Terns (TERN) Gains 13.6% YTD: Will the Momentum Continue?

Terns Pharmaceuticals, Inc. TERN, a clinical-stage biopharmaceutical company, is having a good run year to date (YTD).

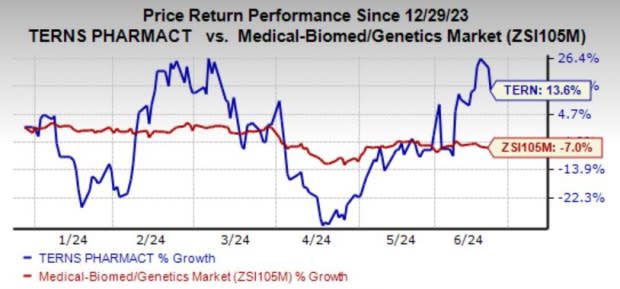

Shares of the company have risen 13.6% YTD against the industry’s decline of 7%.

Image Source: Zacks Investment Research

The outperformance can be attributed to encouraging pipeline progress.

Terns is developing a portfolio of small molecule product candidates in the oncology and obesity space. The pipeline contains three clinical-stage development programs, including an allosteric BCR-ABL inhibitor, a small molecule glucagon-like peptide-1 (GLP-1) receptor agonist, a THR-β agonist, and a preclinical GIPR modulator discovery effort, prioritizing a GIPR antagonist nomination candidate.

TERN-701, an oral, allosteric BCR-ABL inhibitor is being evaluated for the treatment of chronic myeloid leukemia (CML). TERN-701 has demonstrated superior efficacy and safety compared to traditional active-site tyrosine kinase inhibitors (TKIs).

A phase I study, CARDINAL, in CML is ongoing and interim data from the initial CARDINAL dose escalation cohorts are expected in the second half of 2024.

In April, Terns announced upbeat data from a phase I study of TERN-701 in Western healthy volunteers. The study is an ongoing phase I open-label, single ascending dose trial to evaluate the pharmacokinetics (PK), food effect, safety and tolerability of TERN-701 in healthy adults. Data indicated that TERN-701 can be administered once daily with or without food at doses that achieve clinically efficacious exposures.

According to the company, TERN-701 has the potential to be a differentiated BCR-ABL inhibitor with advantages over Novartis’ NVS Scemblix (asciminib), including more convenient dosing to improve treatment options and quality of life for people living with CML.

In March 2024, the FDA granted orphan drug designation to TERN-701 for the treatment of CML.

The successful development of TERN-701 should be a significant boost for the company, given the market potential.

The cash position, which also looks good, should enable TERN to fund its development programs. As of Mar 31, 2024, cash, cash equivalents and marketable securities were $240.7 million. Based on its current operating plan, Terns expects these funds to be sufficient to support its planned operating expenses into 2026.

NVS’ Scemblix is approved in several countries, including the United States and the EU, to treat adults with Ph+ CML-CP who have previously been treated with two or more TKIs.

Terns’ other pipeline candidates appear promising as well. The company is evaluating TERN-601, an oral, small-molecule GLP-1 receptor agonist for obesity.

A phase I first-in-human clinical trial in obese and overweight participants is progressing. The multiple ascending dose portion of the study is underway, evaluating once-daily administration of TERN-601.

Terns is on track to report top-line 28-day weight loss data in the second half of 2024. Obesity is a lucrative market that is in the spotlight following the stupendous success of Novo Nordisk’s Wegovy, among others.

Positive data readouts from the ongoing studies should keep investors’ interest afloat and maintain momentum for Terns.

Meanwhile, TERN ccontinues to evaluate opportunities for TERN-501, an oral, thyroid hormone receptor-beta (THR-β) agonist, in metabolic diseases.

As reported by Terns, THR-β is an orthogonal mechanism to GLP-1, potentially providing broader metabolic and liver benefits in addition to increased weight loss based on non-clinical studies.

Terns is also prioritizing its discovery efforts on nominating a GIPR antagonist development candidate based on in-house discoveries and growing scientific rationale supporting the potential of GLP-1 agonist/GIPR antagonist combinations for obesity.

Zacks Rank & Other Stocks to Consider

Terns carries a Zacks Rank #2 (Buy) at present.

A couple of other top-ranked stocks in the biotech sector are Ligand Pharmaceuticals LGND and ALX Oncology Holdings ALXO, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2024 earnings per share (EPS) has increased 16 cents to $4.71. During the same time frame, the consensus estimate for 2025 EPS has increased 70 cents to $5.90. Year to date, shares of LGND have risen 12.7%.

Ligand beat on earnings in each of the trailing four quarters, delivering an average surprise of 56.02%.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Terns Pharmaceuticals, Inc. (TERN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance