The granny flat trend is on the rise - but how do you finance one?

At just over $1 million, New South Wales boasts the largest median house price in the entire country.

That, combined with its incredibly lenient second dwelling laws, has meant it is home to the most granny flats in the country.

Related article: House prices are still dropping, but the bottom is in sight

Related article: Bad news for parents: Sydney property too expensive, granny flat trend booms

Related article: How to avoid these common 8 renovation mistakes

Housing Industry Australia data revealed there were a whopping 6,065 granny flats built in the state last year, which is almost triple the amount built in runner-up state, Queensland.

Their benefits are obvious: An affordable option for family members to move in to; great for second income; add value to your land.

How much can granny flats cost?

Domain reports a granny flat can cost anywhere between $20,000 and $200,000 - and sometimes even more.

Prices can vary depending on the purpose of the residence, and the quality you’re after.

So, while $24,000 might nab you a flat-pack DIY dwelling, $70,000 could build you a one-bedroom prefabricated dwelling.

How can I finance my granny flat?

1. Home loan top-up

If you’re still paying off a mortgage, you could apply for a home loan top up.

A home loan top up is the process of increasing your existing loan amount, and it uses the equity you have in your home to allow you to increase the loan amount, Finder reported.

It means your lender will perform a new valuation on your home and offer you additional funds based on the equity in your property - which is the difference between what your home is worth and what you’ve paid off so far.

The good thing about home loan top ups is that you don’t need to go through a new application process or pay additional establishment or ongoing fees.

But, the downside of this is that it can make your expenses a little tough to track for tax purposes.

“If you're using your granny flat as a rental property, the interest on your loan will be tax deductible,” Finder said.

“But with a home loan top up, there will be no clear distinction between the repayments allocated toward your owner-occupied home and your investment granny flat.”

2. Credit loan

Alternatively, Finder said you could get a line of credit loan, which offers you a credit limit based on the amount of equity you have in your home.

They function much like a credit card, because you’re only charged interest on the amount you use, rather than the full credit limit.

Finder said this could be a pretty savvy tax strategy too: “Because you'll only make interest repayments on the amount you've used, you'll be maximising your tax-deductible debt.”

3. Construction loan

These loans are approved based on the value of the existing property and the value of the granny flat, Granny Flat Approvals said.

In addition to the normal bank requirements, you will also need to provide the lender with a signed contract with the builder; and council approved plans and specifications.

What are the regulations around building second dwellings?

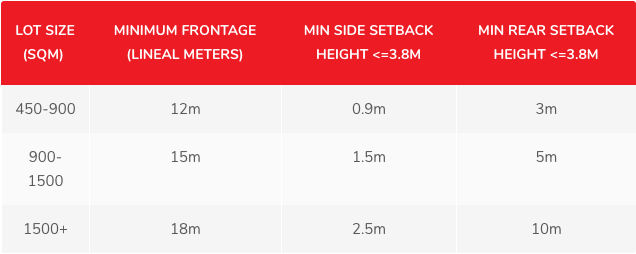

In 2009, the NSW government removed the need for council approval to build a granny flat on your property, if your property is larger than 450 square metres, and has a minimum 12 metre street frontage, according to Backyard Grannys.

It was introduced to allow granny flats in NSW to be approved as “complying developments” or “CDCs” in just 10 days.

In addition to being 450 square metres and having a 12 metre street frontage, your property must also be zoned residential.

Your granny flat must maintain a 3 metre distance from any existing trees that are over 6 metres in height and ave a maximum external area of 60 square metres.

In other states, the laws around building granny flats are much tighter.

In SA, your property must be greater than 600 square metres, and it needs to be attached to your main property.

In some council areas in Victoria, your granny flat can only host family members, or persons dependent on the resident of the main dwelling. You’ll also need council approval.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance