Telecom Stock Roundup: QCOM Chips to Power Cars, NOK Extends Tele2 Deal & More

After a brief hiatus, U.S. telecom stocks witnessed a steady uptrend in the later stages of the past week as the industry averted a likely collision with the aviation sector with a short-term truce. The potential stalemate cropped up at the beginning of the past week when Verizon Communications Inc. VZ and AT&T Inc. T refused to pay heed to the pleas from U.S. officials for the deferment of their 5G expansion plans by about two weeks. However, when the situation appeared to blow out of proportion with various airline trade groups threatening to seek legal help to stop the 5G rollout in the C-Band spectrum, the two disgruntled telecom operators were forced to do a volte-face and agreed to delay the scheduled deployment by about two weeks.

Verizon and AT&T also agreed to reduce the power of their new 5G networks around airports for six months, within which the FAA is likely to study potential interference of the C-Band spectrum with aviation safety standards and identify requisite steps to eliminate the risks associated with it. The risks pertain to the commercial launch of the C-Band wireless service in the 3.7-3.98 GHz frequency band and its likely interference with radar or radio altimeter signals that measure the distance between the aircraft and ground. Data from these devices are fed to the cockpit safety system that helps pilots gauge the air safety metrics and prevent mid-air collision, avoid crashes and ensure a safe landing. The FAA argued that 5G deployment in the C-Band airwaves would significantly affect air cargo and commercial air travel at most of the biggest airports and highest traffic destinations across the country, with airlines warning that about 4% of daily flights are likely to be delayed, canceled, or diverted. With President Biden acknowledging the truce agreement as the best step forward for both the industries to seek a mutually agreeable solution, the industry gathered steam and exhibited an uptick.

Notable company-specific news that grabbed the spotlight over the past week include Qualcomm Incorporated’s QCOM collaboration with leading car manufacturers and Nokia Corporation’s NOK 5G deal extension with Tele2. Also, NETGEAR Inc. NTGR introduced a feature-packed service for gaming buffs. AT&T issued select subscriber results for the fourth quarter and Verizon expanded its 5G Ultra Wideband service.

Recap of the Week’s Most Important Stories

1. Qualcomm recently inked definitive agreements with leading car manufacturers to supply automotive chips for their upcoming models. The deals for an undisclosed amount with Volvo, Honda and Renault are likely to sow the seeds for digitizing their product lines.

Volvo will leverage Qualcomm's ”Snapdragon Cockpit” chips for the production of its electric SUV, which are likely to go into production this year. Honda will use the automotive chips for vehicles rolling out in 2023. Although Renault did not specify which models will use Qualcomm chips, it aims to work in tandem with Google to design a rich and immersive in-vehicle experience for its next-generation electric vehicles.

2. Nokia announced the extension of its partnership with Tele2 to deploy 5G RAN in Estonia, Latvia and Lithuania in a long-term deal. The deal builds on the long-standing partnership between the companies in the Baltic region.

As the sole supplier in this project, Nokia will provide equipment from its ReefShark System on Chip-powered AirScale equipment portfolio to upgrade Tele2’s nationwide radio network. The rollout will commence once Tele2 acquires spectrum with auctions for both low- and high-band frequencies scheduled next year. Tele2 had earlier acquired a 5G spectrum in the 3.5 GHz band and the 700 MHz spectrum in Latvia.

3. NETGEAR recently augmented its portfolio by introducing a feature-packed service for gaming buffs. Dubbed the NETGEAR Game Booster, the service is likely to be a strategic fit for gaming enthusiasts and offers an integrated solution to enhance performance and eliminate unnecessary network lag.

Powered by DumaOS — a powerful router operating system that offers control of the home network system — NETGEAR Game Booster is equipped with essential features for a superior gaming experience. These include Ping Heatmap, which helps players identify and choose the fastest game servers for their preferred games by viewing and analyzing ping for servers and Geo-Filter that reduces lag by selecting best-performing servers based on distance and ping rate.

4. AT&T provided select subscriber results for the fourth quarter of 2021. The company continues to deliver on its objectives to grow customer relationships across wireless, fiber and HBO Max.

For the fourth quarter, AT&T delivered total postpaid net additions of 1.3 million, which includes almost 880,000 postpaid phones. For the full-year 2021, postpaid phone net additions were 3.2 million. This reflects AT&T’s highest annual postpaid phone net additions in more than a decade as it continues to benefit from strong network performance and go-to-market strategy.

5. Verizon announced that more than 100 million people in 1,700-plus cities will have access to its 5G Ultra Wideband network this month. Nearly one in three Americans could experience a speed of up to 10 times faster than 4G LTE on the go, at homes or businesses.

This mega launch will provide excellent speed and security to Verizon’s customers, and expand its offering of home and business broadband to more places across the country. Verizon’s 5G Ultra Wideband service has been built on the virtualized network infrastructure to meet customers’ personalized needs in real time.

Price Performance

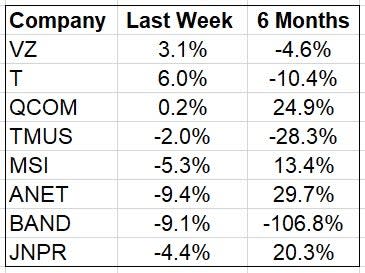

The following table shows the price movement of some of the major telecom stocks over the past week and six months.

Image Source: Zacks Investment Research

In the past five trading days, AT&T gained the most, with its stock rising 6%. Arista declined the most, with its stock falling 9.4%.

Over the past six months, Arista has been the best performer, with its stock appreciating 29.7%, while Bandwidth has declined the most, with its stock falling 106.8%.

Over the past six months, the Zacks Telecommunications Services industry has declined 6%, while the S&P 500 has rallied 8.5%.

Image Source: Zacks Investment Research

What’s Next in the Telecom Space?

In addition to 5G deployments and product launches, all eyes will remain glued to how the administration implements key policy changes to safeguard the industry’s interests and address the bottlenecks to spur growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

AT&T Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance