Sun Life (SLF) Q2 Earnings Rise Y/Y, Asset Management Grows

Sun Life Financial SLF reported second-quarter 2019 underlying net income of $552.4 million (C$739 million), up 1.4% year over year. The upside was driven by business growth, favorable expense experience and benefits from tax related items primarily in the United States. However, unfavorable morbidity experience in Canada and the United States, lower new business gains in International in Asia and lower available-for-sale (AFS) gains in the United States due to lower premiums were partial offsets.

Insurance sales increased 3.8% year over year to $491.1 billion (C$657 million) on the back of higher sales in both SLF U.S. and SLF Canada. Wealth sales were up 20% year over year to $27.7 million (C$37 billion) in the quarter on higher sales in Canada

Premiums and deposits were $32.4 billion (C$43.3 billion), up 16.9% year over year due to higher net premium revenues, segregated fund deposits, mutual fund sales and managed fund sales.

Net premiums of the company increased 3.8% year over year to $3.4 billion (C$4.5 billion).

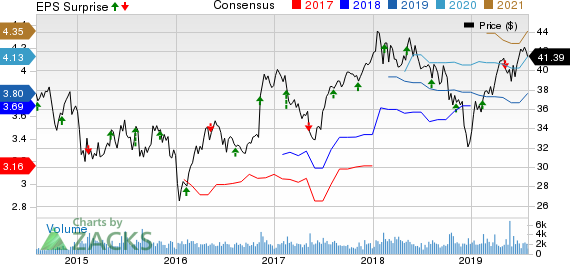

Sun Life Financial Inc. Price, Consensus and EPS Surprise

Sun Life Financial Inc. price-consensus-eps-surprise-chart | Sun Life Financial Inc. Quote

Segmental Results

SLF Canada’s underlying net income decreased 1% year over year to $181.6 million (C$243 million) due to unfavorable morbidity and credit experience, partly offset by reflecting favorable expense experience and continued business growth. Insurance sales declined 27% on lower sales in Group Benefits. Wealth sales increased 7%, driven by increased sales in Group Retirement Services

SLF U.S.’s underlying net income was $82.2 million (C$110 million), down 12% from the prior-year quarter. This downside can be attributed to less favorable morbidity experience and lower AFS gains, partially offset by improved lapse and other policyholder behavior experience and benefits from tax related items. Sales increased 40% driven primarily by continued strong momentum and leadership position in medical stop-loss.

SLF Asset Management’s underlying net income of $183.1 million (C$245 million) increased 13% year over year, driven by expense management, investment income including returns on seed capital and the favorable impact of foreign exchange.

SLF Asia reported an underlying income of $109.9 million (C$147 million), up 1% year over year, reflecting favorable expense experience, favorable credit experience, and continued business growth, largely offset by lower new business gains in International. Insurance sales improved 12% in the quarter under review with double-digit growth in most markets. Wealth sales declined 28% due to lower sales in India.

Financial Update

Global assets under management were $781.9 billion (C$1024 billion), up 3.9% year over year.

Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (LICAT) ratio was 133% as of Jun 30, 2019. The LICAT ratio for Sun Life was 144%.

Sun Life’s reported return on equity of 11% in the second quarter contracted 30 basis points (bps) year over year. Underlying ROE of 13.7% contracted 30 bps year over year.

Leverage ratio of 20.4% at the quarter end improved 80 basis points year over year.

Capital Deployment

Sun Life’s dividend was 52.5 cents in the second quarter.

The board of directors announced a new share buyback program authorizing the company to buy back 15 million shares.

Zacks Rank

Sun Life currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Second-quarter earnings of Torchmark TMK and MGIC Investment MTG beat the respective Zacks Consensus Estimate while that of Reinsurance Group of America RGA missed expectations.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report

Torchmark Corporation (TMK) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance