Technical Outlook For AUD/USD, AUD/JPY & AUD/NZD: 14.09.2018

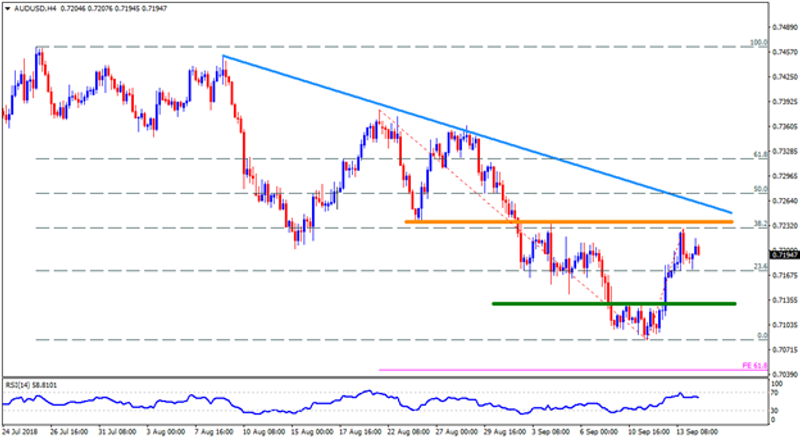

AUD/USD

AUDUSD’s recovery from 0.7080 region may find it hard to prevail for long as not only 0.7235-40 horizontal-area but the descending TL figure of 0.7265 could also challenge the Aussie buyers. If the pair manage to surpass 0.7265 trend-line barrier, the 0.7320 and the 0.7355 can come back on the chart whereas 0.7370 and the 0.7410 might please the Bulls afterwards. Alternatively, the 0.7165 and the 0.7130 can offer immediate supports to the pair during its pullback before highlighting the 0.7080 mark for sellers. In case the quote continue declining past-0.7080, the 61.8% FE level of 0.7040 and the 0.7000 round-figure could gain market attention.

AUD/JPY

With the two-month old downward slanting TL restricting AUDJPY’s upside, chances of the pair’s drop to 79.70-65 and then to the 79.25 seem brighter. However, recent low around 78.65 and the 61.8% FE level of 77.95 may try disappointing the sellers, if not then 77.40 can become Bears’ favorite. Meanwhile, D1 close beyond 80.75 trend-line can escalate the pair’s rise to 50-day SMA level of 81.55 and then to the 82.00 comprising 200-day SMA. Given the price rally above 82.00, the 82.80 and the 83.65-70 should be watched carefully.

AUD/NZD

Having reversed from five-week old descending trend-line, the AUDNZD may revisit the 1.0900 and the 1.0880 supports while 1.0860 can limit the pair’s further downside. Should the quote drops below 1.0860, the 1.0840 and the 61.8% FE level of 1.0820 may prove as strong rest-points. On the upside, aforementioned TL at 1.0955, followed by another trend-line figure of 1.0985, can restrict the pair’s nearby advances, breaking which 1.1020 and 1.1060 seem crucial to watch. Assuming that the quote continue rising post-1.1060, the 1.1100 and the 1.1130 can be targeted if holding long positions.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Futures (GC) Technical Analysis – September 14, 2018 Forecast

Gold Edges Up On Weak USD Owing to Disappointing US Macro Data

Oil Price Fundamental Daily Forecast – WTI Strengthens Over $68.78, Weakens Under $68.28

Bitcoin and Ethereum Price Forecast – BTC Prices Buoyant Again

Technical Outlook For AUD/USD, AUD/JPY & AUD/NZD: 14.09.2018

Yahoo Finance

Yahoo Finance