Technical Overview of AUD/USD, EUR/AUD & AUD/CHF: 21.09.2018

AUD/USD

Even after clearing six-week old descending trend-line, the AUDUSD presently struggles with an intermediate resistance-line, at 0.7300, in order to justify its strength. If the pair reverses from said barrier, the 0.7260, the 0.7245 and the 0.7230 are likely following supports to gain market attention. However, an upward slanting TL, at 0.7210 now, could confine the pair’s downside past-0.7230, if not then the 0.7160, the 0.7130 and the 0.7080 become important to watch. Alternatively, an upside break of 0.7300 can propel prices to 0.7330 and to the 0.7370 prior to highlighting 0.7410 to buyers. Assuming the pair’s ability to trade successfully beyond 0.7410, the 0.7440 and the 0.7465 might play their roles.

EUR/AUD

EURAUD’s bounce off the 1.6050-60 support-zone needs to surpass the 1.6170 mark to aim for 1.6220 whereas immediate descending TL, at 1.6280, could restrict the pair’s further advances. Given the Bulls’ refrain to respect the 1.6280 hurdle, the 1.6355 and the 61.8% FE level of 1.6420 may flash on the chart. Meanwhile, the 1.6130 can offer nearby rest to the pair ahead of dragging it again to 1.6060-50 region, break of which may push sellers towards 1.6000 round-figure. Should there be additional south-run beneath 1.6000, the 1.5955-45 and the 1.5835 can appear in the Bears’ radar.

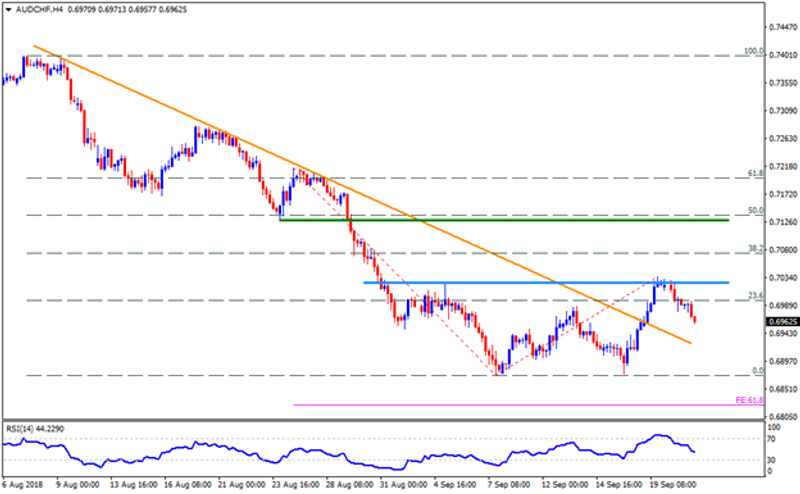

AUD/CHF

Having taken a U-turn from 0.7025-30 resistance-area, the AUDCHF may revisit the 0.6950 and the 0.6925 supports while the 0.6900 might challenge the pessimists afterwards. In case prices continue declining below 0.6900, the 0.6870 and the 61.8% FE level of 0.6825 could lure the traders. On the upside, sustained break of 0.7030 can escalate the pair’s rise to 0.7080 and then to the 0.7130 horizontal-line. Additionally, pair’s north-run beyond 0.7130 can avail the 0.7175, the 0.7210 and the 0.7250 numbers on target.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance