Technical Checks For Important GBP Pairs: 6.12.2017

GBP/USD

GBPUSD’s gradual declines from 1.3550 seems dragging the pair beneath a short-term ascending trend-line, which if sustained could further fetch it to 1.3330 and then to the 1.3280-75 horizontal-line. Should the quote continue declining below 1.3275, the 1.3220 and the 1.3180 rest-points may please sellers. However, pair’s inability to extend latest downtick may trigger its upside to the 1.3405 and the 1.3450, breaking which 1.3480 and the 1.3510 can re-appear on the chart. During the pair’s additional advances beyond 1.3510, the 1.3550 and the 1.3610 are likely resistances that buyers might target.

GBP/JPY

Following its failure to surpass September high on a daily closing basis, the GBPJPY is now indicating the 50-day SMA re-test that lays around 149.35 at the moment. If the pair drops under the same, the 148.90 and the 147.80 might offer intermediate halts while stretching its downturn towards 147.00–146.90 support-zone, including 100-day SMA. Meanwhile, the 150.30 and the 151.50-55 could be considered as adjacent resistances if prices reverse from present levels. Should the pair successfully trades above 151.55, it needs to close beyond September high of 152.85 in order to highlight the 61.8% FE level of 155.35.

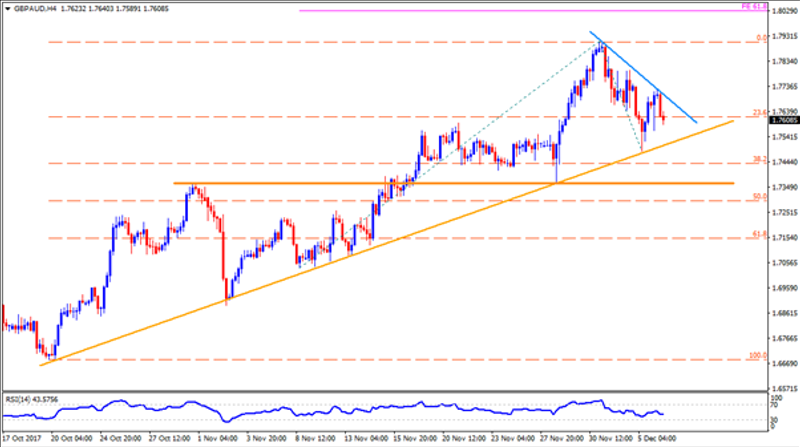

GBP/AUD

With the GBPAUD’s latest U-turn from 1.7730, chances of its revisit to nearly two-month old ascending TL, at 1.7500, become brighter. Given the pair’s refrain to respect the 1.7500 mark, the 1.7420 and the 1.7380 can act as buffers ahead of igniting the importance of 1.7360-65 horizontal-line, which if broken can make it vulnerable enough to plunge towards 1.7290 and the 1.7230 support-levels. Alternatively, the 1.7700 could pose as immediate resistance for the pair, breaking which 1.7755 and the 1.7800 can be expected. Should buyers propel the prices beyond 1.7800, a sustained clearance of 1.7910 seems pre-requisite for them to aim at the 1.8000 psychological-magnet and the 61.8% FE level of 1.8030.

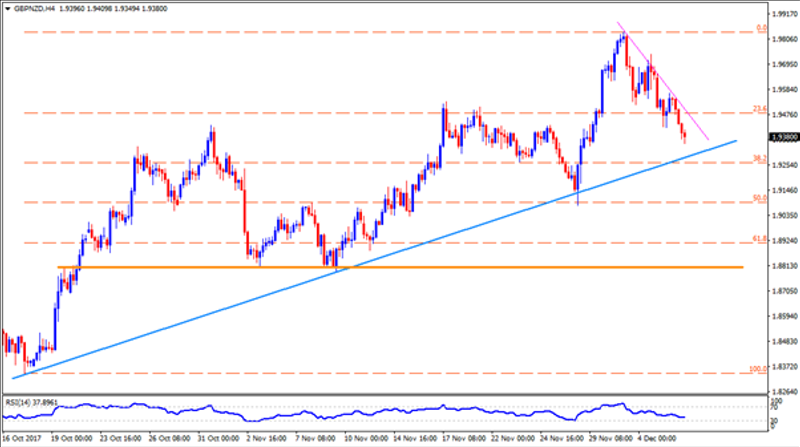

GBP/NZD

GBPNZD becomes another GBP pair that is running down to re-test near-term ascending TL, at 1.9290 now, conquering which may further weaken it towards 1.9160 and then to the 1.9070. During the pair’s additional south-run beneath 1.9070, the 1.9000 round-figure and the 1.8890 might hold its declines confined, failing to which could help Bears target the 1.8810–1.8800 horizontal-line. On the contrary, 1.9460 and the 1.9510 seems nearby resistances for the traders to watch, surpassing which 1.9550 and the 1.9620 may play their roles as upside stops. In case of the quote’s run-up above 1.9620, the 1.9740, the 1.9790 and the 1.9835-40 may entertain the Bulls.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance