Will Subscription Growth Benefit C3.ai's (AI) Q4 Earnings?

C3.ai’s AI fourth-quarter fiscal 2023 results, to be reported on May 31, are expected to reflect strengthening momentum in its Subscription business.

The segment, which primarily comprises term licenses, stand-ready COE support services, trials and pilots of applications and software-as-a-service offerings, contributed 85.6% to sales in third-quarter fiscal 2023.

This Zacks Rank #3 (Hold) company expects to see positive growth in its pilot bookings diversity. Continued investments in technology innovation, significant generative AI developments, expanding product portfolio and partner ecosystem are expected to remain key catalysts in driving growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for subscription revenues for the fiscal fourth quarter is pegged at $57 million, suggesting growth of 1.24% from the figure reported in the year-ago quarter.

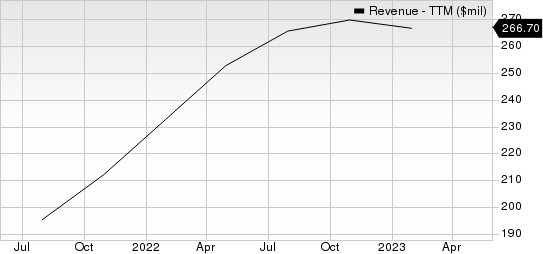

C3.ai, Inc. Revenue (TTM)

C3.ai, Inc. revenue-ttm | C3.ai, Inc. Quote

Click here to know how C3.ai’s overall fiscal fourth-quarter performance are likely to be.

Factors to Consider

C3.ai transitioned its subscription-based pricing model to a consumption-based model, which charges customers based on vCPU/hour, offering one AI Enterprise application, unlimited use of the C3 AI Platform, unlimited developer licensing, unlimited runtime licensing and a concierge technical support and training program.

In the fiscal third quarter, C3.ai’s customer count increased 8% to 236 and closed 27 deals during the quarter, 17 of which were pilot deals under the consumption model.

The consumption model is likely to have continued strengthening C3.ai’s partner base, which includes the likes of Alphabet’s GOOGL Google Cloud, Microsoft’s MSFT Azure, and Amazon’s AMZN AWS.

C3.ai is likely to have gained from its extended partnership with Google during the to-be-reported quarter on the back of its portfolio of enterprise AI applications and services, which have been made available on the Google Cloud marketplace.

Its expanded go-to-market partnership with AWS might have contributed well to the subscription revenues in the fiscal fourth quarter.

Also, C3.ai’s collaboration with Azure to deliver a highly-successful pilot engagement to a U.S. Defense Agency, might have remained another positive.

An expanding partner ecosystem is expected to have helped the C3.ai in scoring more pilot opportunities in its pipeline during the quarter under review.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance