Teva (TEVA) to Report Q4 Earnings: What's in the Cards?

Teva Pharmaceutical Industries Limited TEVA is scheduled to report fourth-quarter and full-year 2019 results on Feb 12. In the last reported quarter, the company delivered a negative earnings surprise of 3.33%.

Teva’s earnings surpassed expectations in two of the last four reported quarters while missing in the other two, with the average negative surprise being 0.45%.

Teva Pharmaceutical Industries Ltd. Price and EPS Surprise

Teva Pharmaceutical Industries Ltd. price-eps-surprise | Teva Pharmaceutical Industries Ltd. Quote

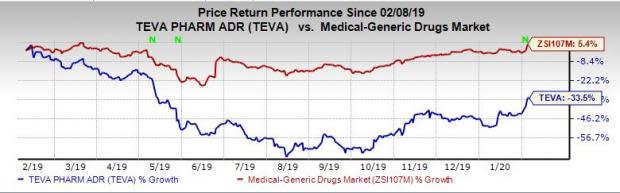

This generic drugmaker’s shares have declined 33.5% in the past year against the industry’s increase of 5.4%.

Let’s see how things have shaped up for this announcement.

Factors to Consider

Teva reports under three segments based on three regions — North America (United States and Canada), Europe and International Markets.

In the fourth quarter, sales are expected to have been hurt once again by generic erosion in sales of Copaxone, lower sales of other branded drugs, Bendeka/Treanda and ProAir, pricing erosion in the U.S. generics business as well as negative currency impact due to the strengthening of the dollar. The Zacks Consensus Estimate for sales of Copaxone and Generic Products in North America is $236 million and $980 million, respectively.

Among its newer drugs, sales of its CGRP, Ajovy were soft in the third quarter. Back then, Teva had said that there was a decline in new prescription share of Ajovy, which was due to preference of patients for auto injectors while Ajovy is available as a subcutaneous injection. An update on the market share of Ajovy is expected on the fourth-quarter conference call. Importantly, the FDA approved an autoinjector device for Ajovy last month and we expect management to discuss how this new device will help improve market share of the drug on the fourth-quarter conference call. Please note that Amgen AMGN and Lilly’s LLY CGRPs, Aimovig and Emgality, respectively, were also launched last year.

Meanwhile, sales of the other new product Austedo are likely to have increased in the fourth quarter. The Zacks Consensus Estimate for sales of Ajovy and Austedo in North America is $30.3 million and $114 million, respectively.

Teva’s new generic product launches are likely to have boosted sales of its Generics unit, making up for price erosion. Teva saw stabilization of U.S. and European generics business in the first nine months of 2019, which coupled with new generic launches, is strengthening these businesses. An update is expected on the call.

Meanwhile, in International Markets segment, soft performance in markets like Russia and Japan hurt sales to an extent in the third quarter. It remains to be seen if this trend reversed or continued in the fourth quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Teva this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: Its Earnings ESP is -6.32% as the Zacks Consensus Estimate of 62 cents is higher than the Most Accurate Estimate of 59 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Teva carries a Zacks Rank #3.

Stock to Consider

Here is a generic maker that has the right mix of elements to beat estimates this time around.

Mylan MYL has an Earnings ESP of +0.89% and is Zacks #3 Ranked. You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.--

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Mylan N.V. (MYL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance