Tenet Healthcare (THC) Beats on Q1 Earnings, Ups '24 EPS View

Tenet Healthcare Corporation THC reported first-quarter 2024 adjusted earnings per share (EPS) of $3.22, which surpassed the Zacks Consensus Estimate by a whopping 122.1% and crossed management’s expectation of $1.24-$1.62. The bottom line more than doubled year over year.

Net operating revenues advanced 6.9% year over year to $5.4 billion and exceeded management’s guidance of $5-$5.2 billion. The top line beat the consensus mark by 4.4%.

The solid quarterly results were driven by growing patient volumes within the Hospital Operations and Services segment, partly offset by higher medical fees. Meanwhile, an increase in service lines drove the Ambulatory Care segment’s results. On top of that, a significant decline in the overall expense level contributed to the upside.

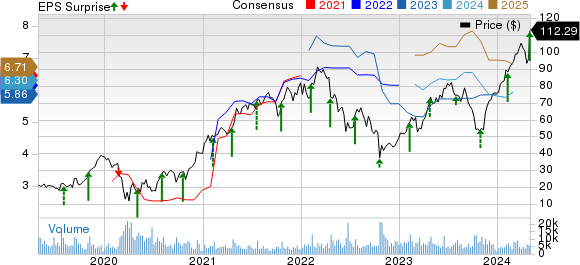

Tenet Healthcare Corporation Price, Consensus and EPS Surprise

Tenet Healthcare Corporation price-consensus-eps-surprise-chart | Tenet Healthcare Corporation Quote

Q1 Performance

Adjusted net income from continuing operations amounted to $324 million, which more than doubled year over year and comfortably exceeded management’s expected range of $130-$170 million.

Adjusted EBITDA of $1 billion climbed 23.1% year over year on the back of improved same-hospital admissions and favorable payer mix. Adjusted EBITDA margin improved 250 basis points (bps) year over year to 19.1%.

Total operating costs of $2.1 billion dropped 52.1% year over year on the back of a significant increase in net gains on sale, consolidation and deconsolidation of facilities from the prior-year quarter. However, costs related to salaries, wages and benefits, supplies and other operating expenses, net, increased 2.8%, 4.2% and 5.6%, respectively, on a year-over-year basis.

Segmental Details

Hospital Operations and Services – The segment recorded net operating revenues of $4.4 billion in the first quarter, which grew 6.2% year over year on the back of higher admissions, favorable payer mix and strong pricing yield. The metric outpaced the Zacks Consensus Estimate of $4.09 billion and our estimate of $4.13 billion. On a same-hospital basis, net patient service revenues advanced 10.8% year over year.

Adjusted EBITDA rose 28% year over year to $630 million, higher than the consensus mark of $449.6 million and our estimate of $429.5 million. Adjusted EBITDA margin was 14.4%, which improved 240 bps year over year.

Ambulatory Care – Net operating revenues in the segment improved 9.9% year over year to $995 million, attributable to improved net revenue per case, buyouts, inauguration of de novo facilities and the expansion of service lines. The metric surpassed the Zacks Consensus Estimate of $981.6 million and our estimate of $985 million.

Adjusted EBITDA grew 15.9% year over year to $394 million, higher than the consensus mark of $387.2 million but short of our estimate of $404.2 million. Adjusted EBITDA margin of 39.6% improved 200 bps year over year.

Financial Position (As of Mar 31, 2024)

Tenet Healthcare exited the first quarter with cash and cash equivalents of $2.5 billion, which more than doubled from the figure in 2023 end. Total assets of $28.9 billion increased 2.1% from the 2023-end level.

Long-term debt, net of the current portion, amounted to $12.8 billion, down 14.2% from the figure as of Dec 31, 2023. The current portion of long-term debt totaled $107 million.

Total shareholders’ equity of $3.5 billion more than doubled from the figure at 2023 end.

Net cash provided by operating activities was $586 million, which climbed 30.5% year over year. Free cash flows were recorded at $346 million, which soared 61.7% year over year.

Share Repurchase Update

THC bought back common shares worth $278 million in the first quarter of 2024. It had a leftover capacity of $272 million under its authorized repurchase program as of Mar 31, 2024, which is set to expire on Dec 31, 2024.

Outlook

2Q24

Net operating revenues are anticipated to lie within $4.9-$5.1 billion. Adjusted EBITDA is forecasted between $835 million and $885 million, while adjusted EBITDA margin is estimated to lie in the 17-17.4% band. Adjusted net income from continuing operations is expected to be between $160 million and $200 million. Adjusted EPS is estimated to be between $1.58 and $1.98.

2024

Net operating revenues are currently forecasted to be between $20 billion and $20.4 billion for 2024, up from the prior guidance of $19.9-$20.3 billion. The midpoint of the revised guidance indicates a 1.7% decline from the 2023 reported figure.

Net operating revenues of the Hospital segment are presently anticipated between $15.9 billion and $16.1 billion. The same at the Ambulatory Care unit is likely to be between $4.2 billion and $4.3 billion.

Adjusted EBITDA is estimated to lie within $3.5-$3.7 billion, up from the earlier view of $3.285-$3.485 billion. Adjusted EBITDA margin is expected in the 17.5%-18.1% range.

Adjusted net income from continuing operations is projected to lie between $845 million and $950 million, up from the prior expectation of $605-$725 million. The midpoint of the updated guidance suggests 20.6% growth from the 2023 figure. Adjusted EPS is anticipated to be within $8.37-$9.41, higher than the previous outlook of $5.76-$6.90. The mid-point of the revised outlook implies a 27.4% rise from the 2023 figure. Interest expense continues to be estimated between $825 million and $835 million.

Net cash provided by operating activities is currently forecasted between $1.7 billion and $2.1 billion for 2024. It is expected that free cash flow will stay between $950 million and $1.2 billion. Capital expenditures continue to be projected to be in the range of $775-$875 million.

Zacks Rank

Tenet Healthcare currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported first-quarter 2024 results so far, the bottom-line results of HCA Healthcare, Inc. HCA, Centene Corporation CNC and Molina Healthcare, Inc. MOH beat the Zacks Consensus Estimate.

HCA Healthcare reported first-quarter 2024 adjusted EPS of $5.36, which beat the Zacks Consensus Estimate by 7%. The bottom line improved 8.7% year over year. Revenues amounted to $17.3 billion, which improved 11.2% year over year in the quarter under review. The top line outpaced the consensus mark by 2.9%. Same-facility equivalent admissions advanced 5.2% year over year while same-facility admissions grew 6.2% year over year.

Same-facility revenue per equivalent admission rose 3.5% year over year. Same-facility inpatient surgeries grew 1.7% year over year. Same-facility outpatient surgeries declined 2.1% year over year. Same-facility emergency room visits advanced 7.2% year over year in the first quarter. Adjusted EBITDA improved 5.7% year over year to $3.4 billion. HCA operated 188 hospitals and roughly 2,400 ambulatory sites of care across 20 states and the United Kingdom as of Mar 31, 2024.

Centene recorded first-quarter 2024 adjusted EPS of $2.26, which outpaced the Zacks Consensus Estimate by 8.1%. The bottom line improved 7.1% year over year. Revenues advanced 3.9% year over year to $40.4 billion. The top line beat the consensus mark by 11%. Revenues from Medicaid amounted to $21.5 billion, which slipped 3% year over year in the quarter under review, while Medicare revenues inched up 1% year over year to $5.9 billion.

Additionally, commercial revenues of $7.8 billion climbed 48% year over year. Premiums of CNC rose 5% year over year to $35.5 billion. Service revenues of $808 million declined 28.3% year over year. As of Mar 31, 2024, total membership was 28.4 million, which dipped marginally year over year. Adjusted net earnings grew 4.1% year over year to $1.22 billion.

Molina Healthcare reported first-quarter 2024 adjusted EPS of $5.73, which beat the Zacks Consensus Estimate by 5%. However, the bottom line dipped 1.4% year over year. Total revenues amounted to $9.9 billion, which improved 21.9% year over year. Also, the top line outpaced the consensus mark by 4.3%. Premium revenues of $9.5 billion climbed 21% year over year in the quarter under review.

Investment income soared 52.1% year over year to $108 million. Adjusted general and administrative expense ratio deteriorated 10 bps year over year to 7.1%. MOH’s adjusted net income dipped 0.9% year over year to $334 million. The consolidated medical care ratio (medical costs as a percentage of premium revenues), was 88.5% in the quarter under review. The metric deteriorated 140 bps year over year. As of Mar 31, 2024, total membership advanced 9% year over year to around 5.7 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance