Technical Update For GBP/USD, EUR/GBP & GBP/CAD: 04.01.2019

GBP/USD

With more than a quarter old support-line pulling the GBPUSD up, 50-day SMA level of 1.2775 is likely to play its role of resistance soon, if not then 1.2900 mark, comprising 100-day SMA, followed by 1.3000 round-figure, may gain buyers’ attention. Should prices rise beyond 1.3000 on a daily closing basis, eight-month long downward slanting TL, at 1.3055, and the 200-day SMA level of 1.3165 seem crucial to watch. Alternatively, the 1.2600, the 1.2570 and the 1.2500 could try limiting the pair’s declines before highlighting the 1.2425 TL support for one more time. In case the quote registers a D1 close under 1.2425, the 61.8% FE level of 1.2380 and the 1.2300 might entertain sellers prior to pleasing them with the 1.2200 & the 1.2120, including 100% FE, numbers to south.

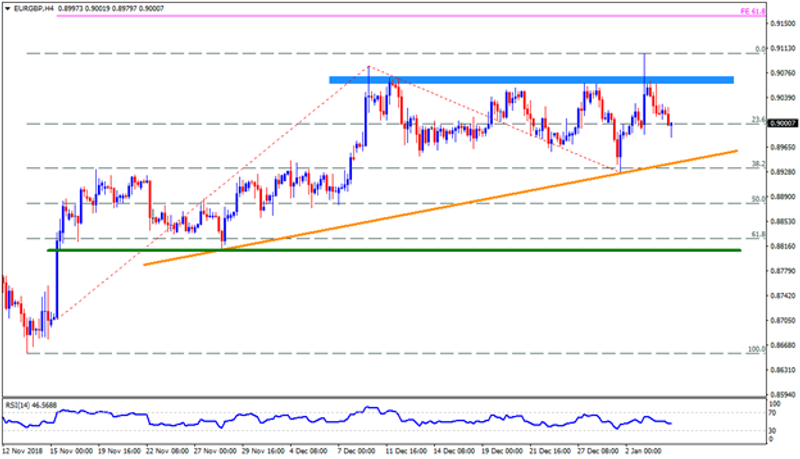

EUR/GBP

Another failure to sustain an uptick past-0.9060-70 resistance-region presently drags the EURGBP towards ascending trend-line, at 0.8935, which if broken can fetch the pair to 0.8880-75 and 0.8810-0.8800 rest-points. Given the Bears’ refrain to respect the 0.8800 mark, the 0.8770, the 0.8740 and the 0.8690 may flash on their radars. Meanwhile, 0.9030 can serve as immediate resistance for the pair ahead of pushing Bulls to 0.9060-70 area. Though, successful clearance of 0.9070 enables the pair to target the 0.9105 and the 61.8% FE level of 0.9160.

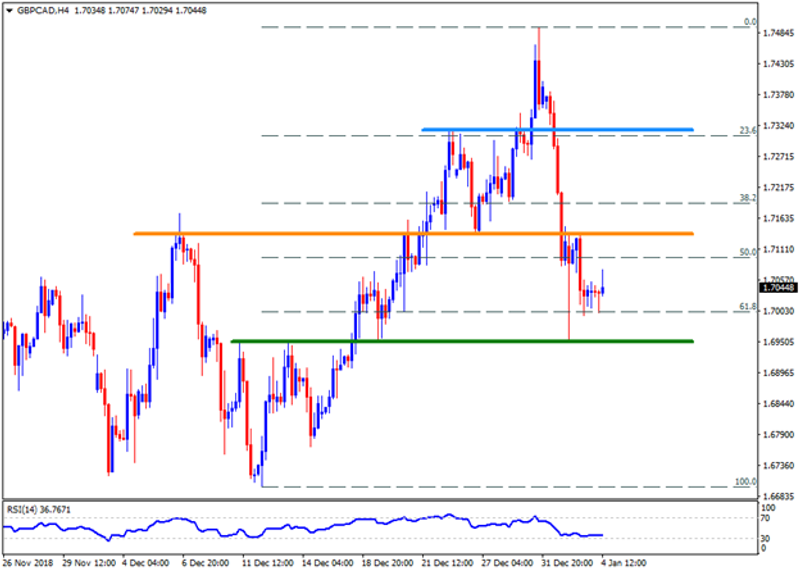

GBP/CAD

GBPCAD is yet to justify its strength by conquering the 1.7130-40 resistance-zone, until that the pair might be considered weak enough to re-test the 1.6950-45 horizontal-support. If at all 1.6945 fall short of restricting the pair’s dip, the 1.6880, the 1.6775 and the 1.6700 could act as consecutive supports. On the contrary, pair’s ability to cross the 1.7140 barrier can escalate the recovery to 1.7200 and the 1.7270 but the 1.7315-20 may confine its further advances. Assuming the quote’s capacity to surpass 1.7320, the 1.7350, the 1.7400 and the 1.7465 might provide buffers during its rally to 1.7500 landmark.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Weekly Price Forecast – Gold markets show signs of exhaustion

Silver Weekly Price Forecast – Silver markets hit resistance during the week

Crude Oil Weekly Price Forecast – crude oil markets bounce for the week

GBP/USD Price Forecast – British pound tries to rally but fails

USD/JPY Price Forecast – US dollar rallied slightly after strong jobs number

GBP/JPY Price Forecast – British pound rallied slightly against Japanese yen

Yahoo Finance

Yahoo Finance