Will Strong Data Center Growth Aid AMD's Q4 Earnings Growth?

Advanced Micro Devices AMD is expected to report lackluster client segment revenues in fourth-quarter 2022 results, set to be released on Jan 31, due to weak PC shipment demand.

However, robust top-line growth from data center and embedded segments are expected to have driven top-line growth. AMD has been witnessing strong adoption of EPYC processors. Moreover, demand for Xilinx’s FPGA solutions and Pensando GPUs has been robust in the to-be-reported quarter.

AMD expects fourth-quarter 2022 revenues to be $5.5 billion (+/-$300 million), which indicates year-over-year growth of 14%.

Click here to know how AMD’s overall fourth-quarter performance is likely to be.

Diversified Product Portfolio: Key to AMD’s Q4 Growth

AMD’s fourth-quarter results are likely to reflect benefits of its expanding product portfolio, which caters to trending high-growth markets like cloud, gaming, data center and EV.

The continued strong adoption of EPYC processors by the likes of Dell DELL, Alphabet GOOGL, Hewlett Packard Enterprises HPE, Lenovo, Microsoft and Oracle is expected to have benefited data center revenues in the to-be-reported quarter.

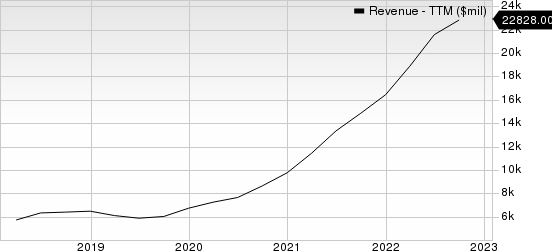

Advanced Micro Devices, Inc. Revenue (TTM)

Advanced Micro Devices, Inc. revenue-ttm | Advanced Micro Devices, Inc. Quote

In third-quarter 2022, more than 70 AMD instances were launched by Microsoft, Amazon, Tencent, Baidu and others.

AMD introduced fourth-generation EPYC processor in the fourth quarter.

Dell announced the next generation of its PowerEdge servers with fourth-gen EPYC processors. Alphabet announced that it is incorporating the latest EPYC processors in Google Cloud Compute Engine. HPE announced its new ProLiant Gen11 servers, supported by the latest processors, that are also available through a pay-as-you-go consumption model with HPE GreenLake.

Moreover, this Zacks Rank #4 (Sell) company has constantly been improving the performance of its Ryzen processors to help address the increasing proliferation of Artificial Intelligence and machine learning in industries like cloud, gaming and data center.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the to-be-reported quarter, AMD introduced graphics cards built on the next-generation high-performance, energy-efficient RDNA 3 architecture, Radeon RX 7900 XTX and Radeon RX 7900 XT graphics cards.

The Zacks Consensus Estimate for data center, embedded, client and gaming revenues for the fourth quarter are pegged at $1.58 billion, $1.28 billion, $1.49 billion and $1.12 billion, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance