Stock Market Live Updates: House votes to impeach President Donald Trump

Follow Yahoo Finance here for up-to-the-minute briefings on the financial markets, breaking news and other topics of interest to investors and traders. Please check back for continuing coverage.

8:26 p.m. ET: House votes to impeach President Donald Trump

In its third impeachment ever, the U.S. House of Representatives voted to impeach President Donald Trump for abuse of power over withholding aid as part of an effort to pressure Ukraine to investigate his political rivals. The House will also vote on a second article of impeachment over obstruction of Congress.

The next step in the effort to remove Trump from office, however, would be a trial in the Republican-controlled Senate, presided over by Chief Justice John Roberts. Markets expect Senate Democrats will fail to get the 20 GOP members that would be required to remove Trump from office, and also expect Trump to be reelected in 2020 for a second term.

-

4:05 p.m. ET: Stocks close mixed, S&P and Dow slightly lower

Here’s where markets settled at the end of regular equity trading:

S&P 500 (^GSPC): -0.04%, or 1.35 points

Dow (^DJI): -0.09%, or 26.76 points

Nasdaq (^IXIC): +0.05%, or 4.38 points

10-year Treasury yield (^TNX): +3.1 bps to 1.92%

Gold (GC=F): -0.07% to $1,479.60 per ounce

-

12:57 p.m. ET: Smart money bets on Trump staying, and winning 2020

As the drive to impeach President Donald Trump comes to a head, political betting markets are pricing in a whopping 99% chance the House will vote to be removed — but odds remain overwhelming that the president will both remain in office, and prevail in the general election next year.

According to Sarbjit Bakhshi, Head of Political Markets at Smarkets:

"With the Ukraine scandal coming to a head, President Trump is currently 99% likely to be impeached today according to our market. However, with a Republican-loaded Senate, trading activity on our exchange suggests he has an 83% chance to serve his full term.

"Not only that, but the Republican leader's chances of getting re-elected have actually gone from strength to strength on our Next President market, now trading near an all-time high at 49%, well ahead of his nearest rival Joe Biden at 13%."

Follow Yahoo News’ live coverage of the impeachment hearing here.

-

12:30 p.m. ET: Unicorns hit public markets in record numbers in 2019

Via Reuters:

Unicorns like Uber, Lyft and Slack may have had disappointing IPOs, but U.S. venture capital firms gave birth to a record number of unicorns in 2019. So far this year 66 venture capital-backed unicorns were minted in the United States versus 58 in 2018, according to market data firm CB Insights.

-

12:15 p.m. ET: Tech giants join forces for uniform smart-home standard

According to Bloomberg, Apple (AAPL), Alphabet Inc.’s Google (GOOG) and Amazon.com (AMZN) are coming together to make internet-connected home devices easier and safer to use:

The rivals announced Wednesday that they’re working with the Zigbee Alliance, a foundation that promotes standards for the Internet of Things, and its members including Samsung Electronics Co., Somfy SA, and IKEA, on a new standard that will ensure their products work with each other.

The move comes as Big Tech remains under intense pressure over data security and privacy concerns — and the idea that three of the biggest names in the consumer tech industry are coalescing around one issue may agitate more people than it mollifies. Bloomberg notes that bringing more devices together raises the prospect of more personal data being shared with more companies — none of which have the same standards.

-

11:30 a.m. ET: IHS: Commodities benefit from surge in risk appetite

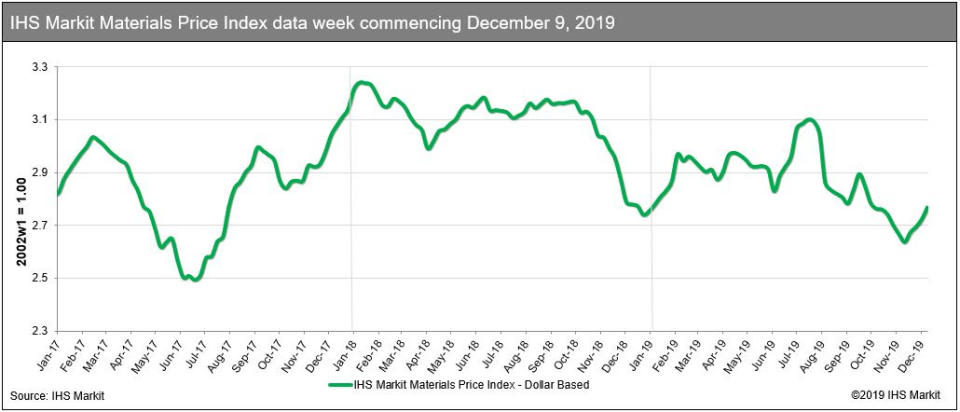

According to the IHS Materials Price Index (MPI), commodity prices rose 1.6% last week, boosted by surging investor appetite for risk. The encouraging backdrop has helped put a bottom under crude and other commodities, IHS notes:

Most important was a “phase-one” agreement reached between the US and China that promises to at least partially roll-back tariffs. In other good news, there was an agreement on the new US-Mexico-Canada trade pact and clarity on Brexit following Prime Minister Johnson’s election victory. The UK election result makes the UK’s exit from the European Union an almost certainty and will most likely move-up the leaving date.

Since hitting a 2019 low in mid-November, the MPI has risen by nearly five percent. While it is difficult to say if November represented a definitive turning point for commodities, the mood in markets has certainly improved. Positive trade developments and data showing manufacturing activity stabilizing are cause for at least guarded optimism about the near-future. This good news is tempered, however, by our outlook for 2020. The rebound forecasted in industrial production is not particularly strong, and at the same time, the US dollar continues to show strength, suggesting that the rally in commodity prices will not persist.

Brent crude (CL=F) is up modestly on the day near $60 per barrel.

-

10:03 a.m. ET: Tesla’s stealth bull market

Jim Chanos and David Einhorn, please call your respective offices: Tesla’s (TSLA) stock is on a tear, having hit new intraday highs above $387 and up 2% on the day (H/T CNN’s Paul Lamonica):

New all-time intraday high for Tesla. $TSLA up 2% today and hit $388.15, topping peak price from Aug. 2018. Stock up 16% YTD.

— Paul R. La Monica (@LaMonicaBuzz) December 18, 2019

On Wednesday, Bloomberg reported that Tesla was weighing a price cut on its China-built Model 3 sedans by 20% or more next year, citing people familiar with the matter. It’s a bet to lure in more buyers in the world’s biggest market for electric vehicles. The stock is now just shy of an all-time high at $389.61.

Still, given the volatile nature of 2019 — including an ugly Q1 miss in which it burned through cash and the ignominious unveiling of its long-hyped cybertruck — the carmaker’s ear-to-date gain of 16% is even more impressive.

Somewhere, CEO Elon Musk is surely smiling, given his relentless campaign against bearish investors trying to short the stock.

-

9:55 a.m. ET: Like a Phoenix from the ashes

Whether you’re looking to buy or rent, Phoenix has always been seen as one of the more desirable and affordable U.S. metro areas, according to the National Association of Realtors. The NAR’s chief economist tells Yahoo Finance that the Valley of the Sun’s thriving jobs market, a hot housing market and a great climate.

-

9:45 a.m. ET: Deutsche says go long on Facebook

Despite all kinds of legal, regulatory and political headaches, Facebook (FB) is Deutsche Bank’s top large cap pick for 2020, the bank said in a research note. It upped the stock’s price target to $270, from $260, amid what it called “renewed strength in the core Facebook app becoming a critical leg of the story,” as well its redoubling of video and algorithms for ads and content.

But wait, there’s more:

Not only has Facebook used its massive audience in its core product to scale new surfaces and experiences, but the company has managed several large transitions - the original rollout of news feed in 2006, the shift to mobile during the IPO in 2012, and more recently the shift to the Stories format. Looking at specific initiatives, in Marketplace the company has added premium inventory from established [third party] vendors, improved the search and discoverability on the platform (Figure 9), and streamlined the payment flow through Facebook Pay...

Aside from eCommerce, the company's work around Groups, Stories, and Watch have improved engagement trends in the core. We also see these new products increasing the utility nature of the platform, which helps with frequency and build durability. Net- net, we feel increasingly comfortable the strength in core Facebook -app engagement, ad impression growth and monetization – can continue over the medium term. As this becomes more clear over the course of the next few quarters, we see investors gaining comfort in terminal value in the core Facebook app and driving multiple expansion on, top of revenue and EPS upside captured in our above-consensus estimates for 2020 23.6% constant currency ad revenue growth estimate vs Street at 21%.

The stock traded up nearly 2% in early dealings, near $202.

-

9:30 a.m. ET: Stocks shrug off FedEx, Trump woes; aim for new highs

Wall Street was poised to build on Tuesday’s gains that carried major indices to new record highs, opening modestly higher at Wednesdays opening bell. Investors shrugged off bad news that included another negative profit outlook from FedEx (FDX), and Congress’ move to impeach President Donald Trump.

Here’s where markets began trading Wednesday:

S&P 500 (^GSPC): +0.13%, or 4.09 points

Dow (^DJI): +0.10%, or 29.08 points

Nasdaq (^IXIC): +0.19%, or 17.03 points

10-year Treasury yield (^TNX): flat to 1.8920%

Gold (GC=F): -0.22% to $1,477.20 per ounce

Brent Crude (CL=F): -0.67% to $60.53

With GOP support in the Senate relatively strong, market observers don’t expect the House’s impeachment of Trump to result in his removal from office. Meanwhile, the delivery giant reported earnings late Tuesday that missed expectations, citing “weak global economic conditions” and feeling the sting from having lost business from Amazon (AMZN).

-

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance