A stock-market relationship has broken down and it points to a group you want to own for the final stages of the bull run

A technical breakdown between small- and large-cap stocks suggests investors ought to own the latter, according to analysis from Oppenheimer.

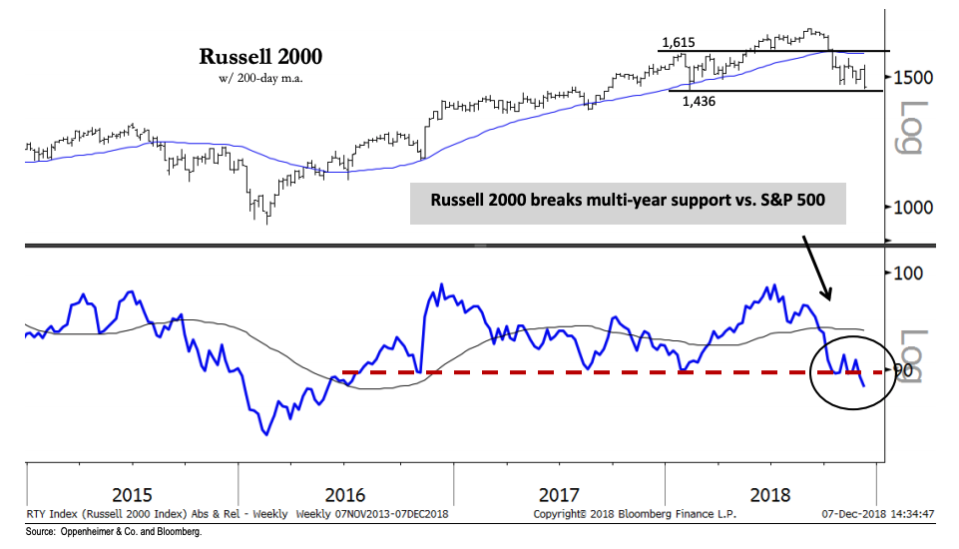

The Russell 2000 small-cap index, down 17% from its recent high, has broken multi-year support relative to the S&P 500, the large-cap benchmark.

Oppenheimer's head of technical analysis told Business Insider that "you want to own large caps."

The relationship between small- and large-cap stocks has broken down, a development that suggests the latter is the group you want to own, according to an analysis from Oppenheimer.

The Russell 2000, comprised of small-cap names, has plunged 17% since its 2018 high hit back in August. Its decline presaged that of large-caps, which didn't top out until about a month later and are now down about 10% from their recent peak.

At this point, the Russell's decline has broken through multi-year, technical support relative to the S&P 500, according to Ari Wald, Oppenheimer's head of technical analysis.

And while small- and mid-cap US stocks have seen outflows over the past two months, according to Deutsche Bank, large-cap stocks have seen inflows.

To underscore his bullish thesis on the larger names, Wald says the S&P 500 has signalled the velocity of its sell-off is slowing down.

"For instance, the index's 14-day [relative strength index] has made higher lows on each successive pullback since October," Wald wrote in a note sent out to clients last weekend. "Still, trading action remains poor and we believe the S&P 500 is transitioning to a larger range. For levels, we see 2,600 as support and 2,815 as resistance."

While Wald believes the small-cap index is indeed oversold - or trading below its true value - he thinks the group may have topped out. He recommends selling them into technical resistance on the belief that "the final leg of the cycle is likely to be led by the late-cycle attributes of large-caps."

"In general we've found its more important for small caps to participate in absolute terms than lead relatively," Wald told Business Insider in an email.

"We remind clients that much of the 1980s-1990s bull market was led by large caps too. So as far as what it means for, it means you want to own large caps."

Now read:

Yahoo Finance

Yahoo Finance