The TETRA Technologies (NYSE:TTI) Share Price Is Up 644% And Shareholders Are Delighted

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When you find (and hold) a big winner, you can markedly improve your finances. In the case of TETRA Technologies, Inc. (NYSE:TTI), the share price is up an incredible 644% in the last year alone. Also pleasing for shareholders was the 55% gain in the last three months. Zooming out, the stock is actually down 15% in the last three years.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for TETRA Technologies

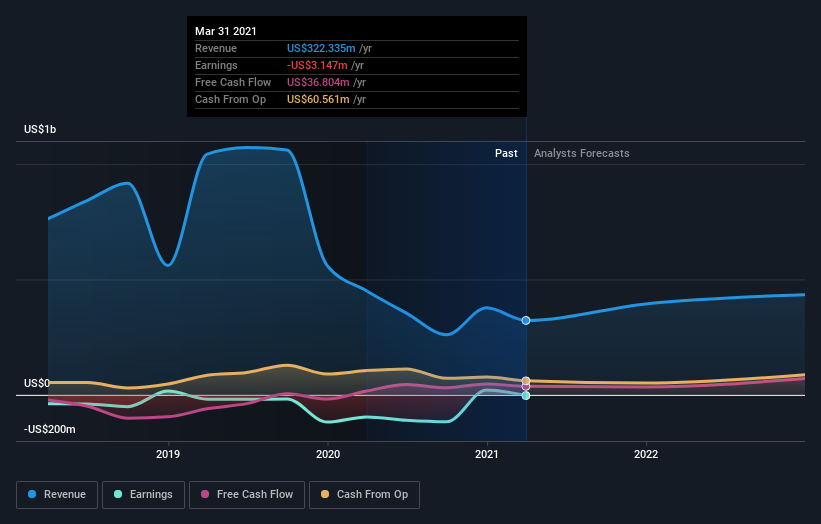

Because TETRA Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

TETRA Technologies actually shrunk its revenue over the last year, with a reduction of 28%. So it's very confusing to see that the share price gained a whopping 644%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on TETRA Technologies

A Different Perspective

We're pleased to report that TETRA Technologies shareholders have received a total shareholder return of 644% over one year. That certainly beats the loss of about 6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with TETRA Technologies , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance