SVB Financial (SIVB) Q2 Earnings Beat, Provisions Increase

SVB Financial Group’s SIVB second-quarter 2020 earnings of $4.42 per share comfortably surpassed the Zacks Consensus Estimate of $2.96. However, the bottom line was down 27.3% year over year.

The results largely benefited from higher fee income, and improving loan and deposit balances. However, higher provisions, increase in operating expenses and contracting net interest margin (NIM) were the undermining factors.

Net income available to common shareholders was $228.9 million, down 28% from the prior-year quarter.

Revenues & Expenses Rise

Net revenues were $881.7 million, increasing 2.1% year over year. Also, the top line beat the Zacks Consensus Estimate of $757.2 million.

Net interest income (NII) was $512.9 million, which declined 2.1% year over year. Further, NIM — on a fully-taxable equivalent basis — contracted 88 basis points (bps) to 2.80%.

Non-interest income was $368.8 million, which grew 10.5% from the prior year. The upswing primarily resulted from a drastic improvement in investment banking revenues.

Non-interest expenses increased 25.1% from the prior-year quarter to $479.6 million. Increase in all expense components, except for business development and travel costs, resulted in the upside.

Non-GAAP core operating efficiency ratio was 55.70%, up from the prior-year quarter’s 45.49%. A rise in efficiency ratio indicates lower profitability.

Loans and Deposit Balances Increase

As of Jun 30, 2020, SVB Financial’s net loans amounted to $36.7 billion, increasing 1.9% from the prior quarter, while total deposits jumped 20.6% to $74.6 billion.

Credit Quality Deteriorates

Provision for credit losses increased significantly from $23.9 million in the year-ago quarter to $66.5 million. Also, the ratio of allowance for loan losses to total loans was 1.61%, up 58 bps year over year.

However, the ratio of net charge-offs to average loans was 0.12%, down 11 bps year over year.

Capital Ratios Mixed, Profitability Ratios Worsen

At second quarter-end, CET 1 risk-based capital ratio was 12.64% compared with 12.92% at the end of the prior-year quarter. Total risk-based capital ratio was 14.78% as of Jun 30, 2020, up from 13.97% in the corresponding period of 2019.

Return on average assets on an annualized basis was 1.17%, down from 2.10% recorded in the year-ago quarter. Also, return on average equity was 13.36%, which decreased from 23.29% a year ago.

Second-Half 2020 Outlook

Average loans are expected to be stable or slightly down from the second-quarter level. Further, deposit balances are expected between $71 billion and $74 billion.

NII is anticipated between $1.05 billion and $1.09 billion. NIM is projected to be 2.70-2.80%.

Core fee income is projected in the range of $255-$275 million.

Non-GAAP non-interest expenses (excluding costs related to non-controlling interests) are projected between $900 million and $930 million.

The effective tax rate is expected to be 27-29%.

Our Viewpoint

SVB Financial remains well poised to gain from persistent growth in loans and deposits, along with global diversification. However, continuously increasing expenses and declining NIM due to lower interest rates are major near-term concerns.

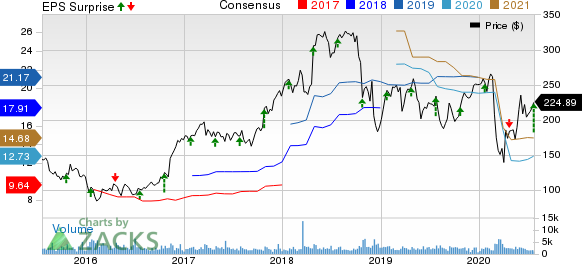

SVB Financial Group Price, Consensus and EPS Surprise

SVB Financial Group price-consensus-eps-surprise-chart | SVB Financial Group Quote

SVB Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Zacks #3 Ranked First Horizon National Corporation FHN reported second-quarter 2020 adjusted earnings per share of 20 cents, missing the Zacks Consensus Estimate of 21 cents. Further, the bottom line was 52.4% lower than the year-ago figure.

Regions Financial RF, currently holding a Zacks Rank #4 (Sell), reported second-quarter 2020 adjusted loss of 23 cents per share against earnings of 39 cents recorded in the prior-year period. The Zacks Consensus Estimate was pegged at earnings of 7 cents per share.

Zacks #3 Ranked Zions Bancorporation’s ZION second-quarter 2020 net earnings per share of 34 cents missed the Zacks Consensus Estimate of 37 cents. Moreover, the bottom line compared unfavorably with the year-ago quarter’s 99 cents per share.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

First Horizon National Corporation (FHN) : Free Stock Analysis Report

SVB Financial Group (SIVB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance