StoneCo Ltd. (NASDAQ:STNE) Analysts Just Cut Their EPS Forecasts Substantially

Market forces rained on the parade of StoneCo Ltd. (NASDAQ:STNE) shareholders today, when the analysts downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

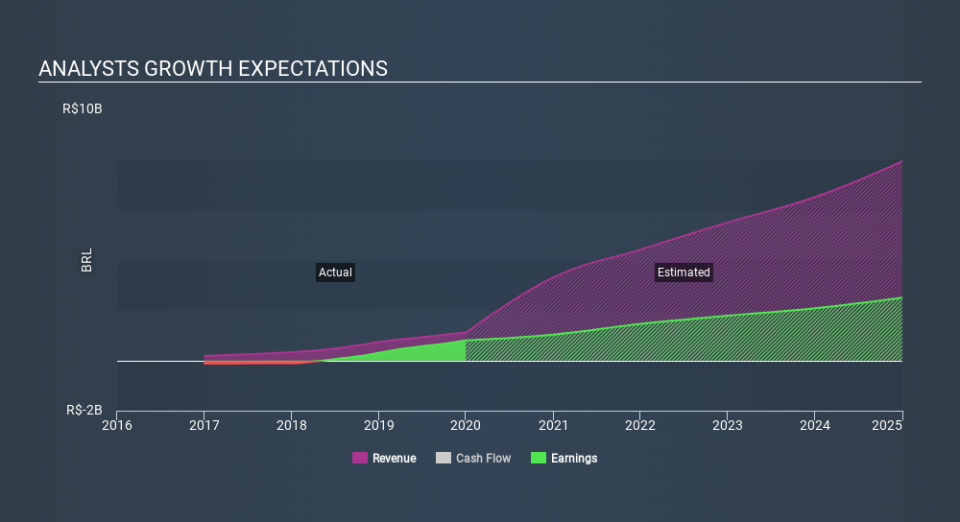

Following the downgrade, the current consensus from StoneCo's 14 analysts is for revenues of R$3.3b in 2020 which - if met - would reflect a substantial 200% increase on its sales over the past 12 months. Statutory earnings per share are presumed to shoot up 23% to R$3.56. Prior to this update, the analysts had been forecasting revenues of R$3.7b and earnings per share (EPS) of R$4.12 in 2020. Indeed, we can see that the analysts are a lot more bearish about StoneCo's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for StoneCo

The consensus price target fell 6.0% to R$183, with the weaker earnings outlook clearly leading analyst valuation estimates. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values StoneCo at R$238 per share, while the most bearish prices it at R$123. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting StoneCo'sgrowth to accelerate, with the forecast 200% growth ranking favourably alongside historical growth of 52% per annum over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 9.8% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that StoneCo is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

That said, the analysts might have good reason to be negative on StoneCo, given concerns around earnings quality. For more information, you can click here to discover this and the 2 other flags we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance