Terreno Realty (TRNO) Concludes Development of Hialeah Property

Terreno Realty Corporation TRNO recently announced the completion of the development and stabilization of Countyline Corporate Park Phase IV Building 40 in Hialeah, FL, effective Jun 30, 2024. This building has been 100% leased to four tenants.

Building 40, with a 36-foot clear height, is located in Terreno Realty’s Countyline Corporate Park. This 186,000-square-foot industrial distribution building is placed on 9.1 acres of land. It includes 60 dock-high and two grade-level loading positions, as well as parking for 159 cars.

The building, with a total expected investment of $43.8 million and an estimated stabilized cap rate is 6.3%, is expected to achieve LEED certification.

Countyline Corporate Park Phase IV encompasses a 121-acre project approved for the construction of 2.2 million square feet of industrial distribution buildings in Miami's Countyline Corporate Park (”Countyline”). Countyline itself is a landfill redevelopment area, positioned adjacent to Florida's Turnpike and the southern terminus of I-75 located at the intersection of NW 170th Street and NW 107th Avenue.

Upon its anticipated completion in 2027, Countyline Phase IV is likely to comprise ten LEED-certified industrial distribution buildings, encompassing a total area of approximately 2.2 million square feet. These buildings will offer 660 dock-high and 22 grade-level loading positions, along with parking spaces for 1,875 cars. The estimated investment for this project is approximately $511.5 million.

This development strengthens Terreno's strategic positioning in the regional industrial real estate sector. With an advantageous location, the buildings are expected to lure tenants and enjoy high occupancy.

With a solid operating platform, a healthy balance sheet position and strategic expansion moves, TRNO seems well-positioned to capitalize on long-term growth opportunities amid favorable industry fundamentals. However, the elevated supply of industrial real estate and a high interest rate environment pose key concerns for the company.

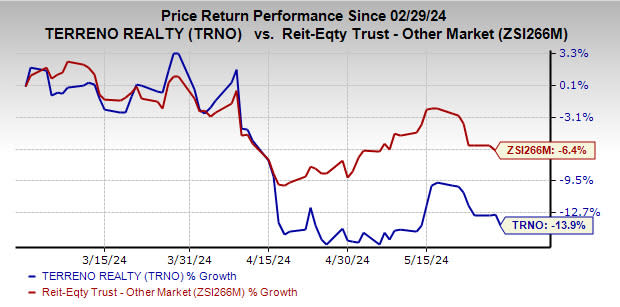

Over the past three months, shares of this Zacks Rank #4 (Sell) company have declined 13.9% compared with the industry’s fall of 6.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are American Tower AMT and Lamar Advertising LAMR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for AMT’s 2024 FFO per share stands at $10.53, which indicates an increase of 6.69% from the year-ago period’s actual.

The Zacks Consensus Estimate for LAMR’s 2024 FFO per share is pegged at $8.03, which suggests 7.5% year-over-year growth.

Note: Anything related to earnings presented in this write-up represents FFO, a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

Terreno Realty Corporation (TRNO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance