Revealed: The super funds that outperformed during Covid-19

Years of growth for Australia’s superannuation funds came to a nauseating end in March, although the recovery has been better than commentators may have expected, a new report has found.

The 2019 financial year dipped the bull market into a rapid sell-off and nearly as rapid recovery, and Australians’ super balances reflect that, SuperRatings revealed on Friday. But some funds have performed better than others.

“Importantly, over the long term, returns remain very healthy,” said SuperRatings executive director Kirby Rappell.

“Super is a long-term game, so members should avoid chasing short-term results and ensure they are invested in a quality fund with the right investment strategy that is well positioned to deliver for their needs over the course of their working life.”

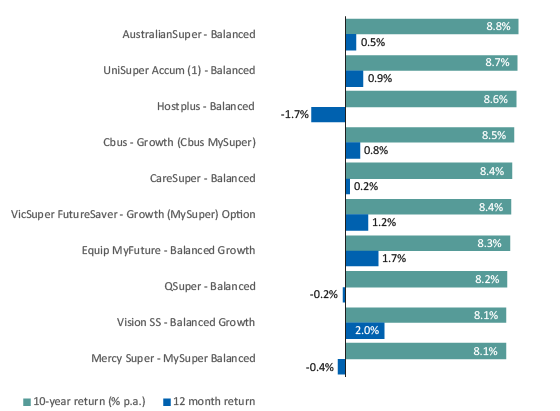

In fact, of the top performing funds over the last year, only half were among the top performing funds over the last decade. Rappell said this shows how difficult it is for investment strategies to perform consistently over rapidly changing market conditions.

Members with one of the top 15 balanced funds will have seen a small positive return, compared to the estimated median return of -1.2 per cent.

Top 10 SR50 Balanced Index options over 12 months

However, SuperRatings reiterated, Australians shouldn’t make major financial decisions based on one year’s performance.

The super group said long term performance is what really counts, noting that over the last decades the top performers were AustralianSuper, UniSuper and Hostplus. SuperRatings said performance for the median balanced option is still strong, returning around 7.6 per cent in the decade to 30 June 2020.

“It was pleasing to see 15 out of the 50 options in the SR50 Balanced Index generate a positive return in the 2019-20 financial year, which speaks to the quality of funds available to members,” Rappell said.

“Managing risks while delivering a positive return in this environment has been a real challenge, and this is likely to continue through the rest of 2020.”

Continuing, Rappel warned that Australians should brace for more market bumps - and that those bumps will feel more severe after 10 years of growth.

“Prior to Covid-19, we saw the industry average account balance rise over $100,000, compared to around $30,000 during the GFC,” Rappell said.

“This means that, on an absolute basis, members will see their balance move around a lot more than they have previously. Funds have done an excellent job of both managing risk and educating their members on these issues, but more can be done in this space.”

Australians’ relationship with their super

It’s been a big year for super with State Street’s Global Retirement Report showing 67 per cent had had their work impacted and were checking their superannuation balances.

The State Street survey found that 67 per cent of Australians haven’t changed their retirement savings plans, but 21 per cent have reduced or stopped their rate of saving.

And compared to other countries, a greater proportion of Australians switched to lower-risk investment and started drawing down on their super.

However, the majority of Australians surveyed also agreed the financial fallout of Covid-19 wouldn’t last for longer than one year.

In the meantime, 38 per cent said the pandemic was having a high impact on retirement confidence.

“I am most concerned about the time it will take for my superannuation balance to recover from the fall in the stock market since the outbreak of Covid-19,” one respondent said.

Others expressed a lack of trust in the retirement system, and concerns about their ability to save.

Want to take control of your finances and your future? Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.

Yahoo Finance

Yahoo Finance