Swedish Exchange Showcases Three Growth Companies With High Insider Ownership

As global markets respond to a mix of easing inflation and varied economic signals, the Swedish stock exchange presents a unique landscape for investors interested in growth companies with high insider ownership. This focus can offer insights into firms where leadership has significant skin in the game, potentially aligning management's interests with those of shareholders especially in an environment marked by shifting economic indicators.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Sileon (OM:SILEON) | 20.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

BioArctic (OM:BIOA B) | 34% | 50.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Here's a peek at a few of the choices from the screener.

BioArctic

Simply Wall St Growth Rating: ★★★★★★

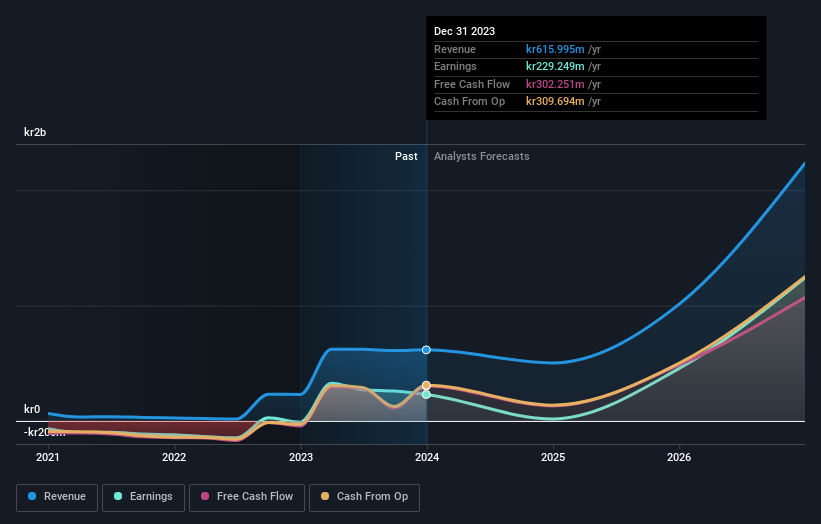

Overview: BioArctic AB, based in Sweden, specializes in developing biological drugs for central nervous system disorders and has a market capitalization of SEK 20.85 billion.

Operations: The company generates SEK 252.21 million from its biotechnology segment, focusing on biological drugs for central nervous system disorders.

Insider Ownership: 34%

Earnings Growth Forecast: 50.9% p.a.

BioArctic, a Swedish biopharma firm with significant insider ownership, has recently seen approval in South Korea for its Alzheimer's treatment, Leqembi®, enhancing its product portfolio. Despite a challenging Q1 in 2024 with a shift from profit to loss, the company is poised for recovery with anticipated high revenue growth (40.8% per year) and return to profitability within three years. Strategic alliances like the ongoing collaboration with Eisai Co., Ltd., underscore its commitment to innovation in Alzheimer's therapy.

Click here and access our complete growth analysis report to understand the dynamics of BioArctic.

Our valuation report here indicates BioArctic may be undervalued.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a global hotel property company that owns, develops, and leases hotel properties with a market capitalization of approximately SEK 38.33 billion.

Operations: The company generates revenue primarily through two segments: own operation, which brought in SEK 3.27 billion, and rental agreements, contributing SEK 3.82 billion.

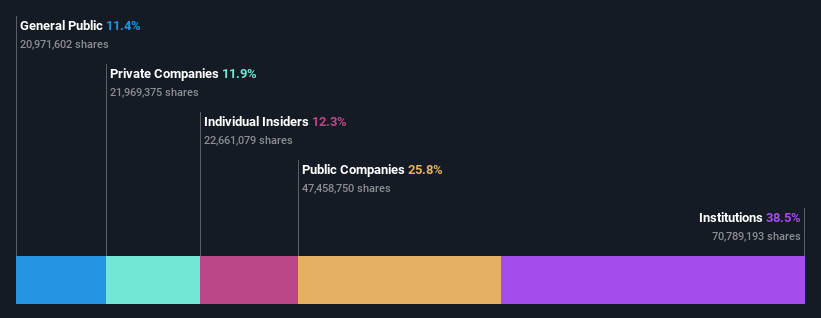

Insider Ownership: 12.3%

Earnings Growth Forecast: 27.7% p.a.

Pandox, a Swedish hotel operator with substantial insider ownership, demonstrated robust financial performance in the first half of 2024. With a significant increase in net income to SEK 1.15 billion from SEK 71 million the previous year and strong quarterly sales growth, Pandox is navigating its market effectively despite a low forecasted return on equity of 4.9% and modest revenue growth predictions at 2.3% annually. However, its dividend coverage remains weak, and interest payments are poorly supported by earnings.

Wallenstam

Simply Wall St Growth Rating: ★★★★☆☆

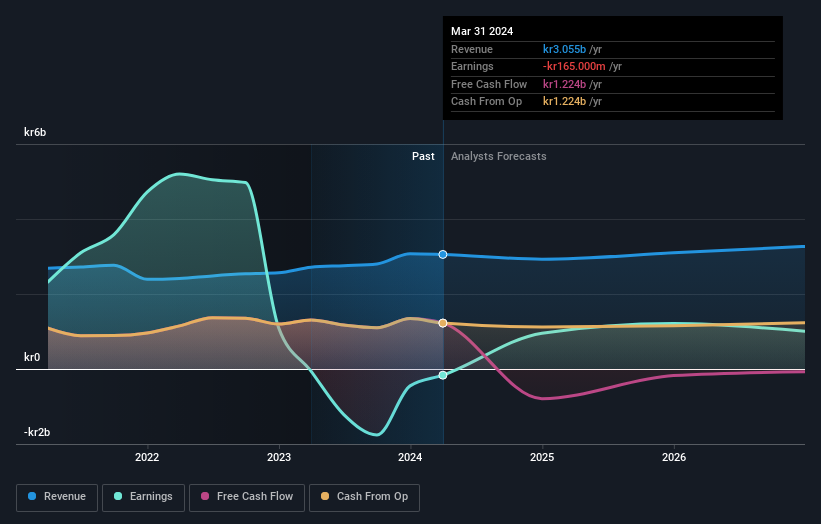

Overview: Wallenstam AB (publ) is a Swedish property company with a market capitalization of approximately SEK 37.22 billion.

Operations: The company generates revenue primarily from its operations in Gothenburg and Stockholm, with SEK 1.94 billion and SEK 0.94 billion respectively.

Insider Ownership: 35%

Earnings Growth Forecast: 55.3% p.a.

Wallenstam AB, reflecting mixed financial dynamics, recently shifted from a net loss to generating a net income of SEK 408 million in the first half of 2024. Despite modest annual revenue growth projections at 3.2%, the company's earnings are expected to surge significantly, outpacing the Swedish market's average. However, challenges persist as interest payments are inadequately covered by earnings and projected return on equity remains low at 4.4% in three years' time.

Key Takeaways

Get an in-depth perspective on all 87 Fast Growing Swedish Companies With High Insider Ownership by using our screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BIOA B OM:PNDX B and OM:WALL B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance