Sydney homes are worth $448 more every day in new boom

There’s a new property boom. And like all others before this one, it’s terrific for homeowners and terrible for beleaguered buyers.

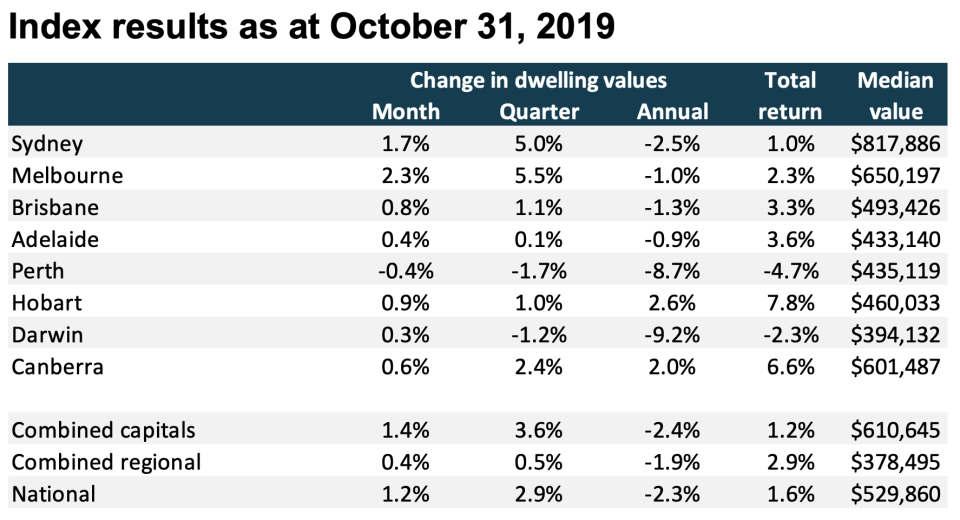

Exclusive analysis by Yahoo Finance of CoreLogic figures shows the average Sydney property, now worth $817,886, is growing at $448 a day. That’s the reality each time the earth simply spins if the strong 5 percent growth recorded last quarter continues.

Related story: Property investors flock to Sydney once again

Related story: The safe haven suburbs for property investors

Related story: Time running out to buy cheap property

Melbourne property increased by even more in percentage terms, 5.5 percent, but a lower average property price of $650,197 puts the daily ‘taking’ at $391.

Next come Canberra at $158 a day (based on a $601,487 average price), Brisbane at $60 ($493,426), Hobart at $50 ($460,033) and Adelaide at $48 ($433,140).

But two capital cities are still falling a little each day. Darwin property, worth an average of $394,132, is receding by $52, while Perth property, at an average $435,119, is still losing $81.

Over the quarter, these cities went backwards, by 1.2 percent and 1.7 percent respectively.

How Australia’s capital cities are faring in the recovery

The one-month national growth of 1.4 percent is the fastest in 3.5 years.

And the consecutive price lifts – this actually marks the fourth month of increases – coupled with a dramatic rise in auction clearance rates and also an increase in home loans approvals, point to a real-estate rebound. CoreLogic’s Kevin Brogan has just confirmed as much to Sky News.

“We are definitely seeing, in Sydney and Melbourne, some quite strong indicators for the first time,” he said.

Just for the month of October prices increased by 1.7 percent in Sydney, but this was overtaken by a 2.3 percent surge in Melbourne, the largest month-on-month gain since November 2009.

In fact, real estate agents in the Harbour City’s eastern suburbs are quietly telling me it’s “going nuts” again. And agents report a similar demand spike from buyers in Melbourne.

One area that was previously languishing is also showing early signs of a turnaround.

“In the first half of 2019, Brisbane really struggled to reach 50 percent but over the last few weeks we’ve seen clearance rates in Brisbane above 50 percent.” That capital put on 0.8 percent to October.

Why the seemingly sudden sentiment change?

Three reasons.

One, the Coalition won the election… and so evaporated the threats to negative gearing and capital gains tax discounting.

Two, interest rates began falling… three times so far with a potential for more.

Three, the banking watchdog relaxed lending standards such that prospective loans went from being ‘stress tested’ at a 7 percent theoretical interest rate, to just 2.5 percentage points above the actual interest rate.

Craig Morgan, director of Independent Mortgage Planners, says the last development means people might be able to borrow some 11 percent more than earlier in the year… and it appears they are.

So should first homebuyers panic?

Morgan counsels: “While my personal bias probably tends towards being ‘pro-property’, I question commonly accepted clichés like ‘getting a foot on the property ladder’ when I suspect at the moment it’s probably more like leaping onto the debt rollercoaster (or merry-go-round).”

Indeed, the rapid rebound has only 17 percent of experts feeling positive about housing affordability, down from 54 percent in just April, according to the latest Finder RBA Cash Rate Survey.

Meanwhile, 59 percent of Aussies believe now is a good time to buy property, slightly up from 54 percent in May.

It speaks of a potentially dangerous disconnect between how industry insiders and people desperately chasing prices view the market.

However, Finder’s insights manager Graham Cooke counters: ““Nobody knows what’s around the corner, but the chances that this price boost is a dead-cat-bounce seems less and less likely as prices continue to recover.

“First time buyers with a deposit saved may miss the good-value window if they don’t get into the market soon.”

Around the country, values remain 5.7 percent below their October 2017 peak but a predicted fourth rate cut next year will only fuel further price growth.

Nicole Pedersen-McKinnon is a financial educator and commentator, and the author of How to get mortgage-free like me, available from November 16 at www.nicolessmartmoney.com. Follow Nicole on Facebook, Twitter, LinkedIn, YouTube and Instagram @NicolePedMcKMoney.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance