Synopsys (SNPS) & Samsung Foundry Team Up on 3nm Process Design

Synopsys SNPS recently announced that it has produced multiple successful test chip tapeouts on its digital and custom design solutions in collaboration with and certified by Samsung Foundry. The company intends to accelerate Samsung's 3 nanometer (nm) gate-all-around (GAA) technology adoption for its designs that require optimal power, performance and area (PPA).

Samsung’s GAA technology defies the performance limitations of FinFET, improving power efficiency by reducing the supply voltage level, while enhancing performance by increasing drive current capability. The first-generation 3nm process can reduce power consumption by up to 45%, improve performance by 23% and reduce the area by 16% while the second-generation 3nm process can reduce power consumption by up to 50%, improve performance by 30% and reduce the area by 35%.

With the recent announcement, Synopsys intends to meet the growing demand of customers using mobile, high-performance computing and artificial intelligence applications by substantially reducing power, improving performance standards and decreasing area levels.

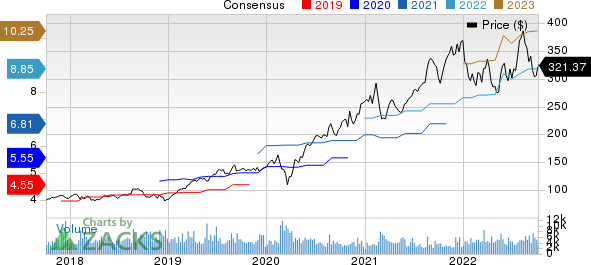

Synopsys, Inc. Price and Consensus

Synopsys, Inc. price-consensus-chart | Synopsys, Inc. Quote

Synopsys has been benefiting from strong design wins, courtesy of its robust product portfolio. Given the current economic scenario, customers are strengthening their supplier relationships and focusing on cost efficiencies. Many of them have selected Synopsys as their primary electronic design automation partner.

The latest development strengthens Synopsys’ relationship with Samsung Foundry. In July, the company designed a radio frequency (RF) design reference flow and design solutions kit on Samsung Foundry's 8nm RF low-power FinFET process, in collaboration with the Pennsylvania-based engineering simulation software developer Ansys ANSS.

In June, Synopsys launched an integrated RF Design Reference Flow solution, collaborating with Keysight Technologies KEYS and Ansys for the Taiwan Semiconductor Manufacturing Company’s TSM N6RF process that accelerates 5G performance and power efficiency.

The TSMC RF Design Reference Flow comprises Synopsys' Custom Compiler, PrimeSim, StarRC and IC Validator solutions, and Keysight's PathWave RFPro for EM simulation. It also includes Ansys' VeloceRF, RaptorX and RaptorH solutions, and Totem-SC products.

In April, Samsung Foundry, the Korean semiconductor manufacturer, adopted an advanced voltage-timing signoff solution, developed jointly by Synopsys and Ansys. In July 2021, Synopsys partnered with Samsung Foundry on its VC Functional Safety Manager solution to accelerate the time to achieve ISO 26262 compliance for automotive SOCs.

Currently, Keysight flaunts a Zacks Rank #1 (Strong Buy) while Synopsys carries a Zacks Rank #2 (Buy). Ansys has a Zacks Rank of 3 (Hold) while Taiwan Semiconductor has a Zacks Rank of 4 (Sell). Shares of SNPS and KEYS have jumped 7.7% and 3.4%, respectively, in the past year. Shares of ANSS and TSM plunged 32.9% and 31.9%, respectively, during the same time frame.

You can see the complete list of today's Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance