Technical Checks For GBP/USD, AUD/USD, NZD/USD & USD/CAD: 28.11.2017

GBP/USD

Having repeatedly failed to provide a daily closing beyond 1.3335-40 horizontal-line, the GBPUSD seems now coming back to 50-day SMA level of 1.3240 with 1.3280 acting as immediate rest-point. If the pullback extends beneath 1.3240, the 1.3200 and the 1.3175 may offer intermediate halts during the pair’s dip towards testing 1.3120 support-line. Should sellers keep fetching the prices southwards after conquering the 1.3120 TL, a bit broader ascending trend-line, at 1.3035 now, may challenge the bears, if not then the 1.2950-45 area can reappear on the chart. Meanwhile, pair’s D1 close above 1.3340 can be considered as a trigger for its advances in direction to 1.3440 and then to the 1.3460, break of which may enable buyers to aim for 1.3550 and the 1.3600 round-figure. In case of the pair’s successful trading above 1.3600, the September high around 1.3660 and the 2016 low of 1.3835 may flash in Bulls’ radar.

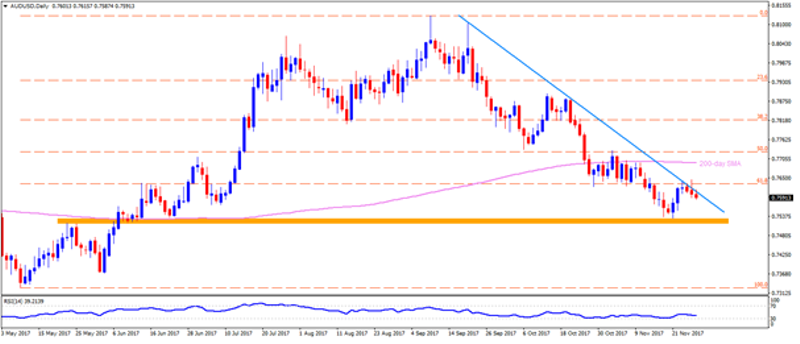

AUD/USD

AUDUSD is another major which couldn’t surpass trend-line resistance and is witnessing pullbacks. Presently, the 0.7570 can act as adjacent stop for the pair before confronting the 0.7530-15 broad support-zone. Given the pair drops below 0.7515 on a daily closing basis, the 0.7470, the 0.7425 and the 0.7380 could be judged as buffers during its southward trajectory to 0.7370 and then to the May month low near 0.7325. If at all the quote reverses from current levels, it needs to close beyond 0.7615 trend-line in order to meet the 0.7635 and the 200-day SMA level of 0.7695. Moreover, pair’s sustained trading above 0.7695 could open the door for its rally to the 0.7730, the 0.7745 and to the 0.7785 consecutive resistances.

NZD/USD

Even after surpassing nearly two-month old descending trend-line, an intermediate TL stretched since late-October is likely restricting the NZDUSD’s present upside. As a result, the overbought RSI seems playing its role and the pair might revisit the 0.6890 and the 0.6845 supports. However, pair’s following downside may find it hard to break the 0.6815, the 0.6780 and the 0.6760 levels, breaking which it can plunge to 61.8% FE number of 0.6700. Alternatively, a clear break of 0.6945 trend-line resistance may help the pair escalate its recovery to 0.6980 and then to the 0.7010 north-side figures. In case of the pair’s further rise beyond 0.7010, the 0.7045 and the 0.7100 may please the Bulls.

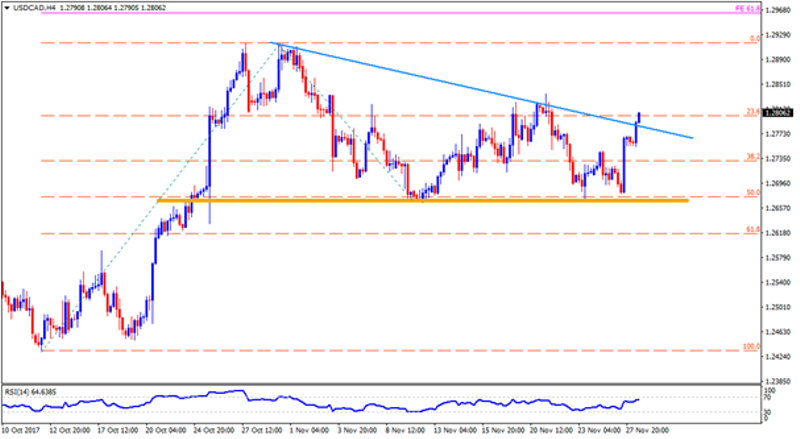

USD/CAD

Unlike previous three pairs, the USDCAD just smashed an immediate trend-line resistance of 1.2785 which opens the lag for its run-up to 1.2820 and then to the 1.2840 numbers. Given the pair’s ability to keep rising above 1.2840, the 1.2870 and the 1.2915 may get buyers’ attention, which if broken could increase the importance of 61.8% FE level of 1.2965. On the contrary, pair’s failure to sustain the breakout, with a dip below 1.2785, can again drag it to 1.2745 and 1.2720 levels but its following declines may be challenged by 1.2670-65 horizontal-region. Should additional selling pressure refrains to respect the 1.2665 mark, the 1.2600 is what becomes the likely rest for the pair.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

More From FXEMPIRE:

Technical Checks For GBP/USD, AUD/USD, NZD/USD & USD/CAD: 28.11.2017

US Dollar Index (DX) Futures Technical Analysis – November 28, 2017 Forecast

Crude Oil Price Update – Looking for Short-Term Pullback into $57.03 to $56.55

Markets Fight Back against Lows in Asia, Bitcoin Hits $10,000 on Some Exchange

Yahoo Finance

Yahoo Finance