The Aussies set to score nearly 10 times more from Budget, tax cuts

The Government passed its Budget tax cuts on Friday, after bringing forward major cuts slated for July 2022 to July 2020.

Around 11.6 million Australians are set to feel some benefit, but the overall Budget benefit will be far from equally spread, new analysis from the National Centre for Social and Economic Modelling (NATSEM) at the University of Canberra has found.

In fact, some families will see as much as 10 times more from the Budget as others, the analysis of the tax cuts, asset write-offs and wage subsidies revealed.

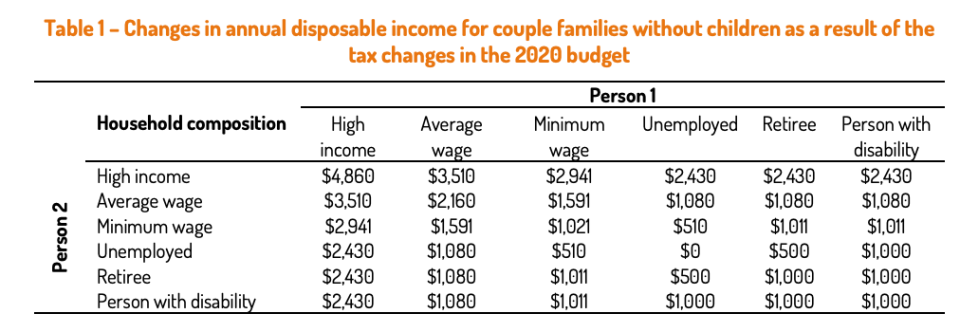

It found that a household of two high-income earners with no children would receive a benefit of $4,860 annually, while another childless household where one is a low-income earner and the other is unemployed would see a benefit of $500. And a household with no children where both adults are unemployed would see no benefit from those policy measures.

And the same trend occurs across all types of households, whether they are single, single-parent or dual-parent households.

“The message from our analysis is clear. The less households earn, the less they gain from this Budget,” the research reads.

“Meanwhile, high income households gain the most from tax cuts.”

‘Perverse outcome’ of tax cuts blasted

Analysis by The Australia Institute also found that the top 20 per cent of earners will receive more than 40 per cent of the benefit of the tax cuts.

“It is clear that most of this tax cut will go to those who are far more likely to save it. Saving the tax cut is made worse during an economic crisis,” The Australia Institute senior economist Matt Grudnoff said.

“People who are worried about losing their job are not keen to spend. Any additional money they get is likely to be used to pay down debt and increase savings in order to create a buffer against the growing uncertainty that they are feeling.”

Grudnoff also noted that a large amount of the tax cut flowing through to low- and middle-income earners is temporary, in the form of the low- and middle-income tax offset. However, the tax cuts for high-income earners are bakde in.

He said this is “the most perverse outcome” of the cuts.

“This leads to a situation where low- and middle-income earners will pay more tax next financial year than they pay this year. Effectively they face a tax increase next year when compared to this year.”

The tax cuts are expected to flow “within days” the ATO confirmed on Friday, after the Senate passed the cuts.

For more Yahoo Finance stories on the 2020 Federal Budget, visit here.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance