Texas Capital (TCBI) Q1 Earnings Miss, Revenues Fall Y/Y

Texas Capital Bancshares TCBI reported earnings per share of 69 cents for first-quarter 2022, missing the Zacks Consensus Estimate of 73 cents. Further, results compare unfavorably with the prior-year quarter’s $1.33.

TCBI’s results were affected by increased expenses and a decline in revenues. Weak balance sheet position was another negative. Nonetheless, improving capital ratios and credit quality were tailwinds.

Net income available to common stockholders came in at $35.3 million, plunging 48.2% year over year.

Revenues Decline, Costs Rise

Total revenues fell 30.5% year over year to $203.8 million due to a decline in both non-interest income and net interest income ("NII"). Revenues lagged the Zacks Consensus Estimate of $215.1 million.

NII came in at $183.5 million, down 5.8% year over year, induced by a fall in average loans held for investment and mortgage finance, partially offset by an increase in investment securities yields.

NIM or net interest margin increased 19 basis points year over year to 2.23%.

Non-interest income plummeted 54% to $20.3 million. This decline primarily resulted from lower net gain/(loss) on sale of loans held for sale, brokered loan fees and servicing income as a result of the mortgage servicing rights (“MSR”) sale, and mortgage correspondent program transition in 2021.

Non-interest expenses increased 2% to $153.1 million from the prior-year quarter’s level. This was mainly led by increases in salaries and benefits, partially offset by a decrease in servicing-related expenses from the sale of Texas Capital’s MSR portfolio in 2021.

As of Mar 31, 2022, total loans held for investment decreased 5% on a sequential basis to $21.7 billion, while deposits decreased 9.7% to $25.37 billion.

Credit Quality Improves

Non-accrual loans held for investment were 0.27% of total loans held for investment compared with the prior-year quarter’s figure of 0.4%. Total non-performing assets plunged 39.4% to $59.3 million from the prior-year quarter’s level. Texas Capital’s net recoveries were $0.51 million compared with net charge-offs of $6.4 million as of Mar 31, 2021.

However, benefit for credit losses aggregated $2 million was lower than the year-ago quarter’s $6 million.

Capital Ratios Improve

Tangible common equity to total tangible assets came in at 8.9% compared with the year-earlier quarter’s 6.7%. Common Equity Tier 1 (CET1) ratio was 11.5%, up from the prior-year quarter’s 10.2%. Leverage ratio was 9.9%, up from 8.3% as of Mar 31, 2021.

However, stockholders’ equity was down 2.2% year over year to $3.1 billion as of Mar 31, 2022.

Our Viewpoint

Texas Capital’s improved credit quality and capital position during the March quarter were tailwinds. This apart, an improving economic situation is anticipated to help TCBI continue recording benefits for credit losses and drive its performance in the days to come. Lower revenues and margin pressure might erode its near-term profitability.

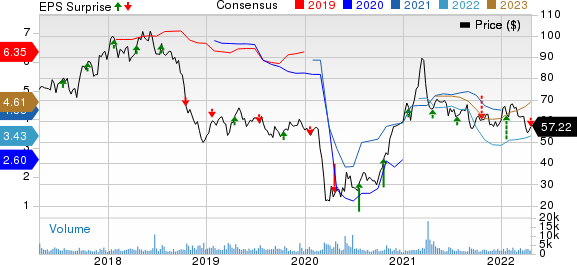

Texas Capital Bancshares, Inc. Price, Consensus and EPS Surprise

Texas Capital Bancshares, Inc. price-consensus-eps-surprise-chart | Texas Capital Bancshares, Inc. Quote

Currently, Texas Capital carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

The PNC Financial Services Group, Inc. PNC pulled off a first-quarter 2022 earnings surprise of 18.4% on substantial recapturing of credit losses. Earnings per share of $3.29, on an as-adjusted basis (excluding pre-tax integration costs related to the BBVA USA acquisition), surpassed the Zacks Consensus Estimate of $2.78. The bottom line decreased 20% year over year.

Higher NII, driven by interest-earning assets and loan growth, was a tailwind for PNC Financial. Higher expenses and a decline in deposits dragged results.

U.S. Bancorp USB reported first-quarter 2022 earnings per share of 99 cents, which beat the Zacks Consensus Estimate of 93 cents. However, results do not compare favorably with the prior-year quarter’s figure of $1.45.

U.S. Bancorp’s results were supported by an increase in revenues, loan growth and lower non-performing assets. USB’s capital position was decent in the quarter. However, higher expenses and elevated provision for credit losses were the offsetting factors.

First Republic Bank’s FRC first-quarter 2022 earnings per share of $2 have surpassed the Zacks Consensus Estimate of $1.90. The bottom line improved 11.7% from the year-ago quarter.

FRC’s results were supported by an increase in NII and non-interest income. The company’s capital position was strong in the quarter. Higher expenses and elevated provision for credit losses were the offsetting factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

Texas Capital Bancshares, Inc. (TCBI) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance