems that investor and property consumer sentiment has moved from very positive last year to more concern this year.

However most of the fundamentals remain positive for property in the medium term, so it will be interesting to see how consumers (both property investors and home buyers) react.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Yahoo Finance

Yahoo Finance