Surmodics (SRDX) Gets FDA's Formal Feedback About SurVeil DCB

Surmodics, Inc. SRDX announced its receipt of positive formal feedback from the FDA regarding its proposed approach to submit an amended premarket approval (PMA) application for the SurVeil drug-coated balloon (DCB). The company had earlier received another letter from the FDA in January, where the agency had indicated that the PMA application for the SurVeil DCB was not currently approvable while providing specific guidance on a path forward.

Following the receipt of the earlier letter, Surmodics prepared and submitted a Submission Issue Request (SIR), under the FDA’s Q-Submission Program, to obtain formal feedback on its proposed approach for addressing the FDA letter. The company has also completed a Submission Issue Meeting with the agency to discuss the request and the written feedback.

The receipt of positive formal feedback from the FDA raises our optimism about Surmodics’ product and its potential to get the PMA. This is likely to strengthen the company’s foothold in the DCB space.

Significance of the Feedback

The FDA had requested additional clarification related to already-completed biocompatibility studies and revisions to Surmodics’ proposed labeling to amend the PMA application to put it into an approvable form. The FDA noted that the feedback it provided was based on the level of information included in the company’s SIR and that the actual determination for the acceptability of Surmodics’ responses will depend on the information provided in its formal amended PMA application to be filed with the FDA.

Per management, the FDA’s feedback will likely provide the essential clarity on the process and content required to successfully amend the PMA application. Management does not anticipate the necessity for additional biocompatibility studies, which will likely significantly reduce Surmodics’ initial assumptions of the time and cost to amend its PMA application.

Based on the alignment and clarity provided by the FDA, management is currently preparing the amended PMA application for submission in the third quarter of fiscal 2023. The company is targeting to receive the PMA in the fiscal fourth quarter.

Industry Prospects

Per a report by Zion Market Research, the global DCB market was worth around $782.4 million in 2021 and is anticipated to reach about $1,819.2 million by 2028 at a CAGR of approximately 15.1%. Factors like the high prevalence of cardiovascular diseases and advanced healthcare infrastructure are likely to drive the market.

Given the market potential, the latest feedback raises optimism about Surmodics.

Notable Development

Last month, Surmodics announced its first-quarter fiscal 2023 results, wherein it registered robust revenues from its Medical Device segment, as well as from its Product sales, and royalties and license fees. During the quarter, Surmodics witnessed strong contributions from sales of its Pounce and Sublime products, indicating their continued solid demand.

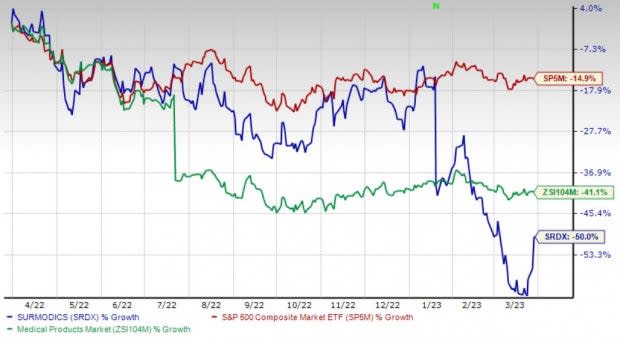

Price Performance

Shares of Surmodics have lost 50.1% in the past year compared with the industry’s 41.1% decline and the S&P 500's 14.9% fall.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Surmodics carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 2.8% against the industry’s 18.8% decline in the past year.

Henry Schein, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 9.3% compared with the industry’s 9.5% decline over the past year.

Avanos, carrying a Zacks Rank #2 at present, has an estimated growth rate of 1.8% for 2023. AVNS’ earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 14.2% compared with the industry’s 18.8% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Surmodics, Inc. (SRDX) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance