Stock market news live: Dow posts best weekly gain since 1938, despite Friday drop

Stocks fell Friday even after the U.S. House of Representatives passed a much-anticipated $2 trillion economic relief package. Earlier Friday morning, a new report showed consumer sentiment tumbled by the most since the financial crisis in March amid the coronavirus outbreak.

By the end of the session, the Dow was off more than 4%, or 900 points. Each of the S&P 500 and Nasdaq shed more than 3%.

But steep gains made earlier in the week still sent the Dow up a total of 12.8% for the week, for its best weekly gain since 1938. The S&P 500 rose 10.3% for its best weekly gain since 2009.

[Click here to read what’s moving markets heading into Monday, March 30]

A day earlier, stocks had ended higher for a third straight session as investors hoped a $2 trillion relief package passed by the U.S. Senate would help offset some of the domestic economic damage dealt by the coronavirus outbreak. Thursday marked the first time the S&P 500 posted three consecutive sessions of advances since mid-February.

The House of Representatives cleared the package Friday afternoon, sending it to President Donald Trump’s desk for signing.

Losses on the three major indices Friday tracked declines in European equities, after EU member countries failed to agree on a concrete plan to address the coronavirus outbreak in the region.

Countries including Italy, Spain and France – those hit hardest by the outbreak – had called for the joint issuance of so-called “coronabonds” to help raise funds through issuance of shared European debt, but other member countries struck down the relief move during last night’s discussions. An announcement that UK Prime Minister Boris Johnson tested positive for COVID-19 also weighed on risk assets.

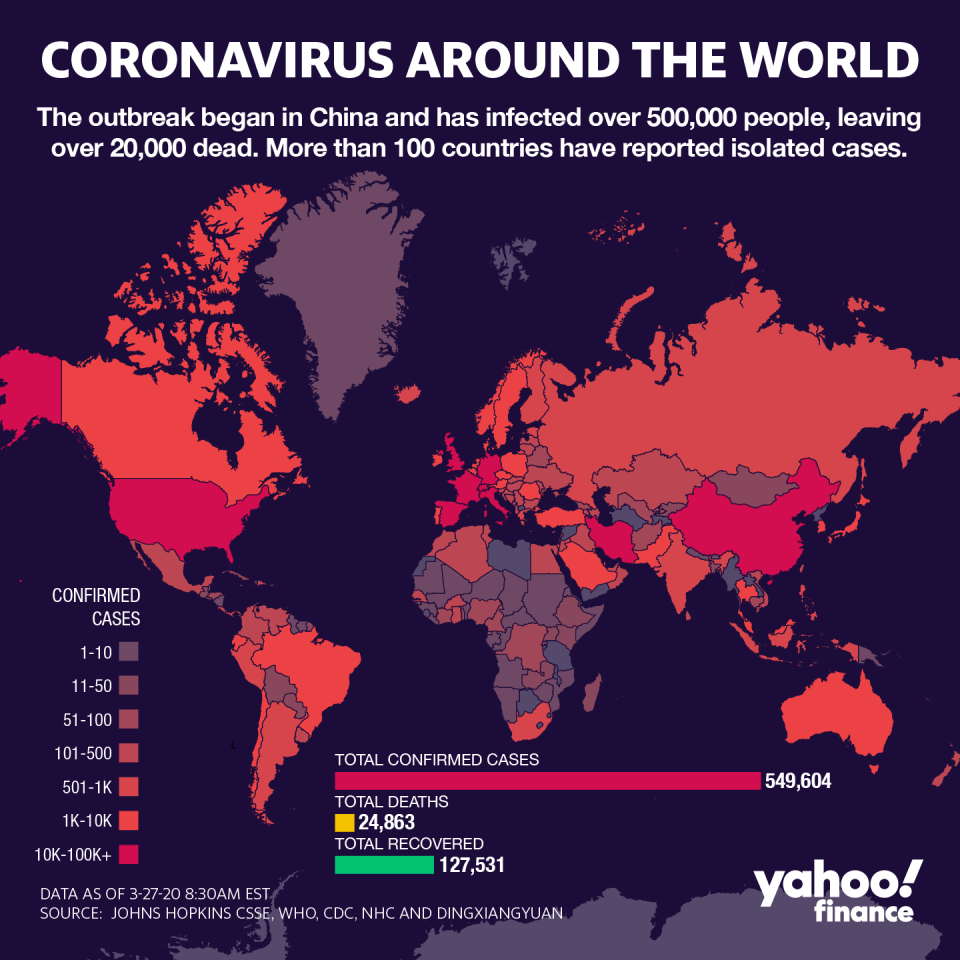

While policymakers around the world have stepped up their efforts to mitigate the economic blow from the virus, the pandemic itself has showed few signs of abating outside of China. Italy, one of the epicenters for the outbreak, reported its largest jump in new cases in the last five days, with new cases Thursday rising by 6,153.

Global cases of the coronavirus topped 585,000 as of Friday afternoon, including 97,000 in the U.S, according to Johns Hopkins data. At that level, the number of cases in the U.S. topped those in China and Italy for the first time, and the domestic death toll from the outbreak surpassed 1,100.

As states across the country remain in or go into lock-down, President Donald Trump sent a letter to governors Thursday suggesting the White House was seeking to create guidelines for individual counties classified as either high, medium or low risk for the outbreak to expand further. Trump has said he wants the country to widely reopen businesses by Easter in mid-April, although health officials have suggested lifting stay-in-place orders by that time could be premature as the coronavirus case count continues to climb.

—

4:09 p.m. ET: Stocks end Friday’s session lower, but clinch steep weekly gains

Each of the three major indices ended Friday’s session lower as investors sold out of risk assets heading into the weekend. The Dow, however, still ended its best week since 1938, and the S&P 500 closed out its best week since 2009.

Here’s where the markets settled at the end of regular equity trading:

S&P 500 (^GSPC): -88.6 points (-3.37%) to 2,541.47

Dow (^DJI): -915.39 points (-4.06%) to 21,636.78

Nasdaq (^IXIC): -295.16 points (-3.79%) to 7,502.38

Gold (GC=F): -$28.80 (-1.74%) to $1,622.40 per ounce

10-year Treasury (^TNX): -11.1 bps to yield 0.697%

—

2:42 p.m. ET: Domestic crude oil prices drop for a fifth straight week

West Texas intermediate crude oil prices, the domestic standard, dropped 4.8% Friday to settle at $21.51 per barrel, as fears that the coronavirus outbreak would wipe out energy demand continued to weigh on the commodity.

Friday’s drop brought U.S. crude oil prices down 3% for the week, for a fifth straight weekly decline. Prices for the commodity have fallen in 10 out of the past 12 weeks.

—

1:32 p.m. ET: House clears $2 trillion economic relief package

The U.S. House of Representatives passed the $2 trillion coronavirus relief package already passed by the Senate earlier this week, sending it to the White House for President Donald Trump to give final approval.

The House’s approval of the massive legislative package was widely expected by market participants, after disputes over the specific relief measures provided by the bill were smoothed over in the Senate earlier this week. The package was passed unanimously by the Senate Wednesday night.

The White House has previously promised individuals would receive direct payments of up to $1,200 as outlined in the bill within several weeks.

Stocks pared some losses after the House passed the bill, but still held lower.

—

1:24 p.m. ET: Services will ‘bear the brunt of global recession’ as coronavirus grips world: Economist

Policymakers have increasingly suggested that the U.S. is already in the throes of a recession as the coronavirus outbreak escalates and drives businesses and entire municipalities to temporarily shut down. And in this downturn, it’s likely the services economy that will see the sharpest pullback.

“Unlike in previous downturns, services are likely to underperform industrial sectors this time around. Consumer-facing services, such as leisure and hospitality, are suffering most already,” Simon MacAdam, global economist for Capital Economics, wrote in a note Friday. “As the shock ripples through supply chains, business services will take more of a hit too. Further ahead, sectors like real estate are better placed to make up lost ground, while international tourism may struggle to recover for years.”

Containment measures implemented worldwide have so far had a disproportionate effect on services, particularly those that are most consumer-facing and have been forced to halt operations as consumer remain in their homes.

These effects could last even after social distancing measures ease, however.

“The real estate sector and big-ticket durable goods producers should get back some of what they lost, as people (who didn’t lose their jobs and income during the recession) make delayed purchases of what they otherwise would have made,” MacAdams said. “In contrast, consumers won’t be making up for restaurant meals, cinema viewings and journeys to work they missed out on during the lockdowns.”

—

—

11:36 a.m. ET: Stocks hold lower as Energy, Industrials sectors fall

The three major indices remained lower as the trading session rolled along. The Dow’s losses topped 700 points, led by declines in shares of Boeing and JPMorgan. The S&P 500 was dragged lower by the Energy and Industrials sectors.

Here were the main moves in markets, as of 11:36 a.m. ET:

S&P 500 (^GSPC): -76.59 points (-2.91%) to 2,553.48

Dow (^DJI): -726.26 points (-3.22%) to 21,825.91

Nasdaq (^IXIC): -222.39 points (-2.82%) to 7,577.48

Crude (CL=F): -$1.20 (-5.31%) to $21.40 a barrel

Gold (GC=F): -$23.30 (-1.41%) to $1,627.90 per ounce

10-year Treasury (^TNX): -6.4 bps to yield 0.744%

—

10:00 a.m. ET: Consumer sentiment plummets by the most since 2008 in March

Consumer sentiment plunged in March by the most since October 2008 as the coronavirus outbreak tore through the domestic economy, according to the University of Michigan’s closely watched Survey of Consumers.

The headline sentiment index sank 11.9 points in March from February, the fourth largest single-month drop in almost 50 years. This brought the index down to 89.1, its lowest level since October 2016.

Subindices tracking consumers’ assessments of current conditions and expectations for the future also fell in March.

Here’s what Richard Curtin, Surveys of Consumers chief economist, said in a statement about the print:

“The extent of additional declines in April will depend on the success in curtailing the spread of the virus and how quickly households receive funds to relieve their financial hardships. Mitigating the negative impacts on health and finances may curb rising pessimism, but it will not produce optimism. There is no silver bullet that could end the pandemic as suddenly as the military victory that ended the Gulf war. To avoid an extended recession, economic policies must quickly adapt to a new era that will reorder the spending and saving priorities of consumers as well as the relative roles of the public and private sectors in the U.S. economy.”

—

9:36 a.m. ET: Dow drops 3%, pacing toward first decline in four sessions

Stocks opened lower Friday morning and were on track to snap a three-session winning streak.

Here were the main moves in the market, as of 9:36 ET:

S&P 500 (^GSPC): -83.41 points (-3.17%) to 2,546.66

Dow (^DJI): -805.61 points (-3.57%) to 21,746.55

Nasdaq (^IXIC): -223.68 points (-2.87%) to 7,573.86

Crude (CL=F): -$1.01 (-4.47%) to $21.59 a barrel

Gold (GC=F): -$21.90 (-1.33%) to $1,629.30 per ounce

10-year Treasury (^TNX): -7 bps to yield 0.738%

—

8:30 a.m. ET: Personal spending rises 0.2% in February, matching expectations

U.S. personal spending rose 0.2% in February, matching consensus economist expectations and January’s pace of gains. Meanwhile, personal income rose 0.6%, outpacing the 0.4% rise expected.

Core personal consumption expenditures rose 0.2% month on month in February, also meeting expectations and January’s gains. Over last year, core PCE – the Federal Reserve’s preferred inflation gauge – rose 1.8%, or slightly faster than the 1.7% gain expected and seen in January.

The Commerce Department’s February measures of personal spending, income and PCE capture the period before the escalation of the coronavirus in the U.S.

—

—

6:56 a.m. ET Friday: Stock futures edge up as overnight session kicks off

Stock futures were lower Friday morning as investors weighed the House of Representative’s planned vote on a $2 trillion stimulus package against a rising coronavirus case count in the U.S., where the outbreak has now infected more people than in Italy and China.

Here were the main moves in markets, as of 6:56 a.m. ET:

S&P 500 futures (ES=F): down 1.86%, or 48.5 points to 2,559.5

Dow futures (YM=F): down 1.88% or 421 points to 21,927.00

Nasdaq futures (NQ=F):down 1.68% or 131.75 points to 7,712.25

Crude (CL=F): +0.13% to $22.73 a barrel

Gold (GC=F): -$23.00 (-1.39%) to $1,628.20 per ounce

10-year Treasury (^TNX): -4.3 bps to yield 0.765%

—

6:01 p.m. ET Thursday: Stock futures edge up as overnight session kicks off

Futures for each of the three major indices were slightly higher Thursday evening as Congress closed in on passing a $2 trillion economic relief package.

Here were the main moves in markets, as of 6:01 p.m. ET:

S&P 500 futures (ES=F): up 0.51%, or 13.25 points to 2,621.25

Dow futures (YM=F): up 0.55% or 122 points to 22,470

Nasdaq futures (NQ=F): up 0.31% or 24.25 points points to 7,868.25

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance