Textile-Home Furnishing Industry Outlook: Prospects Bleak

The Textile-Home Furnishing industry — comprising manufacturers, designers, distributors and marketers of flooring, carpet and upholstery products — seems to be going through a rough patch. Rising raw material costs, higher transportation costs, a stronger dollar and a tight labor market have been creating hurdles for the industry players.

Nevertheless, the companies are registering higher demand courtesy of improving consumer confidence, a lower unemployment rate and higher disposable income. Also, the positive momentum in the U.S. housing market on the back of rising rentals, rapidly increasing household formation and a limited supply of inventory are expected to provide much support to the industry going forward.

The companies are also actively pursuing accretive acquisitions in order to broaden their product portfolio and expand geographic footprint as well as market share. The companies are trying hard to offset higher costs by raising prices, expanding in growing channels, and participating in new products and geographies.

Meanwhile, Hurricane Florence, the first major hurricane to hit the eastern United States this year, could be damaging for some sectors like restaurants, insurance and agriculture. That said, homebuilding companies/building product suppliers/home furnishing companies will remain in focus as cleanup and rebuilding efforts pick up the pace.

Indeed, increased raw material costs as well as start-up expenses behind new products and production continue to raise concerns as the companies are required to make significant investments in new products, distribution network and manufacturing facilities, being in a highly competitive landscape.

Moreover, the threat of tariffs on imports and retaliatory tariffs on exports spell trouble for the industry. If tariffs are implemented, sourcing difficulty faced by home furnishing manufacturers will end up increasing costs.

Industry Lags on Shareholder Returns

Looking at the share price performance over the past year, it is quite evident that the acquisitions and product innovations have not been able to provide a much-needed impetus to Textile - Home Furnishing industry as the industry is lagging both the broader sector and the S&P 500 market.

Despite an improving economy and higher demand, the space still has a lot of uncertainty shrouding increased expenses.

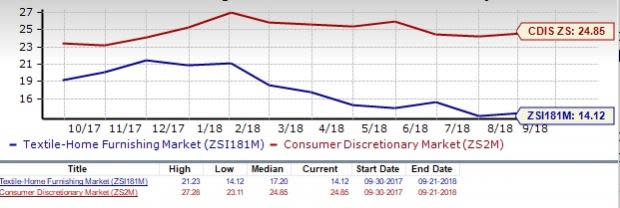

The Zacks Textile-Home Furnishing Industry, a six-stock group within the broader Zacks Consumer Discretionary Sector, has underperformed the S&P 500 index as well as its own sector over the past year.

While the stocks in this industry have collectively declined 20.5%, the Zacks S&P 500 Composite and the Zacks Consumer Discretionary Sector have gained 17.8% and 11.8%, respectively.

One-Year Price Performance

Furniture Stocks Trading Cheap

Owing to the underperformance of the industry over the past year, the valuation looks really cheap now. One might get a good sense of the industry’s relative valuation by looking at its price-to-earnings ratio (P/E), which is the most appropriate multiple for valuing Consumer Discretionary stocks because their earnings are effective in gauging performance.

Generally, the price of a stock rallies on a rise in earnings. As forecasts for expected earnings move higher, demand for the stock should drive its price. If the P/E of a stock is rising steadily, it means that investors are pinning their hopes on the company’s inherent strength.

This ratio essentially measures a stock’s current market value relative to its earnings performance. Investors believe that the lower the P/E, the higher will be the value of the stock.

The industry currently has a trailing 12-month P/E ratio of 14.1, which is the lowest level in the past year. When compared with the highest level of 21.2 and median level of 17.2 over that period, there is apparently plenty of upside left.

The space also looks quite cheap when compared with the market at large, as the trailing 12-month P/E ratio for the S&P 500 is 20.2 and the median level is 20.1.

Price-to-Earnings Ratio (TTM)

The chart below compares the industry's valuation picture with its sector. Such a comparison ensures that the group is trading at a decent discount. The Zacks Discretionary Sector’s trailing 12-month P/E ratio of 24.9 and the median level of 24.9 for the same period are significantly above the Zacks Furniture Industry’s respective ratios.

Price-to-Earnings Ratio (TTM)

Underperformance May Continue Due to Bleak Earnings Outlook

Broader economic growth and positive U.S. housing market fundamentals present solid growth opportunities in the Textile - Home Furnishing space. However, bleak earnings arising from weak margins given high costs of raw materials, freight expenses along with start-up of new projects are certainly weighing on the near-term results of the companies in this space.

But what really matters to investors is whether this group has the potential to perform better than the broader market in the quarters ahead. One reliable measure that can help investors understand the industry’s prospects for a solid price performance going forward is its earnings outlook. Empirical research shows that earnings outlook for the industry, a reflection of the earnings revisions trend for the constituent companies, has a direct bearing on its stock market performance.

The Price & Consensus chart for the industry shows the market's evolving bottom-up earnings expectations for the industry and the industry's aggregate stock market performance. The red line in the chart represents the Zacks measure of consensus earnings expectations for 2019, while the light blue line represents the same for 2018. Clearly, a downward trend has been witnessed in both years.

Price and Consensus: Zacks Textile-Home Furnishing Industry

This becomes even clearer by focusing on the aggregate bottom-up EPS revisions trend. The chart below shows the evolution of aggregate consensus expectations for 2018. It appears that analysts are losing confidence in this group’s earnings potential.

Please note that the $6.91 earnings estimate for the industry for 2018 is not the actual bottom-up dollar EPS estimate for every company within the Zacks Textile-Home Furnishing industry but rather an illustrative aggregate number created by our proprietary analytics model. The key factor to keep in mind is not the industry’s earnings per share for 2018 but how this estimate has evolved recently.

Current Fiscal Year EPS Estimate Revisions

As you can see here, the EPS estimate for 2018 has dropped from $7.41 at the end of March but has increased slightly from $6.88 this time, last year. In other words, the sell-side analysts covering the companies in the Zacks Textile-Home Furnishing industry have been lowering their estimates.

Zacks Industry Rank Indicates Cloudy Prospects

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued underperformance in the near term.

The Zacks Textile - Home Furnishing industry currently carries a Zacks Industry Rank #233, which places it at the bottom 9% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Our proprietary Heat Map shows that the industry’s rank has been languishing in the bottom half over the past eight weeks.

Industry Lags in Long-Term Growth

The long-term (3-5 years) EPS growth estimate for the Zacks Textile - Home Furnishing industry has decreased to 6.7% over the past year. This compares unfavorably with 9.8% for the Zacks S&P 500 Composite.

Mean Estimate of Long-Term EPS Growth Rate

Bottom Line

The Textile - Home Furnishing industry has been grappling with increased expenses. Margins remained under pressure as accelerating raw material, transportation and labor costs continue to hamper the space.

Currently, there is only one stock that is cashing in on the positive economic fundamentals and is witnessing positive earnings estimate revisions with a bullish Zacks Rank. (You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Interface, Inc. (TILE): Headquartered in Atlanta, GA, Interface sports a Zacks Rank #1. The stock has gained 9% over the past year. The consensus estimate for current-year EPS has moved 1.4% north over the past 60 days.

Price and Consensus: TILE

However, poor price performance and south bound earnings estimate revisions mirror bleak prospects of the industry given ongoing headwinds. Below are four stocks that carry a bearish Zacks Rank that we would recommend investors to stay away from for the time being.

Culp, Inc. (CULP): High Point, NC-based Culp carries a Zacks Rank #4 (Sell). The consensus estimate for current-year EPS has moved 14.9% south over the past 60 days.

Price and Consensus: CULP

The Dixie Group, Inc. (DXYN): Dalton, GA-based Dixie Group’s consensus estimate has declined to a loss per share of 4 cents from earnings of 6 cents per share for the current year over the last 60 days.

Price and Consensus: DXYN

Mohawk Industries, Inc. (MHK): Calhoun, GA-based Mohawk currently carries a Zacks Rank #5 (Strong Sell). The consensus estimate for current-year EPS has moved 5.8% south over the past 60 days.

Price and Consensus: MHK

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interface, Inc. (TILE) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

The Dixie Group, Inc. (DXYN) : Free Stock Analysis Report

Culp, Inc. (CULP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance