SunTrust (STI) Q3 Earnings Meet Estimates, Revenues Rise

SunTrust Banks' STI third-quarter 2019 adjusted earnings of $1.40 per share were in line with the Zacks Consensus Estimate. However, the figure reflects a decline of 1.4% from the year-ago quarter’s number.

Results were hurt by an increase in expenses, lower net interest income (NII) and significantly higher provisions. However, rise in non-interest income supported results to some extent. The company’s balance sheet position remained strong in the quarter.

In the reported quarter, the company recorded costs associated with the proposed merger with BB&T Corp. BBT while in the prior-year quarter it recorded certain discrete tax benefits. After considering these, net income available to common shareholders for the quarter under review was $597 million or $1.34 per share, down from $726 million or $1.56 per share in the prior-year quarter.

Revenues Improve, Expenses Rise

Total revenues in the reported quarter were $2.35 billion, up 2.6% year over year. Also, the figure marginally surpassed the Zacks Consensus Estimate of $2.33 billion.

NII declined marginally from the prior-year quarter to $1.51 billion. Net interest margin (FTE basis) was down 21 basis points (bps) to 3.06%.

Non-interest income was $843 million, up 7.8% from the prior-year quarter. The rise was primarily driven by an increase in mortgage-related income, commercial real estate-related income and other non-interest income. In the quarter, the company recorded insurance settlement income of $5 million and net securities gains of $4 million.

Non-interest expenses rose 6.5% from the year-ago quarter to $1.47 billion. The rise was due to an increase in almost all expense components, except for marketing and customer development costs, equipment expenses, and regulatory assessments costs.

Credit Quality: A Mixed Bag

Total non-performing assets were $661 million as of Sep 30, 2019, down 12.3% from the prior-year quarter end. Non-performing loans to total loans held for investment decreased 9 bps year over year to 0.38%.

However, the rate of net charge-offs to total average loans held for investment increased 4 bps to 0.28%. Moreover, provision for credit losses increased substantially from the year-ago quarter to $132 million.

Balance Sheet Strong

As of Sep 30, 2019, SunTrust had total assets of $227.37 billion while shareholders’ equity was $26.49 billion, representing 11.7% of total assets.

As of Sep 30, 2019, total loans held for investments were $158.46 billion, up nearly 1.2% from the prior quarter end. Also, total consumer and commercial deposits rose nearly 4% from the last reported quarter to $166.13 billion.

SunTrust’s estimated common equity Tier 1 ratio under Basel III was 9.33% as of Sep 30, 2019.

Our Viewpoint

The company remains well-positioned for growth, given its favorable deposit mix and enhanced credit quality. Moreover, its initiatives to enhance efficiency are likely to further support revenue growth. However, the company’s margins are expected to be hurt because of the decline in rates. Further, its significant exposure to risky loan portfolios remains a near-term concern.

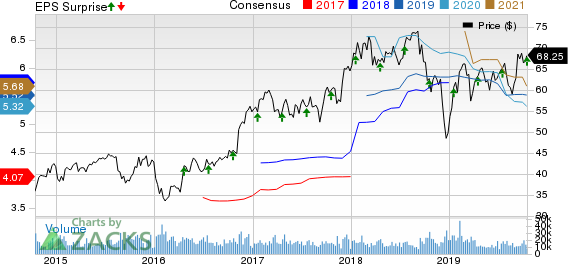

SunTrust Banks, Inc. Price, Consensus and EPS Surprise

SunTrust Banks, Inc. price-consensus-eps-surprise-chart | SunTrust Banks, Inc. Quote

SunTrust currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Comerica CMA reported third-quarter 2019 earnings per share of $1.96 that surpassed the Zacks Consensus Estimate of $1.91. Also, the bottom line improved from the prior-year quarter figure of $1.86. It recorded higher revenues on the back of non-interest income growth and lower expenses.

Citigroup C delivered a positive earnings surprise of 1% in third-quarter 2019, backed by improved investment banking performance. Adjusted earnings per share of $1.98 outpaced the Zacks Consensus Estimate of $1.96. Also, bottom line climbed 20% year over year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BB&T Corporation (BBT) : Free Stock Analysis Report

SunTrust Banks, Inc. (STI) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance