Strong U.S. Durable Goods Orders to Foster EUR/USD Losses

DailyFX.com -

- U.S. Durable Goods Orders to Increase for Second Straight Month in April.

- Non-Defense Capital Goods Orders ex. Aircrafts to Rise for First Time Since September.

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.S. Durable Goods Orders

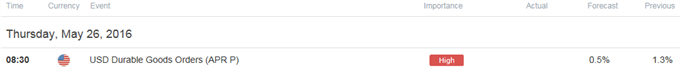

Another 0.5% expansion in orders for U.S. Durable Goods may heighten the appeal of the greenback and spur a near-term decline in EUR/USD as it puts increased pressure on the Federal Open Market Committee (FOMC) to further normalize monetary policy.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:Even though Fed Chair Janet Yellen remains in no rush to implement higher borrowing-costs, we may see a greater dissent at the next quarterly meeting in June as a growing number of central bank officials see the U.S. economy approaching ‘full-employment.’

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

U. of Michigan Confidence (MAY P) | 89.5 | 95.8 |

Consumer Credit (MAR) | $16.000B | $29.674B |

Average Hourly Earnings (YoY) (APR) | 2.4% | 2.5% |

The pickup in household earnings accompanied by the ongoing expansion in private-sector credit may boost demand for large-ticket items, and a positive development may spark a bullish reaction in the greenback as it fuels interest-rate expectations.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Consumer Price Index ex Food & Energy (YoY) (APR) | 2.1% | 2.1% |

Non-Farm Payrolls (APR) | 200K | 160K |

Gross Domestic Product (Annualized) (1Q A) | 0.7% | 0.5% |

However, sticky price growth paired with fears of a slower recovery may drag on private consumption, and a dismal report may drag on the dollar as it dampens speculation for an imminent Fed rate-hike.

How To Trade This Event Risk(Video)

Bullish USD Trade: Demand for Large-Ticket Items Increase 0.5% or Greater

Need red, five-minute candle following the rate decision to consider a short EUR/USD position.

If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Durable Goods Orders Report Disappoints

Need green, five-minute candle to favor a long EUR/USD trade.

Implement same strategy as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

EUR/USD may continue to give back the advance from earlier this year following the failed attempt to test the August high (1.1713), while the Relative Strength Index (RSI) largely fails to preserve the bullish formation carried over from the previous year.

Interim Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Impact the U.S. Durable Goods Orders report has had on EUR/USD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

MAR 2016 | 04/26/2016 12:30 GMT | 1.9% | 0.8% | +47 | +11 |

March 2016 U.S. Durable Goods Orders

Demand for U.S. Durable Goods increased 0.8% in March after contracting a revised 3.1% the month prior, while Non-Defense Capital Goods Orders excluding Aircrafts, a proxy for future business investment, climbed 0.3% amid forecasts for a 0.9% print. Despite expectations for a ‘consumer-led’ recovery in 2016, the ongoing weakness in private-sector consumption may prompt the Federal Open Market Committee (FOMC) to further delay its normalization cycle in an effort to mitigate the downside risks surrounding the real economy. The dollar struggled to hold its ground following the weaker-than-expected print, with EURUSD climbing above the 1.1300 handle, but the market reaction was short-lived as the pair closed the day at 1.1294.

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

EUR/JPY Technical Analysis: Prior Support, New Resistance

US DOLLAR Technical Analysis: A Fitting Finish To May

USD/JPY Technical Analysis: Clearly Defined Support & Resistance To Help Traders

GBP/USD Successful Re-Test of Former Resistance Line

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance