Steven Cohen's Point72 Asset Management Bolsters Position in Pulmonx Corp

Introduction to the Transaction

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management has recently made a notable addition to its investment portfolio by acquiring additional shares in Pulmonx Corp (NASDAQ:LUNG). On February 28, 2024, the firm added 389,994 shares to its holdings, bringing the total share count to 1,936,083. This transaction reflects a 0.01% impact on the portfolio, with the shares purchased at a price of $9.36 each. The firm now holds a 5.00% stake in Pulmonx Corp, representing 0.04% of its investment portfolio.

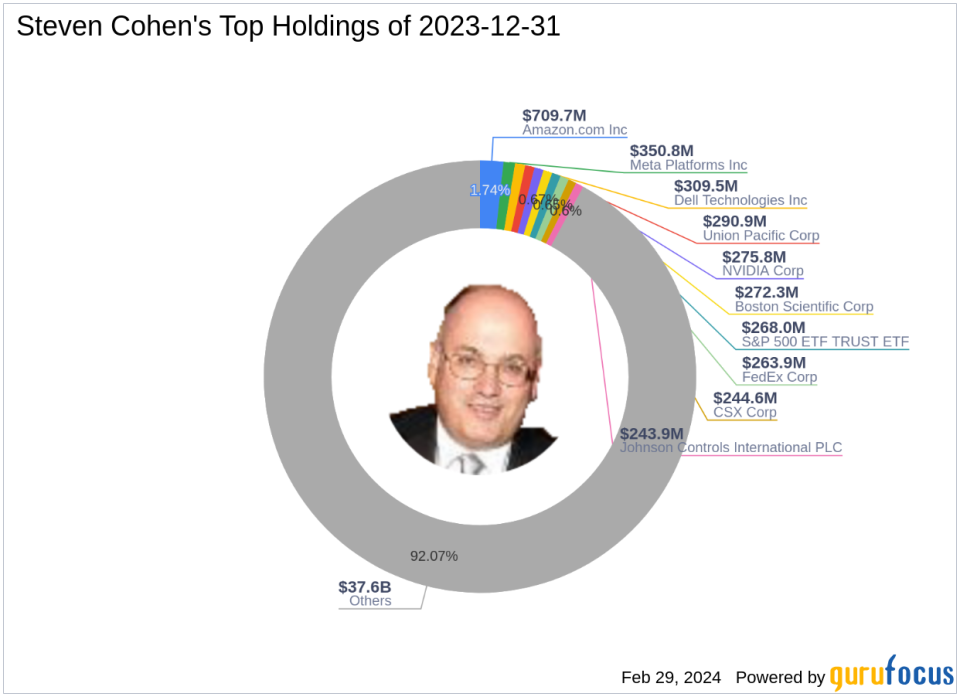

Guru Profile: Steven Cohen (Trades, Portfolio)

Steven A. Cohen, the Chairman and CEO of Point72 Asset Management, is a prominent figure in the investment world. With a career spanning over four decades, Cohen has established a reputation for his long/short equity strategy, which is the core of the firm's operations. Point72 Asset Management, which oversees assets worth $40.82 billion, employs a multi-manager platform and sector-aligned model, relying on fundamental bottom-up research to inform its macro investments. Cohen's firm is also known for its significant holdings in sectors such as healthcare and technology, with top investments in Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and NVIDIA Corp (NASDAQ:NVDA).

Pulmonx Corp Company Overview

Pulmonx Corp, a commercial-stage medical technology company based in the USA, specializes in providing minimally invasive treatments for patients with severe emphysema, a form of chronic obstructive pulmonary disease (COPD). The company's product lineup includes the Zephyr Endobronchial Valve, the Chartis Pulmonary Assessment System, and the StratX Lung Analysis Platform. Since its IPO on October 1, 2020, Pulmonx Corp has been focused on generating revenue through product sales to distributors and hospitals both domestically and internationally.

Analysis of the Trade

The recent acquisition by Steven Cohen (Trades, Portfolio)'s firm has increased its position in Pulmonx Corp to a significant 5.00% stake. The trade price of $9.36 per share is noteworthy, especially when considering the stock's current market performance and valuation metrics. With a current stock price of $9.22, Pulmonx Corp is trading below the GF Value of $27.59, indicating a price to GF Value ratio of 0.33. This suggests that the stock may be undervalued, although it is labeled as a "Possible Value Trap" by GuruFocus, advising investors to think twice before making a decision.

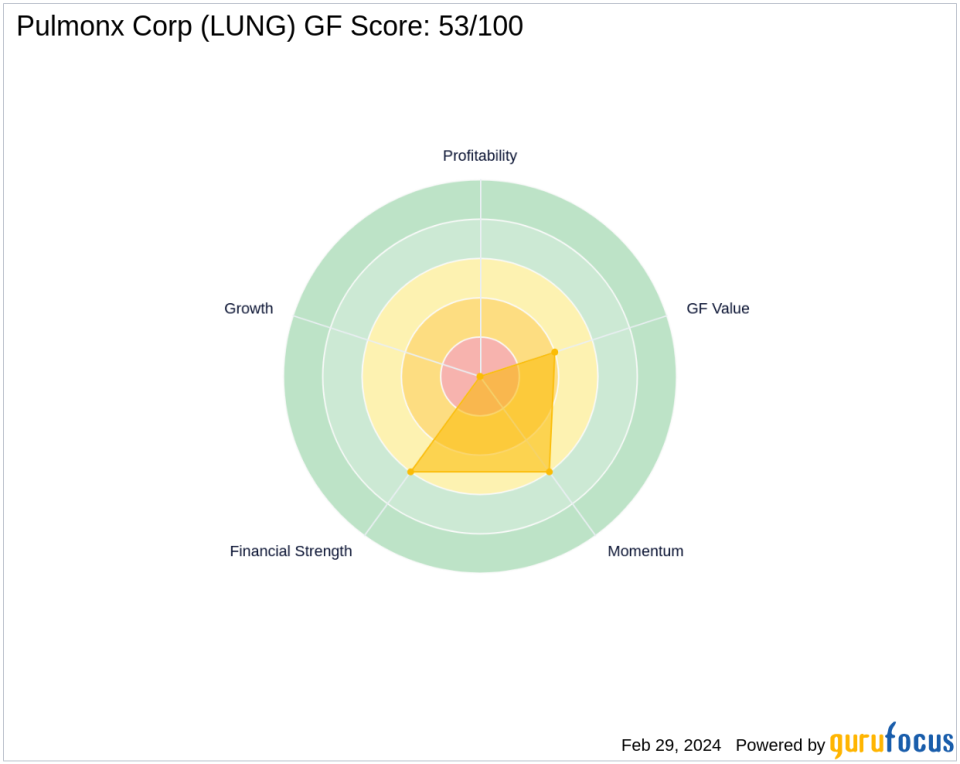

Pulmonx Corp's Stock Performance and Valuation

Pulmonx Corp's stock has experienced a decline of 1.5% since the transaction date, with a significant drop of 76.95% from its IPO and a year-to-date decrease of 27.4%. The company's GF Score stands at 53/100, indicating poor future performance potential. The stock's Financial Strength and Profitability Rank are low, with respective scores of 6/10 and 0/10. However, the firm's Cash to Debt ratio of 2.83 is relatively strong, ranking 391 in its industry. Despite these mixed signals, Cohen's firm has increased its stake, which could be a strategic move based on its investment philosophy.

Sector and Market Context

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management has a history of strong investments in the healthcare and technology sectors. Pulmonx Corp falls within the firm's top sector of healthcare, which may explain the increased interest in the company. The current market conditions and the firm's investment strategy suggest that Cohen sees potential in Pulmonx Corp despite the challenging performance indicators.

Comparative Analysis

When compared to other gurus in the investment community, Point72 Asset Management's stake in Pulmonx Corp is significant. Although the largest guru shareholder information is not provided, Cohen's firm holds a substantial 5.00% of the company, indicating a strong belief in its future prospects. Within the medical devices & instruments industry, Pulmonx Corp's standing is affected by its financial health and market performance, which are areas of concern for investors.

Conclusion

The significance of Steven Cohen (Trades, Portfolio)'s trade in Pulmonx Corp cannot be understated. The firm's decision to increase its stake in the company reflects a strategic move that aligns with its investment philosophy and sector focus. While Pulmonx Corp's current stock performance and valuation present a mixed picture, Cohen's firm appears to be taking a long-term view on the investment. Investors will be watching closely to see how this position evolves and whether it will fit within Point72 Asset Management's successful investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance