Steven Cohen's Strategic Acquisition in Maravai LifeSciences Holdings Inc

Introduction to the Transaction

On June 7, 2024, Steven Cohen (Trades, Portfolio)'s firm made a significant addition to its investment portfolio by acquiring 6,647,015 shares of Maravai LifeSciences Holdings Inc (NASDAQ:MRVI). This transaction, executed at a price of $8.61 per share, represents a notable increase of 5,236,653 shares from the firm's previous holding. This move has increased the firm's stake in Maravai LifeSciences to 5.00% of the total shares outstanding, reflecting a strategic position with a 0.14% portfolio weight and a trade impact of 0.11%.

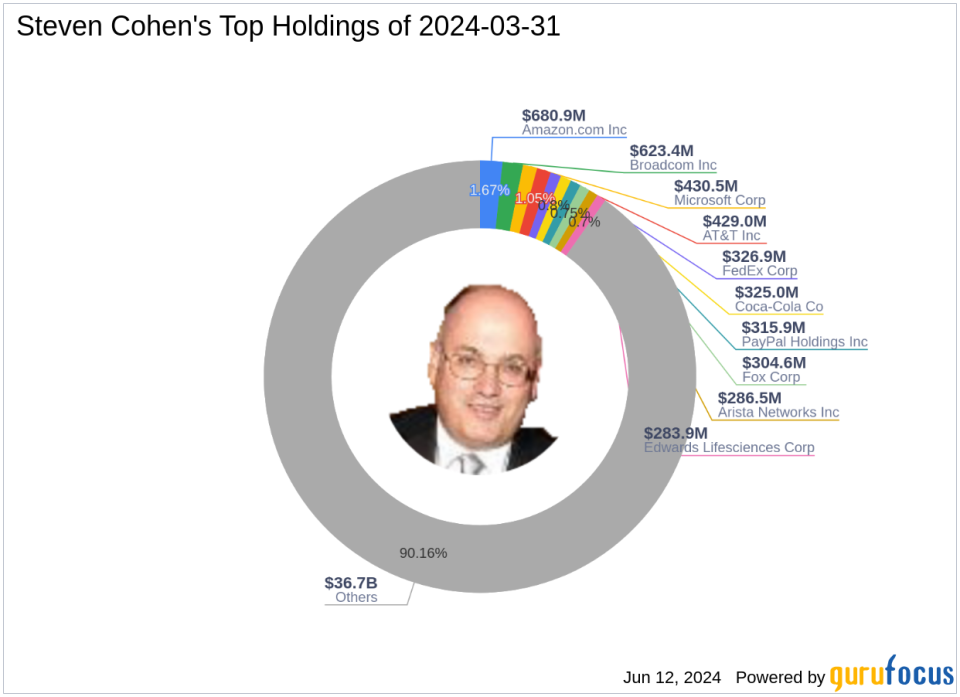

Profile of Steven Cohen (Trades, Portfolio)

Steven A. Cohen, Chairman and CEO of Point72, a prominent investment advisor, has a distinguished career in the financial markets. Starting with S.A.C. Capital Advisors in 1992 and transitioning to Point72 in 2014, Cohen has developed a robust investment strategy focusing on long/short equity, utilizing a multi-manager platform. His firm's top holdings include giants like Amazon.com Inc (NASDAQ:AMZN) and Microsoft Corp (NASDAQ:MSFT), with a strong inclination towards technology and healthcare sectors. The firm manages assets worth approximately $40.76 billion, demonstrating a keen acumen for high-value investments.

Overview of Maravai LifeSciences Holdings Inc

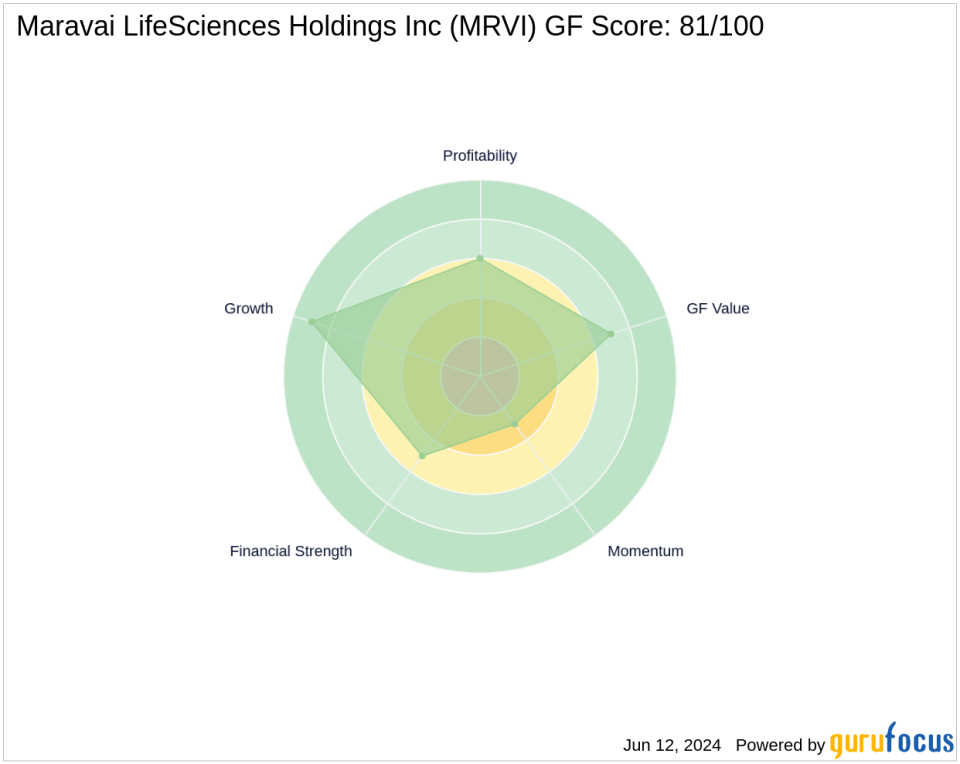

Maravai LifeSciences, based in the USA, operates within the biotechnology industry, focusing on products that support the development of drug therapies, diagnostics, and vaccines. Since its IPO on November 20, 2020, the company has specialized in nucleic acid production and biologics safety testing. Despite a challenging market, Maravai has maintained a market capitalization of $1.08 billion, with a current stock price of $8.11, modestly undervalued with a GF Value of $9.03. The company's GF Score stands at 81/100, indicating good potential for outperformance.

Analysis of the Trade Impact

The acquisition by Cohen's firm not only increases its influence in Maravai LifeSciences but also aligns with its strategic focus on the healthcare sector. Holding 5.00% of the company's shares showcases a significant commitment and belief in Maravai's future prospects. This move could potentially leverage Maravai's specialized capabilities in biologics and nucleic acid production, sectors that are critical in the current biotechnological landscape.

Market Context and Stock Performance

Maravai LifeSciences has experienced a 20.33% increase in stock price year-to-date, although it has seen a decline of 74.62% since its IPO. The recent trading price represents a 5.81% decrease since the transaction date, indicating short-term volatility in its market valuation. However, the stock remains modestly undervalued, suggesting a potential upside according to its GF Value.

Sector and Competitor Comparison

The biotechnology sector is highly competitive and dynamic. Maravai's focus on critical research and therapeutic areas places it in direct competition with other firms in the sector, some of which are also part of Cohen's investment portfolio. Comparatively, Maravai's strategic focus on niche segments could offer unique growth opportunities amidst broader sector trends.

Future Outlook and Analyst Insights

Analysts are cautiously optimistic about Maravai LifeSciences, given its specialized market focus and the essential nature of its products in biotechnology research and development. The firm's strategic investment could be seen as a move to capitalize on potential growth in biologics and vaccine development, areas that are expected to see significant expansion in the coming years.

Conclusion

Steven Cohen (Trades, Portfolio)'s recent investment in Maravai LifeSciences Holdings Inc represents a calculated addition to the firm's diverse and technology-oriented portfolio. With a strong focus on biotechnology and healthcare, this move aligns with the firm's strategic investment philosophy and could potentially yield significant returns, despite current market volatilities and the challenges faced by the sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance