Stock Market News Today: September 5th, 2019

Stock markets rallied on Thursday following news that the U.S. and China have agreed to meet in Washington in October to discuss trade. A trade war continues to rage between the two countries, but talks next month could lead to an eventual resolution.

Index | Change at 1:30 p.m. EDT |

|---|---|

Dow Jones Industrial Average (DJINDICES: ^DJI) | 1.58% |

S&P 500 (SNPINDEX: ^GSPC) | 1.32% |

Nasdaq Composite (NASDAQINDEX: ^IXIC) | 1.58% |

Data source: Yahoo! Finance.

Two stocks that didn't participate in this rally were Slack Technologies (NYSE: WORK) and Smartsheet (NYSE: SMAR). Both cloud software stocks were punished for weak earnings guidance.

Slack's first earnings report doesn't go so well

Revenue is growing at a brisk pace for messaging and collaboration software provider Slack, but the company's first quarterly report as a publicly traded company left investors disappointed. The stock was down about 2.9% at 1:30 p.m. EDT after recovering from losses as big as 16.3% earlier in the day.

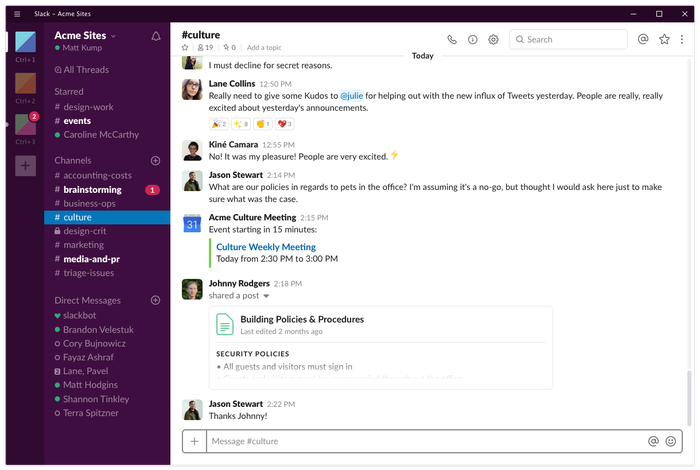

Image source: Slack Technologies.

Slack saw its revenue grow 58% year over year in the second quarter to $145 million, a few million dollars ahead of analyst estimates. Growth was strong even after Slack doled out $8.2 million of credits due to service disruptions.

Slack now has more than 100,000 paid customers, and 720 of those customers send the company more than $100,000 annually. The net dollar retention rate, which measures revenue growth among existing customers, was a healthy 136%. Slack lost $0.14 per share on an adjusted basis during the quarter, beating analyst expectations by $0.04.

Slack will continue to post losses this year, and the size of those losses may have something to do with the slumping stock price. The company expects to lose between $0.08 and $0.09 per share in the third quarter and between $0.40 and $0.42 per share for the full year, both on an adjusted basis. Analysts were expecting losses to be a bit smaller.

Slack faces competition from Microsoft's Teams, which is bundled with the company's business Office 365 subscriptions. Maintaining a lofty growth rate may require heavier spending on sales and marketing given the competitive landscape, which will weigh on the bottom line.

Smartsheet sees bigger losses ahead

Slack wasn't the only software-as-a-service stock that took a beating on Thursday. Smartsheet, which provides a software platform for project management and workflow automation, saw its stock tumble after its second-quarter report featured weak earnings guidance. Shares were down 10.1% at 1:30 p.m. EDT.

There wasn't much wrong with Smartsheet's second-quarter numbers. Revenue grew by 53% to $64.6 million, about $1 million higher than analysts were expecting, and the company lost only half as much as analysts predicted on an adjusted basis, with an EPS loss of $0.08.

The company's metrics are looking good as well. Smartsheet now has more than 82,000 customers; customers with annualized contract values over $5,000 grew by 55%; and the dollar-based net retention rate was a solid 134%.

But Smartsheet's guidance called for bigger losses than analysts were expecting. The company expects to lose between $0.18 and $0.19 per share in the third quarter and between $0.54 and $0.58 per share in the full year, both on an adjusted basis. The third-quarter guidance was worse than the $0.15 loss analysts were anticipating, while the full-year guidance straddled the average analyst estimate.

Revenue growth alone wasn't enough to drive Smartsheet stock higher on Thursday as investors homed in on the bottom line.

More From The Motley Fool

Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Timothy Green has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Microsoft and Slack Technologies. The Motley Fool owns shares of Smartsheet Inc. and has the following options: long January 2021 $85 calls on Microsoft. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance