Synchrony Financial (SYF) to Post Q3 Earnings: What to Expect

Synchrony Financial SYF will release third-quarter 2019 results on Oct 18, before the market opens.

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is pegged at $1.12 cents, suggesting a 23.1% from the year-ago reported figure.

In the last reported quarter, the company delivered a positive surprise of 1.04%, backed by the PayPal Credit program acquisition and higher net interest income excluding the impact of the Walmart portfolio. The bottom line also improved 5.4% year over year.

Let’s see how things are shaping up prior to the announcement.

Earnings Catalysts for Q3

In the Retail Card platform, loan receivables as well as interest and fees on loans increased in the second quarter, a trend that most likely continued in the third quarter on the back of improved card sale. This, in turn, is likely to have contributed to the company’s top line. The Zacks Consensus Estimate for revenues stands at $4.3 billion, indicating a 2.9% rise from the prior-year reported number.

In the quarter to be reported, the Payments Solutions business is expected to have performed well, retaining the winning streak from the previous quarter.

Synchrony Financial is likely to have continued deploying capital for its shareholders per the plan introduced in the second quarter. The plan includes share repurchase of up to $4 billion. In an effort to enhance shareholder value, the company hiked its dividend by 4.8%, which was paid out on Aug 15. Continued capital deployment in the period is likely to have provided an additional impetus to the company’s bottom line.

Reserve build is anticipated around $175 million range during the third quarter, higher than the previous quarter due to acceleration in loan receivables growth and normal seasonality. According to Synchrony Financial’s past forecast, its net charge-offs are expected to be seasonally lower than the second quarter, leading to lower provision for loan losses. The consensus mark for allowance for loan losses implies a 3.8% decline from the year-earlier reported figure.

However, Synchrony Financial might have endured elevated expenses due to investments in sales platforms. Also, higher marketing expenses might have weighed down its margins to some extent.

What the Quantitative Model Predicts

Our proven model predicts an earnings beat for Synchrony Financial this reporting cycle. This is because the stock has the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Synchrony Financial has an Earnings ESP of +0.89%. This is because the Most Accurate Estimate is pegged at $1.13, higher than the Zacks Consensus Estimate of $1.12. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

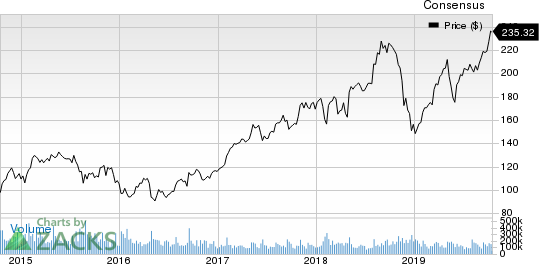

Synchrony Financial Price and Consensus

Synchrony Financial price-consensus-chart | Synchrony Financial Quote

Zacks Rank: Synchrony Financial carries a Zacks Rank #3, which increases the predictive power of ESP.

Other Stocks to Consider

Some other stocks worth considering from the finance sector with the perfect combination of elements to surpass estimates in the upcoming releases are as follows:

American International Group, Inc. AIG is set to report third-quarter earnings on Oct 30. The stock has a Zacks Rank of 3 and an Earnings ESP of +4.81%.

The Hartford Financial Services Group, Inc. HIG is set to report third-quarter earnings on Nov 4. The stock is Zacks #3 Ranked and has an Earnings ESP of +1.54%.

MarketAxess Holdings Inc. MKTX is slated to announce third-quarter earnings on Oct 23. The stock has an Earnings ESP of +3.70% and a Zacks Rank #2.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synchrony Financial (SYF) : Free Stock Analysis Report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

American International Group, Inc. (AIG) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance