Tempur Sealy International Inc. (TPX) Q1 2024 Earnings: Adjusted EPS Aligns with Projections ...

Revenue: Reported at $1.189 billion, a decrease of 1.5% year-over-year, below estimates of $1.213 billion.

Net Income: Decreased by 10.6% to $76.3 million, below the estimated $86.45 million.

Earnings Per Share (EPS): Recorded at $0.43, below the estimated $0.49 and down from $0.48 year-over-year.

Gross Margin: Improved to 43.1% from 41.4% in the prior year, reflecting operational efficiencies and favorable commodity costs.

Operating Cash Flow: Achieved a record first quarter cash flow from operations of $130 million.

Dividend: Declared a quarterly cash dividend of $0.13 per share, payable on May 30, 2024.

Financial Guidance: Reaffirmed full-year 2024 adjusted EPS guidance in the range of $2.60 to $2.90, anticipating low to mid-single digit year-over-year sales growth.

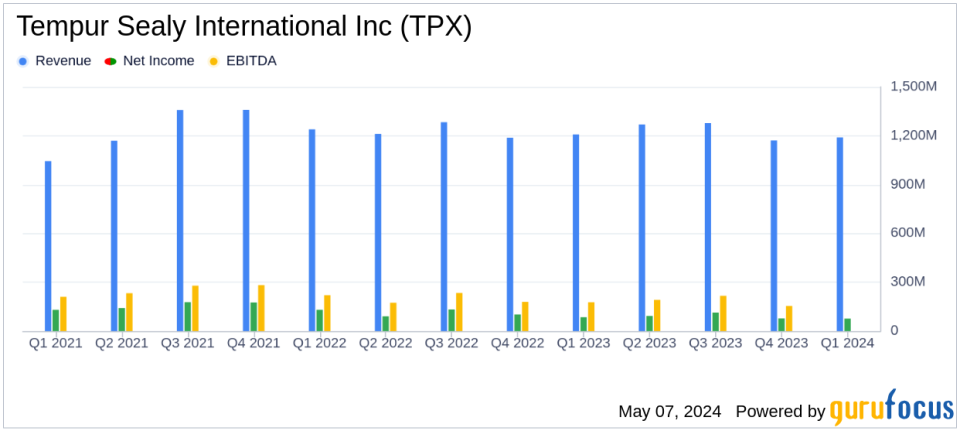

On May 7, 2024, Tempur Sealy International Inc. (NYSE:TPX) disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company, a prominent player in the global bedding market, reported a slight decline in net sales and earnings per share (EPS), while achieving a notable improvement in gross margins and generating record first-quarter cash flow from operations.

Financial Performance Overview

For the quarter ended March 31, 2024, Tempur Sealy announced net sales of $1.189 billion, a decrease of 1.5% from $1.208 billion in the same period last year. This decline was primarily due to a 2.0% decrease in the North America business segment, although international sales remained consistent. Adjusted for constant currency, total net sales decreased by 2.1%.

The company's gross margin improved significantly, rising from 41.4% to 43.1%. This enhancement reflects favorable commodity costs and operational efficiencies. However, operating income fell by 8.2% to $131.5 million, and net income saw a 10.6% decrease to $76.3 million. EPS decreased by 10.4% to $0.43, while adjusted EPS was $0.50, aligning closely with analyst estimates of $0.49.

Segment Performance and Challenges

In North America, net sales through the wholesale channel declined by 3.4%, influenced by macroeconomic pressures affecting U.S. consumer behavior. Conversely, sales through the direct channel, which includes e-commerce, grew by 7.7%. The international segment saw a modest decrease in net sales on a constant currency basis, with a slight improvement in operating margins due to cost efficiencies.

Corporate operating expenses increased to $47.7 million, up from $36.9 million in the prior year, largely due to transaction costs associated with the pending acquisition of Mattress Firm. This acquisition is expected to enhance customer and shareholder value, pending regulatory approval.

Strategic Initiatives and Market Position

CEO Scott Thompson highlighted the company's resilience in the face of a challenging global economic environment. The introduction of innovative products and effective marketing strategies contributed to Tempur Sealy's industry outperformance. Despite the current downturn, the company remains focused on long-term success and is well-positioned to benefit from a market recovery.

"We are pleased to report solid first quarter sales, earnings and record operating cash flow against a global backdrop which appears to be at a historical nadir," said Thompson.

Financial Stability and Outlook

Tempur Sealy reaffirmed its full-year financial guidance for 2024, with adjusted EPS expected to range from $2.60 to $2.90, representing a potential 15% increase from the previous year. The company also declared a quarterly cash dividend of $0.13 per share, underscoring its commitment to shareholder returns.

The company's balance sheet remains robust, with total debt standing at $2.6 billion and a leverage ratio of 2.85 times adjusted EBITDA, indicating manageable debt levels relative to earnings.

Conclusion

While Tempur Sealy faces ongoing macroeconomic challenges and a slight downturn in sales, its strategic initiatives and strong operational efficiencies have allowed it to maintain a solid financial footing and align closely with market expectations for adjusted earnings. The pending Mattress Firm transaction and innovative product launches are expected to further strengthen its market position and enhance shareholder value.

For more detailed insights and updates, investors are encouraged to follow further developments from Tempur Sealy International Inc. (NYSE:TPX).

Explore the complete 8-K earnings release (here) from Tempur Sealy International Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance