State Street (STT) and FNZ to Offer Wealth Manager Servicing

State Street STT is collaborating with FNZ Group on a new wealth manager servicing venture. Per the terms of the agreement, FNZ will acquire a majority interest in State Street’s Wealth Manager Services business, with the latter retaining a minority stake.

The financial terms of the deal, still subject to regulatory approvals and other closing conditions, are not disclosed yet. The transaction is expected to close in the next quarter.

FNZ is one of the leading “global platform-as-a-service provider” that offers digital, personalized, high-quality and low-cost wealth management services in collaboration with financial firms. It serves approximately 8,000 wealth management and financial advice firms across the U.K., Europe, and Asia-Pacific regions and has more than $700 billion in assets under administration.

Thus, the new venture will combine State Street’s custody expertise with the international platform operated by FNZ. Notably, State Street will act as a sub-custodian to the custody assets belonging to Wealth Manager Services’ clients.

Lee Jones, senior vice president of State Street, will join the new venture as CEO upon the transaction’s closure. He said, “We will benefit from a significant investment in technology and people in order to expedite our growth strategy, and we are excited about the future.”

CEO of FNZ, Adrian Durham, said, “This is the first step in a long-term strategy to expand our platform into the North American market. In the US, we see similar long-term drivers in relation to cost, transparency, digitization and personalization in asset and wealth management as other markets in which we operate.”

Earlier in April, State Street had announced partnership with Fidelity National Information Services, Inc.’s FIS Virtus. Through this collaboration, State Street will leverage Virtus’ Business Process-as-a-Service solution to provide collateralized loan obligation and collateralized debt obligation technology management solutions to U.S. and European clients.

Major custodian banks including State Street, BNY Mellon BK and Northern Trust NTRS continue to face a tough operating backdrop amid lower interest rates and coronavirus-induced economic slowdown. So, such collaborations are expected to support top-line growth to some extent.

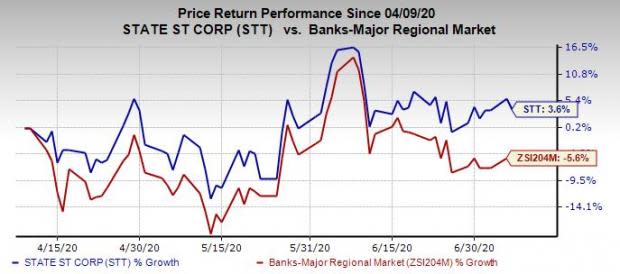

Currently, shares of this Zacks Rank #2 (Buy) company have gained 3.6% over the past three months against the industry’s 5.6% fall. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks to Soar Past the Pandemic: In addition to the companies you learned about above, we invite you to learn about 5 cutting-edge stocks that could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of the decade.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance