Steven Madden's (SHOO) Efforts on Track, Up 10.6% in 3 Months

Steven Madden, Ltd. SHOO is well-poised for growth, thanks to its sturdy digital efforts and other robust strategies, including international business expansion and brand strength. SHOO is witnessing strength in the e-commerce business against a tough operating backdrop. Solid gains from product assortments and direct-to-consumer channels also remain tailwinds.

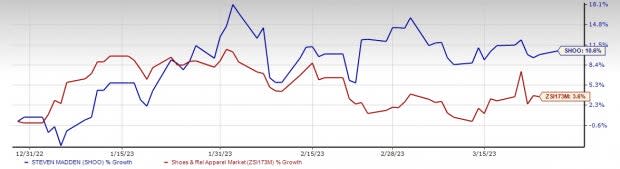

Markedly, shares of this renowned footwear dealer have risen 10.6% in the past three months, outperforming the industry’s 3.6% gain. For 2024, the Zacks Consensus Estimate for Steven Madden’s sales and earnings per share is currently pegged at $2.05 billion and $2.68 each. These estimates suggest growth of 3.8% and 8.4%, respectively, from the year-ago period’s corresponding figures. This reflects analysts’ optimism about the company.

Let’s Delve Deep

Steven Madden remains committed to boosting its e-commerce wing via prudent investments in digital marketing as well as efforts to optimize the features and functionality of the website. Gains from increased investment in digital marketing and robust consumer capabilities such as “try before you buy” have been strengths. The company has also been significantly accelerating its digital commerce initiatives with respect to distribution. It has added high-level talent to the organization, ramped up digital marketing spending, improved data science capabilities, launched a try-before-you-buy payment facility, rolled out buy online, pick-up in store across its entire U.S. full-price retail outlets and introduced advanced delivery and return options.

Image Source: Zacks Investment Research

Although direct-to-consumer revenues were down 3.2% in the fourth quarter of 2022, the metric was offset by a modest rise in e-commerce. Further, direct-to-consumer revenues rose 6.9% to $521.7 million in 2022, backed by increases in the brick-and-mortar and e-commerce businesses. Notably, direct-to-consumer revenues exceeded $500 million for the first time. Compared with the pre-pandemic 2019, direct-to-consumer revenues climbed 62%, including a 192% surge in digital. The overall direct-to-consumer penetration increased approximately 700 basis points in the aforesaid time.

Additionally, management remains optimistic about its strategic agreements to enrich its presence. Management concluded the acquisition of the European joint venture. This transaction distributes the company’s branded footwear and accessories across the majority of countries in Europe. The buyout of BB Dakota, a California-based women's apparel company, through which SHOO is steadily expanding its apparel category, appears encouraging. One of the company’s major growth opportunities is expanding its international business.

What’s More?

On its last earnings call, management highlighted that 2022 marked a record year with respect to revenues and earnings. Consolidated revenues in the year were $2.1 billion, up 13.7% from 2021. Wholesale revenues also grew 16.4% on increases of 16.9% in wholesale footwear revenues and 14.8% in wholesale accessories revenues. The consolidated gross margin rose 10 basis points to 41.2% in 2022. Earnings came in at $2.80 per share, up from $2.50 per share earned in 2021. This is the highest in the company's history. The company crossed the $2 billion mark in revenues for the first time, including double-digit percentage increases on the top and the bottom lines in 2022.

In 2022, the company’s accessories and apparel business surpassed $400 million in revenues and rose 13% versus 2021. The company’s handbags category rose 19% in the year. In apparel, management transitioned from the BB Dakota-Steve Madden co-brand to its namesake brand for the fall of 2022. The overall apparel revenues increased 38% in 2022. Results were driven by the power of its brands, the strength of its business model and the disciplined execution of its strategies.

In a nutshell, the company is focused on driving growth across the direct-to-consumer business, expanding categories apart from footwear such as handbags and apparel, enhancing its presence in the international markets and reinforcing its core U.S. wholesale footwear business. Steven Madden is focused on creating a trend-right merchandise assortment, deepening relations with customers via marketing, enhancing the digital commerce agenda and efficiently controlling expenses. A VGM Score of A for this current Zacks Rank #3 (Hold) stock further speaks volumes.

Eye These Solid Picks

Here we have highlighted three top-ranked stocks, namely, Ralph Lauren RL, Oxford Industries OXM and Deckers DECK.

Ralph Lauren, a footwear and accessories dealer, sports a Zacks Rank #1 (Strong Buy) at present. RL has a trailing four-quarter earnings surprise of 23.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 5.5% and 14%, respectively, from the year-ago corresponding figures.

Oxford Industries, which designs, sources, markets and distributes lifestyle products and other brands, carries a Zacks Rank #2 (Buy). Oxford Industries has a trailing four-quarter earnings surprise of 18.9%, on average.

The Zacks Consensus Estimate for OXM’s current financial-year sales and EPS suggests growth of 13.7% and 10.4% from the year-ago reported numbers.

Deckers, a footwear dealer, has a Zacks Rank of 2 at present. DECK has a trailing four-quarter earnings surprise of 31%, on average.

The Zacks Consensus Estimate for Deckers’ current financial-year sales and EPS suggests growth of 11% and 17.1%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Oxford Industries, Inc. (OXM) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance