State Street (STT) Q3 Earnings Beat on Fee Income, Costs Dip

State Street’s STT third-quarter 2020 adjusted earnings of $1.45 per share outpaced the Zacks Consensus Estimate of $1.42. Also, the figure was 2.1% higher than the prior-year level.

The results reflect new investment servicing wins of $249 billion, improvement in fee income and successful implementation of its cost-saving initiatives. However, lower net interest income, mainly due to lower rates, was the major headwind.

Results included certain non-recurring items. After considering those, net income available to common shareholders was $517 million, down 2.1% from the year-ago quarter.

Revenues & Expenses Down

Total revenues were $2.78 billion, decreasing 4.1% year over year. However, the top line beat the Zacks Consensus Estimate of $2.77 billion.

Net interest revenues declined 25.8% from the year-ago quarter to $478 million. The fall was mainly due to lower market rates, partially offset by higher investment portfolio and loan balances.

Net interest margin decreased 57 basis points year over year to 0.85%.

Total fee revenues grew 2.1% from the prior-year quarter to $2.31 billion. The rise was mainly driven by improving servicing and management fees, robust Charles River Development revenues and FX trading services, partly offset by a fall in securities finance revenues.

Non-interest expenses were $2.1 billion, down 3.5% from a year ago. The decline was attributed to the company’s cost-savings efforts. Excluding notable items, adjusted expenses decreased 1.8% to $2.09 billion.

Provision for credit losses was nil in the reported quarter against $4 million in the prior-year quarter.

Assets Balance

As of Sep 30, 2020, total assets under custody and administration were $36.6 trillion, up 11.4% year over year. The rise was mainly due to higher market levels, net new business growth and client flows.

Also, assets under management were $3.1 trillion, up 6.6% from the prior-year figure. The growth was driven largely by higher market level and net inflows from ETFs, partly offset by institutional net outflows.

Strong Capital and Profitability Ratios

Under Basel III (Standardized approach), estimated Tier 1 common ratio was 12.4% as of Sep 30, 2020 compared with 11.3% in the corresponding period of 2019.

Return on common equity was 8.9% compared with 9.7% in the year-ago quarter.

Our Take

New business wins, strong balance sheet position and cost-saving efforts are likely to continue supporting State Street's profitability. However, lower interest rates and coronavirus-induced economic slowdown remain major near-term concerns.

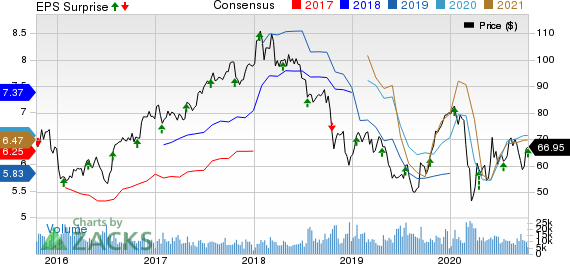

State Street Corporation Price, Consensus and EPS Surprise

State Street Corporation price-consensus-eps-surprise-chart | State Street Corporation Quote

State Street currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Regional Banks

PNC Financial PNC pulled off third-quarter 2020 positive earnings surprise of 62% on prudent expense management. Earnings per share of $3.39 surpassed the Zacks Consensus Estimate of $2.09. Also, the figure was 15% higher than the prior-year level.

U.S. Bancorp’s USB reported third-quarter 2020 earnings per share of 99 cents, which surpassed the Zacks Consensus Estimate of 93 cents. However, the bottom line compares unfavorably with $1.15 reported in the prior-year quarter.

Truist Financial’s TFC third-quarter 2020 adjusted earnings of 97 cents per share surpassed the Zacks Consensus Estimate of 88 cents. Results excluded restructuring charges and BB&T-SunTrust Banks merger-related charges, incremental operating expenses related to the merger, securities gains and charges related to a charitable contribution. Compared to the previous quarter, adjusted earnings improved 18.3%.

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

U.S. Bancorp (USB) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance