Tencent Is Worth More Than a Utility, Fidelity Fund Manager Says

(Bloomberg) -- Battered-down Tencent Holdings Ltd., a once-hot Chinese tech stock that’s lost half its value, shouldn’t be priced as a utility because of its greater earnings potential, according to a Fidelity Investments fund manager.

Most Read from Bloomberg

The firm’s gaming division is poised for more title approvals, parts of the business such as the WeChat messaging app are potentially “under-monetized,” and the company continues to innovate, said John Dance, manager of the $7 billion Fidelity Emerging Markets Fund.

The recovery of China’s tech firms from a regulatory crackdown-fueled slump in late 2022 is leading investors to question whether a drastic repricing to utility-like levels for some is justified. Tencent’s valuation remains low on average relative to the earnings it’s delivered over the past 10 years, Dance said.

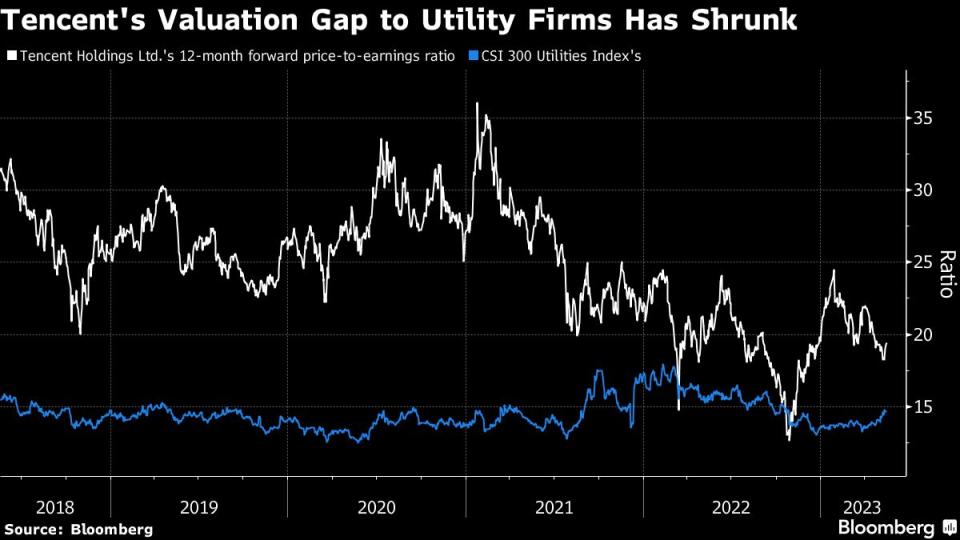

The valuation gap between Tencent and the CSI 300 Utilities Index has shrunk considerably. At the end of 2020, the company’s shares were being priced at nearly double that of the measure. Now, it trades at 19 times forward earnings versus about 15 times for the utility gauge.

Tencent is currently trading at about HK$345, less than half its peak in January 2021.

The company’s plans to develop a ChatGPT-like bot and a resumption of new game approvals are helping support the more than 8% advance in its share price this year, even as Chinese investors have recently been sellers.

Tencent is expected to post its biggest increase in quarterly revenue since 2021 on Wednesday thanks to a gradual recovery in spending and advertising in China, according to analyst estimates compiled by Bloomberg.

“Continued improvements by the regulators with respect to allowing new video games to come into the market” show a degree of pent-up demand, and “there’s some opportunity ahead” to monetize the businesses, Dance said. His fund has beaten 88% of peers over the past five years and had Tencent among its top 10 holdings as of the end of April, according to its latest factsheet.

--With assistance from Jeanny Yu.

Most Read from Bloomberg Businessweek

The Man Who Spends $2 Million a Year to Look 18 Is Swapping Blood With His Father and Son

Japan’s New Military Might Is Rising in a Factory in Hiroshima

ESG Investing Goes Quiet After Blistering Republican Attacks

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance