TEGNA (TGNA) Q1 Earnings Beat Estimates, Revenues Rise Y/Y

TEGNA’s TGNA first-quarter 2022 non-GAAP earnings of 59 cents per share beat the Zacks Consensus Estimate by 3.51% and increased 13.5% on a year-over-year basis.

Revenues increased 6.5% year over year to $774.3 million but missed the consensus mark by 0.51%. The year-over-year upside can be attributed to record first-quarter advertising and marketing services revenues and political revenues.

In February, Tegna entered into a definitive agreement to be acquired by an affiliate of Standard General for $24 per share in cash and become a private company.

The transaction, which the Tegna Board unanimously approved, has an equity value of around $5.4 billion and an enterprise value of $8.6 billion, including the assumption of debt.

With the acquisition in place, Tegna will become the United States’ largest minority-owned broadcast group.

The acquisition is currently on track and is expected to be completed in the second half of 2022, subject to closing conditions.

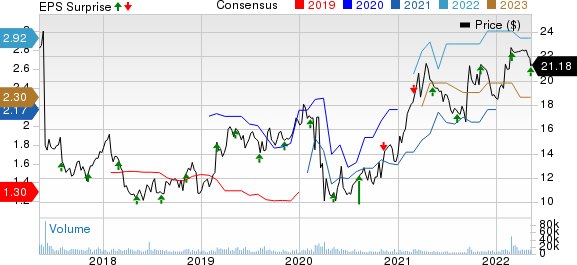

TEGNA Inc. Price, Consensus and EPS Surprise

TEGNA Inc. price-consensus-eps-surprise-chart | TEGNA Inc. Quote

Quarter in Detail

Subscription (50.6% of revenues) revenues inched up 1.3% year over year to $391.7 million due to rate increases.

Advertising and Marketing services (45.8% of revenues) revenues increased 9.9% year over year to $354.7 million, demonstrating significant broad-based strength across advertising categories.

Political (2.3% of revenues) revenues amounted to $18 million, up 90.5% year over year

Other revenues (1.3% of revenues) were $10 million, up 24.7% year over year.

Non-GAAP adjusted EBITDA increased 8.2% year over year to $249.6 million. Adjusted EBITDA margin expanded to 32.2% from 31.7% in the year-ago quarter.

Non-GAAP operating expenses (71.7% of revenues) of $554.8 million were up 5.1% year over year, driven by investments in growth initiatives such as Premion.

Non-GAAP operating income increased 10.1% year over year to $219.3 million. The operating margin expanded to 28.3% from 27.4% in the year-ago quarter.

Balance Sheet & Cash Flow

As of Mar 31, 2022, total cash was $43 million compared with $57 million as of Dec 31, 2021.

Total debt amounted to $3.1 billion and net leverage was 3.03 times as of Mar 31, 2021.

Free cash flow in the first quarter was $182 million compared with $189 million reported in the previous quarter. The uptick can be attributed to growth in advertising and marketing services and political revenues.

Zacks Rank & Stocks to Consider

TEGNA currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are Cable One CABO, Planet Fitness PLNT, and SeaWorld Entertainment SEAS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Cable One is up 36.8% in the year-to-date period against the Zacks Cable Television industry’s decline of 22.8% and the Consumer Discretionary sector’s fall of 29.4%.

Planet Fitness shares are down 23.8% in the year-to-date period against the Zacks Leisure and Recreation Services industry’s decline of 23.2% and the Consumer Discretionary sector’s fall of 29.4%.

SeaWorld Entertainment shares are down 14% in the year-to-date period against the Zacks Leisure and Recreation Services industry’s decline of 23.2% and the Consumer Discretionary sector’s fall of 29.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SeaWorld Entertainment, Inc. (SEAS) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report

Planet Fitness, Inc. (PLNT) : Free Stock Analysis Report

Cable One, Inc. (CABO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance