The market beatings continue amid an 'unusually murky' outlook

This post was originally published on TKer.co

It was a rough week in the stock market as the Federal Reserve renewed its commitment to do whatever it takes to bring down inflation, even if it means pain in the economy.

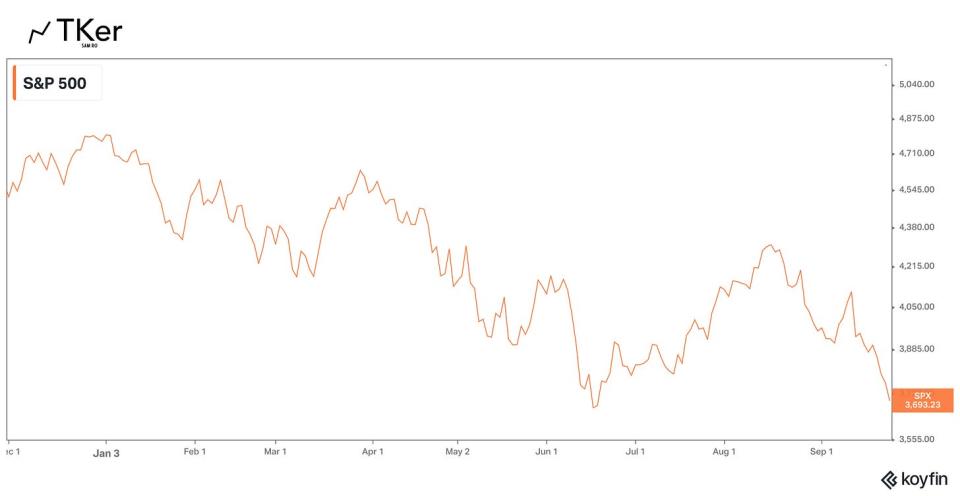

The S&P 500 fell 4.6% to close the week at 3,693.23. The index is now down 23.0% from its January 3 closing high of 4,796.56 and up just 0.7% from its June 16 closing low of 3,666.77.

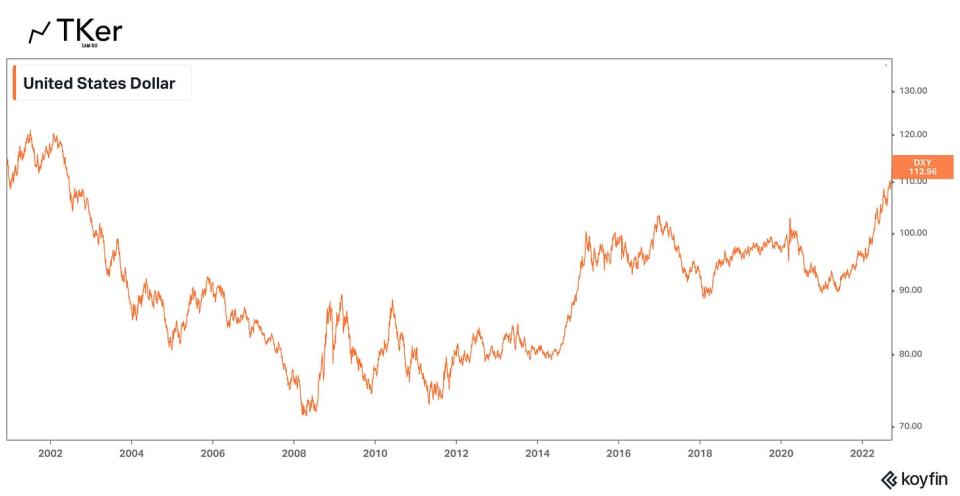

The global market rout came with surging interest rates and a strengthening dollar.

It’s a big mess as investors suffer and the risk of a severe recession rises.

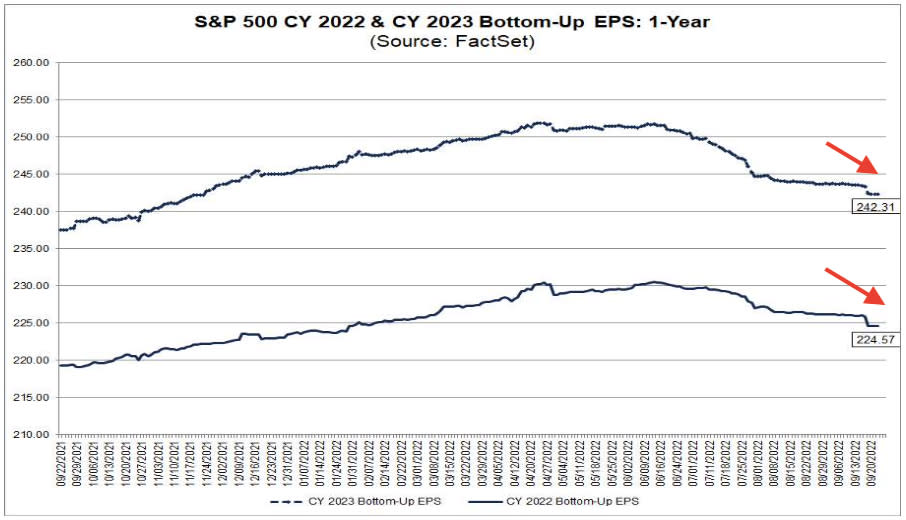

Analysts continue to reduce their expectations for earnings, warning the slowdown will cause profit margins to contract. (Read more about earnings here and profit margins here.)

On Friday, Goldman Sachs slashed its year-end target for the S&P 500 to 3,600 from 4,300 amid higher-than-expected interest rates. From Goldman Sachs’ David Kostin:

“The expected path of interest rates is now higher than we previously assumed, which tilts the distribution of equity market outcomes below our prior forecast. The S&P 500 index actually reached our previous year-end target of 4300 in mid-August, but the rate complex has subsequently shifted dramatically. The higher interest rate scenario that we now incorporate into our valuation model supports a P/E of 15x (vs. prior forecast of 18x) and implies a year-end (3-month) S&P 500 target of 3600 (-5%) and 6-month and 12-month forecasts of 3600 (-5%) and 4000 (+6%).”

This is the firm’s fourth downward revision to its S&P target since the beginning of the year when it predicted the index to end the year at 5,100. (To be fair, almost all of the top strategists on Wall Street have cut their targets multiple times. It’s all a reminder that forecasting the stock market is very hard.)1

“The outlook is unusually murky,” Kostin wrote. “The forward paths of inflation, economic growth, interest rates, earnings, and valuations are all in flux more than usual with a wider distribution of potential outcomes.”

That said, all of this market volatility seems to be what the Fed wants. In its effort to bring down inflation, the central bank has been tightening monetary policy, which has led to tighter financial conditions. Tighter financial conditions — which manifest in the form of higher borrowing costs, falling stock valuations, and a stronger dollar — are intended to slow demand in the economy, which in turn should help cool prices.

All of this speaks to the ongoing conundrum in markets: As long as inflation is uncomfortably high, the Fed will act in ways that are unfriendly to stock prices.

And so as long as inflation remains high, investors should manage their expectations for near-term returns.

Longer term, things look a bit more promising.

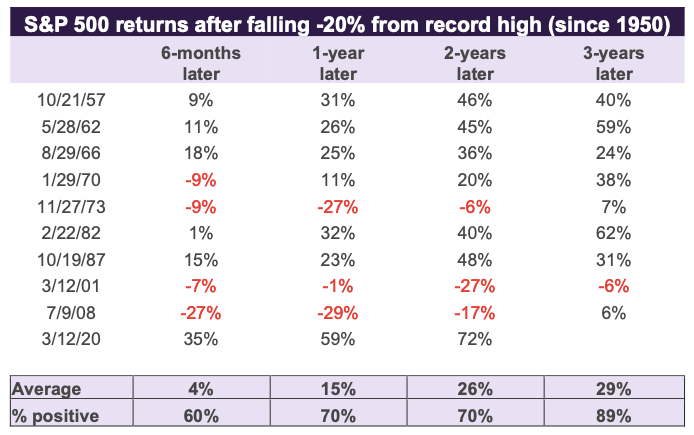

“Historically, buying stocks after they have been down 20% from record highs has been a good risk/reward proposition for longer-term investors,” Keith Lerner, chief market strategist at Truist Advisory Services, wrote on Friday. “Following past instances, the S&P 500 has been higher three years later in eight out of nine cases with a solid average return of 29%.”

As usual, in the stock market, time pays.

By the way, keep in mind that the S&P 500 sees an average decline of roughly 30% around recessions. So assuming we’re heading for a recession, it’s possible that most — or perhaps all — of the downside is already priced in.

Reviewing the macro crosscurrents 🔀

There were a few notable data points from last week to consider:

🤕 Powell reiterates pain. On Wednesday, the Federal Reserve hiked interest rates by another 75 basis points. Fed Chair Jerome Powell warned the central bank’s efforts to bring down inflation would come with economic pain. Indeed, Fed officials expect the labor market to cool with the unemployment rate jumping to 4.4% in 2023, up from the current 3.7% rate. “As an empirical observation, when the jobless rate rises that much from its low, a recession is in train,“ Neil Dutta, head of U.S. economics at Renaissance Macro Research, wrote on Thursday.

💸 King dollar reigns supreme. The U.S. dollar surged against other currencies with the U.S. dollar index hitting a 20-year high. This is a significant risk to the S&P 500 as the underlying companies have significant exposure in non-U.S. markets.

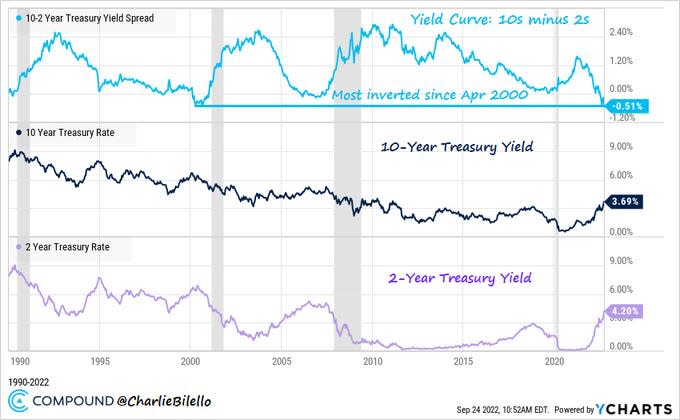

🙃 Rates surge and yield curve inverts. The 2-year Treasury yield jumped to a 15-year high. The 10-year yield hit an 11-year high. The former has been higher than the latter, which means the yield curve is inverted — a phenomenon that typically precedes recessions.

🚨 Recession warning sign. The Conference Board’s Leading Economic Index2 fell for the sixth consecutive month in August. The six-month average change was -0.46%, a reading that's historically associated with recessions. From The Conference Board's Ataman Ozyildirim: "Economic activity will continue slowing more broadly throughout the US economy and is likely to contract. A major driver of this slowdown has been the Federal Reserve’s rapid tightening of monetary policy to counter inflationary pressures. The Conference Board projects a recession in the coming quarters."

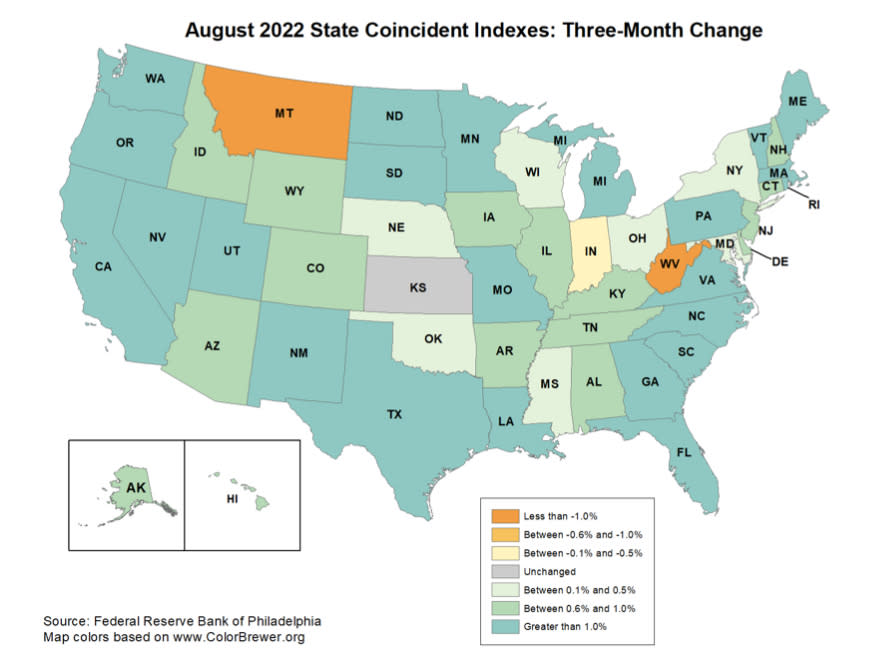

📉 Several U.S. states are already in contraction. From the Philly Fed’s State Coincident Indexes3 report: “ Over the past three months, the indexes increased in 46 states, decreased in three states, and remained stable in one… Additionally, in the past month, the indexes increased in 26 states, decreased in 14 states, and remained stable in 10…“

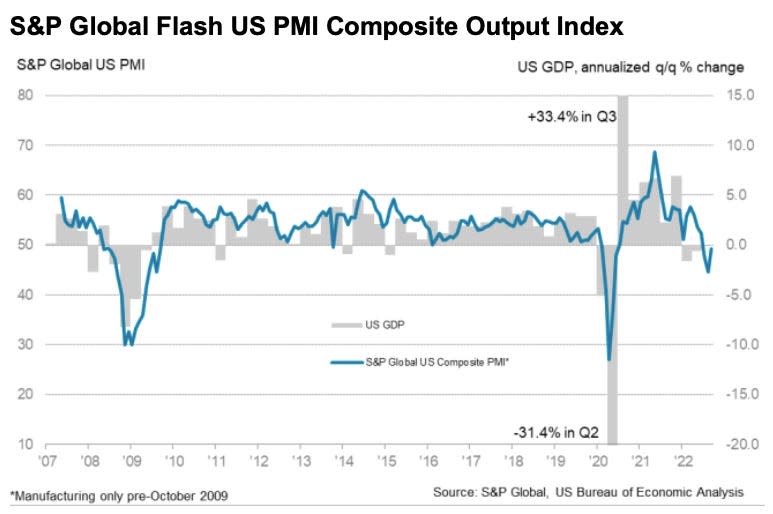

•🙏 But it’s not all terrible. The S&P Global Flash US PMI Composite Output Index signaled a contraction in economic activity in September. However, new orders grew, indicating good things down the road. Also, price inflation cooled, supplier deliveries sped up, and hiring activity continued to rise.

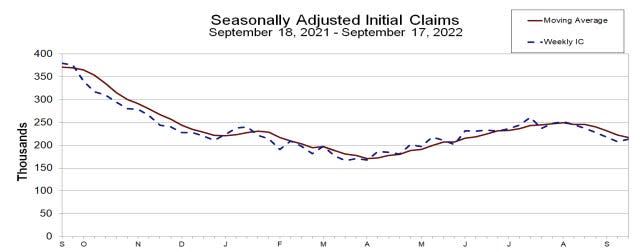

💼 The labor market is holding up. Even as the economy cools and hiring slows, employers seem to be holding on tight to their employees. Initial claims for unemployment insurance came in at 213,000 for the week ending September 17, up from 208,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion.

👍 Yes, there are companies hiring. Amid the anecdotes of companies laying off workers, there are also anecdotes of companies hiring. From Bloomberg: “American Express Co. is on the hunt for software engineers, coders and developers, part of a 1,500-person hiring spree for its sprawling technology arm. The company, the biggest US card issuer by purchases, has already added more than 3,600 technical workers this year and hopes to fill the remaining openings by the end of the year, Ravi Radhakrishnan, AmEx’s chief information officer, said in an interview.“

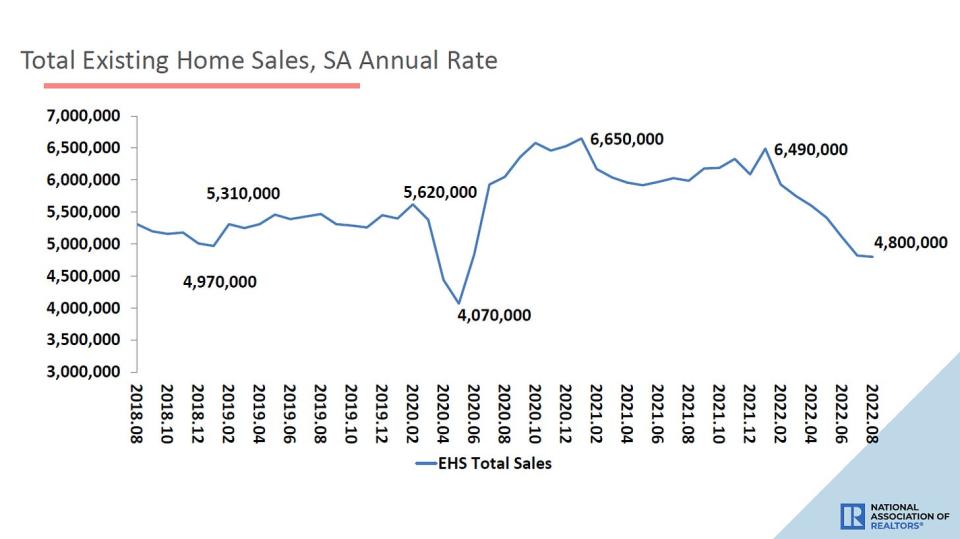

🏚 Home sales are cooling. Sales of previously owned homes fell 0.4% in August to an annualized rate of 4.8 million units. From NAR chief economist Lawrence Yun: "The housing sector is the most sensitive to and experiences the most immediate impacts from the Federal Reserve's interest rate policy changes. The softness in home sales reflects this year's escalating mortgage rates. Nonetheless, homeowners are doing well with near nonexistent distressed property sales and home prices still higher than a year ago."

💸 Home prices are cooling. From the NAR: “The median existing-home price for all housing types in August was $389,500, a 7.7% jump from August 2021 ($361,500)... However, it was the second month in a row that the median sales price retracted after reaching a record high of $413,800 in June, the usual seasonal trend of prices declining after peaking in the early summer.“

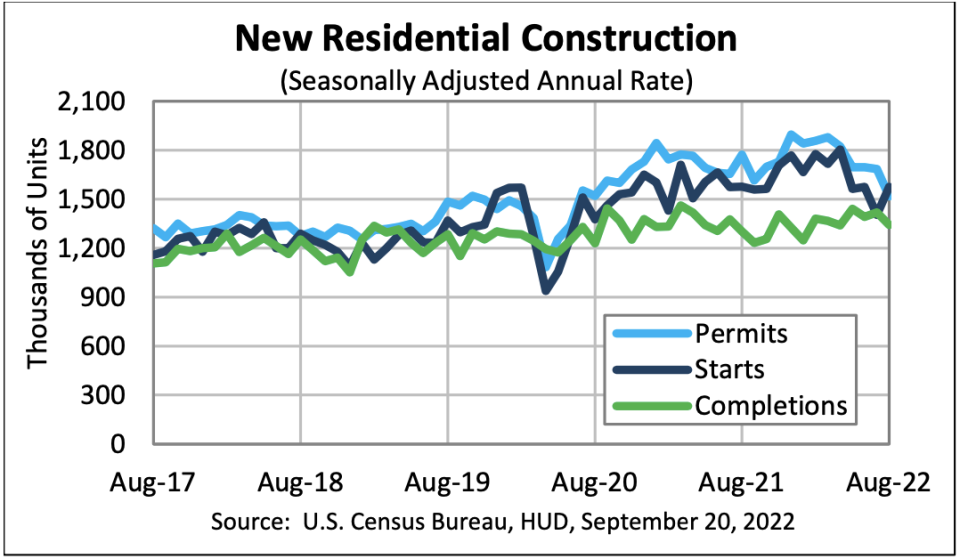

🔨 Home construction is cooling. According to the Census Bureau, new building permits fell 10% month-over-month in August. Starts climbed 12.2%, but completions declined by 5.4%. From Wells Fargo: “The surprising gain in total starts is a welcome reprieve from the onslaught of negative housing data received recently. That said, August's sharp decline in permits is a reminder that builders and developers are likely to continue scaling back production in response to retreating demand and higher financing costs.“

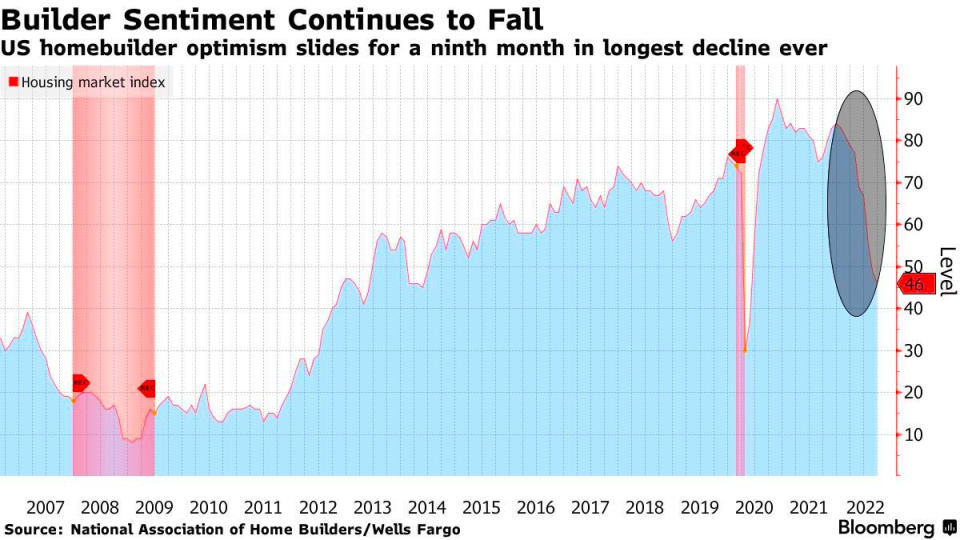

🛠 Builder sentiment is in the dumps. From the NAHB: “Builder confidence in the market for newly built single-family homes fell three points in September to 46, the lowest level since May 2014 with the exception of the spring of 2020.“ From NAHB chief economist Robert Dietz: “Builder sentiment has declined every month in 2022, and the housing recession shows no signs of abating as builders continue to grapple with elevated construction costs and an aggressive monetary policy from the Federal Reserve that helped pushed mortgage rates above 6% last week, the highest level since 2008. In this soft market, more than half of the builders in our survey reported using incentives to bolster sales, including mortgage rate buydowns, free amenities and price reductions.“

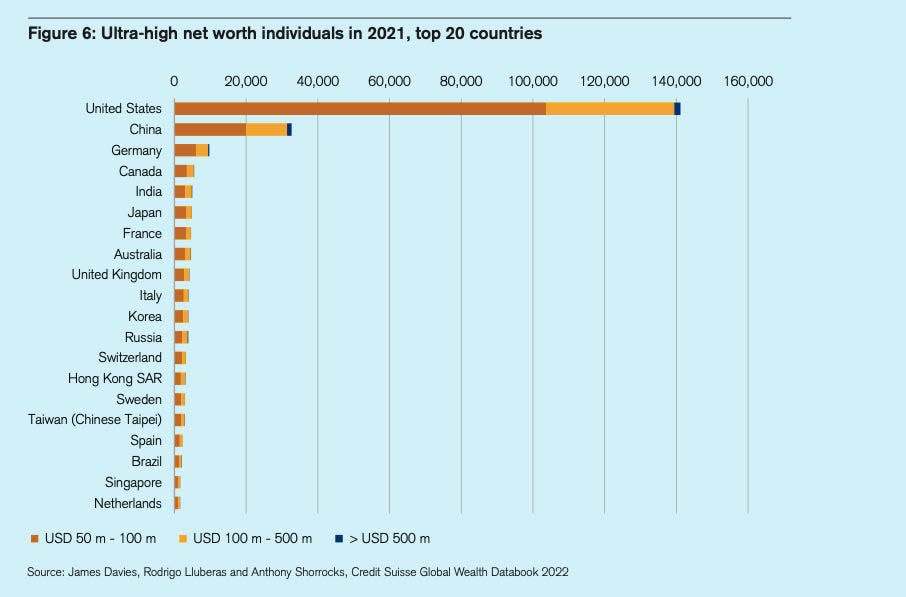

💵 Where the extremely wealthy live. From Credit Suisse: “Looking in more detail at the [ultra-high-net- worth] group reveals 84,490 adults with wealth above USD 100 million at the end of 2021, of which 7,070 are worth more than USD 500 million. The regional breakdown of the UHNW group as a whole is dominated by North America with 146,680 members (56%), while 42,780 (16%) live in Europe, 32,710 (12%) in China and 30,010 (11%) in Asia-Pacific countries, excluding China and India. Among individual countries, the United States leads by a huge margin with 141,140 members, equivalent to 53% of the world total.“

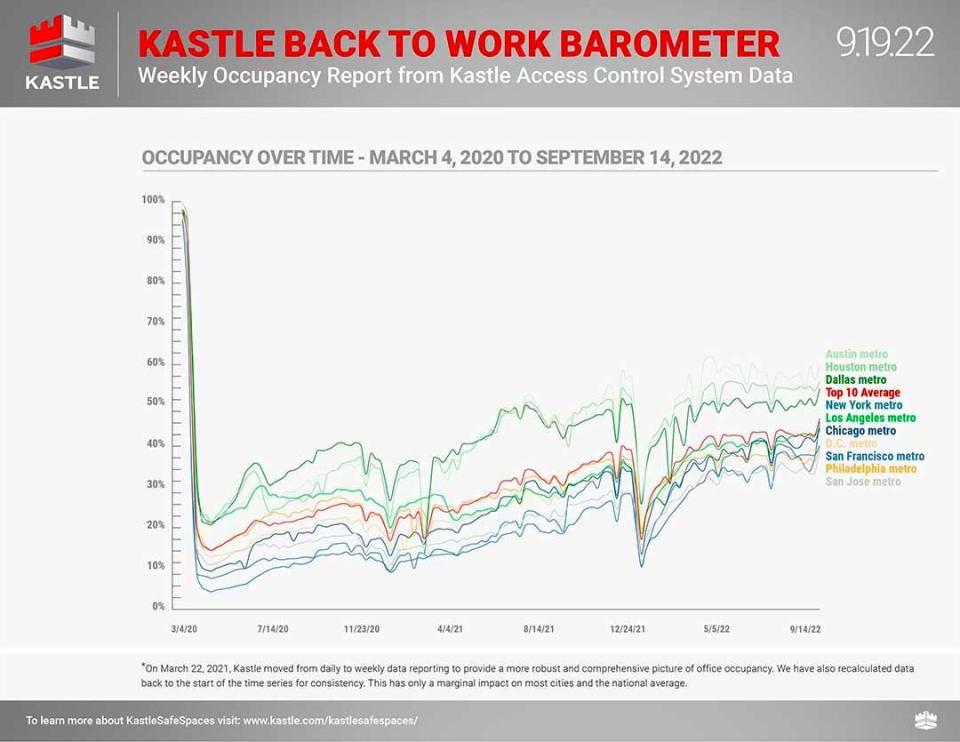

🏢 Workers are returning to the office. From Kastle Systems: “…office occupancy has continued increasing steadily since Labor Day. Last week, occupancy rose more than four points to 47.5%, the highest level since before the pandemic, according to Kastle’s 10-city Back to Work Barometer. All cities tracked saw significant increases last week, with New York City experiencing the biggest jump, rising 8.7 percentage points to 46.6% occupancy. Despite that, Austin, Texas still surpassed New York City with office occupancy reaching 60.5%. We expect these rates to continue rising.“

📉 Maybe the sell-off is almost over. From Oppenheimer’s Ari Wald: “…major market bottoms have occurred in October more than any other month since 1932. We think the combination of extreme pessimism and “less-intense” selling would provide the setup for another October turn. This reminds us of old Wall Street wisdom to Sell Rosh Hashanah, and Buy Yom Kippur. Those dates fall on September 26th and October 5th, respectively, in 2022.”

Putting it all together 🤔

Tighter monetary policy from the Federal Reserve is clearly impacting the housing market as higher mortgage rates cool activity. But it’s also having the central bank’s intended effect of cooling prices.

It’s the same story with the broader economy: Activity continues to cool while delivery times continue to improve, suggesting supply chain constraints continue to ease, which is taking pressure off of prices.

While some price indicators have been easing, inflation nevertheless remains troublingly high. Consequently, financial markets remain volatile as the Fed increasingly tightens financial conditions in its effort to cool prices.

The good news is the labor market remains very strong, with layoff activity near record lows. But prepare for things to cool. Even the Fed understands that its efforts could cause unemployment to rise.

And so, recession risks are intensifying and analysts are trimming their forecasts for earnings. For now, all of this makes for a conundrum for the stock market and the economy until we get “compelling evidence” that inflation is indeed under control.

This post was originally published on TKer.co

Sam Ro is the author of TKer.co. Follow him on Twitter at @SamRo.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Yahoo Finance

Yahoo Finance