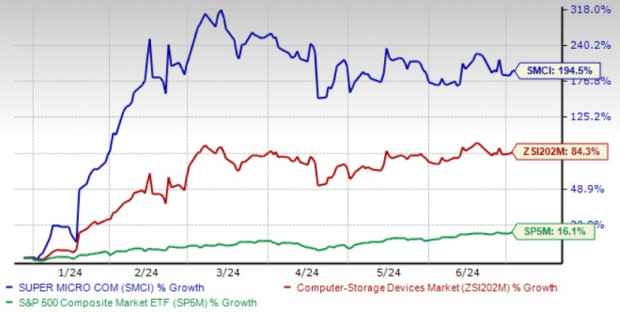

Super Micro Computer (SMCI) Up 194.5% YTD: Is it Worth Buying?

Super Micro Computer SMCI shares have skyrocketed 194.5% year to date, outpacing the Zacks Computer – Storage Devices industry and S&P 500 index, which have returned 84.3% and 16.1%, respectively. This impressive performance can be largely attributed to the company's solid position in artificial intelligence (AI) infrastructure market, which as per a Precedence Research report, is expected to witness a CAGR of 27.5% from 2024 to 2033.

Super Micro Computer has been capitalizing on the current AI boom on the back of robust demand for its server and storage solutions. Especially, growing OEM component orders are leading to a spike in the uptake of its AI servers.

Moreover, its diversified business model, which encompasses Graphics Processing Units (GPU), AI, core computing, storage, 5G, edge computing and Internet of Things solutions, is helping the stock grow.

Super Micro Computer remains optimistic about its robust pipeline of new products as well as existing products. It raised its guidance for fiscal 2024 revenue from fiscal year from $14.3-$14.7 billion to $14.7-$15.1 billion in its third-quarter fiscal 2024 earnings release.

The Zacks Consensus Estimate for SMCI’s fiscal 2024 revenues is pegged at $14.93 billion, indicating 109.7% growth year over year.

The company expects fiscal 2024 non-GAAP earnings per share in the range of $23.29-$24.09. The consensus mark for the same is pegged at $23.82, which has been stable over the past 30 days. The estimate indicates growth of 101.7% year over year.

SMCI Year-to-Date Price Performance

Image Source: Zacks Investment Research

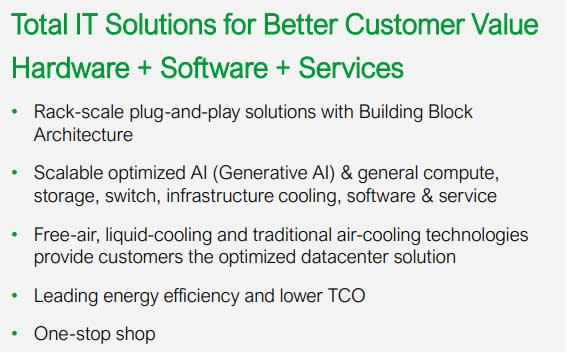

Strong Portfolio Aids Prospects

Super Micro Computer’s solid traction across top-tier data centers, emerging cloud service providers, enterprise/channel and edge/IoT/telecom customers, owing to its robust Total IT solutions portfolio is driving its prospects.

Strength in Total IT Solutions

Image Source: Super Micro Computer

Super Micro Computer is at the forefront of the current AI revolution. It is riding on its diversified AI portfolio and strong AI integrations into its storage systems.

Given the fact that AI is accelerating the need for liquid cooling, Super Micro Computer has invested heavily in high-quality, optimized Direct Liquid Cooling (DLC) solutions for high-end applications.

It has recently added three new manufacturing facilities in Silicon Valley to support the growth of AI and enterprise rack-scale liquid-cooled solutions and capitalize on the rising demand for liquid-cooled data centers.

The company is experiencing solid adoption of its Rack-Scale PnP Total AI solutions, which is contributing well to its server and storage revenues. It expects 5,000 racks capacity per month by the end of this year. Super Micro Computer is currently on track to produce more than two thousand DLC racks per month of AI servers, with production volumes ramping up steadily.

Strong momentum across its H100-based systems and AI inferencing systems is another positive.

Partnerships Drive Momentum

Super Micro Computer’s strategic partnerships with NVIDIA NVDA, Intel INTC and Advanced Micro Devices AMD are playing a vital role in driving its customer momentum.

In fiscal 2023, Super Micro Computer announced more than 50 products supporting Intel’s new Sapphire Rapids data center CPU. Its product portfolio was also enhanced to support AMD’s Genoa data center CPU.

SMCI’s robust portfolio of infrastructure solutions for 5G and telecom workloads, on the back of its strong partnership with NVIDIA, remains a major positive. It is also benefiting from strong momentum across the NVIDIA GPU product lines.

Many Super Micro Computer servers are explicitly designed for high-performance NVIDIA GPUs for AI processing, such as the very high-density 4U-8GPU systems, the Intel CPU-based SYS-421GE-TNHR2-LCC, and the AMD CPU-based AS -4125GS-TNHR2-LCC.

To further capitalize on the growing proliferation of AI, Super Micro Computer has deployed NVIDIA HGX H100 SuperCluster solutions to deliver enhanced experience to its customers.

The company recently unveiled Rack Scale Plug-and-Play Liquid-Cooled AI SuperClusters for NVIDIA Blackwell and NVIDIA HGX H100/H200. By optimizing with NVIDIA AI Enterprise software, SMCI strives to offer global manufacturing capacity with world-class efficiency to customers across various industries.

SMCI is now deepening its focus on developing new generative AI and inference-optimized systems based on the next-generation NVIDIA H200, B100, B200, GH200 and GB200 GPUs, as well as Intel’s Gaudi2/3 and Advanced Micro Devices’ MI300X/A GPUs.

Conclusion

Super Micro Computer’s long-term prospects are likely to benefit from its significant investments in production, operations, management software, AI portfolio, cloud features and customer service, which are expected to bolster its customer base in the days ahead.

However, near-term macroeconomic uncertainties and supply chain challenges, especially in DLC-related components, remain concerns for this Zacks Rank #3 (Hold) company. Increasing competition from original design manufacturers like Foxconn, Quanta Computer, and Wiwynn, among others, poses a threat to SMCI’s market position. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Moreover, SMCI is trading at a premium with a forward 12-month P/E of 35.02X compared with the industry’s 22.2X and higher than the median of 27.27X, reflecting a stretched valuation. Hence, investors looking to buy the stock should wait for a better entry point.

SMCI’s P/E F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance