Startup helping retail investors wage activist campaigns against Apple and JPMorgan raises $10 million

A London startup helping small-time investors lobby big corporations like Apple and JPMorgan has raised $10 million after operating for just four months.

Tulipshare, founded in July, has raised $10.8 million in ‘seed’ funding from investors including VCs Eurazeo, Speedinvest, and Frst.

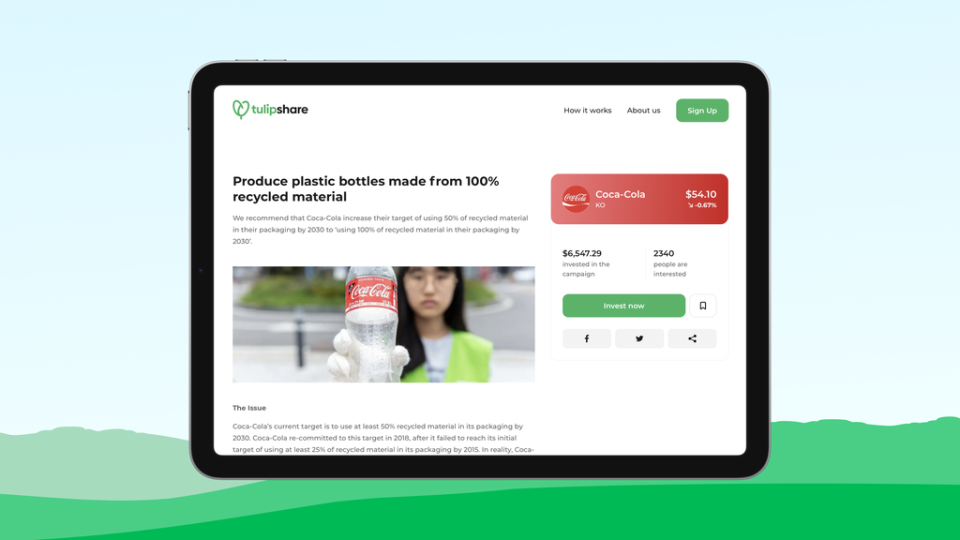

Tulipshare has built a platform that lets retail investors club together to leverage their corporate voting power by running the kind of activist campaigns usually carried out by hedge funds or other large institutions.

“It’s a whole new form of activism we’re advocating,” said Antoine Argouges, Tulipshare’s founder.

Investors who buy shares over Tulipshare platform can pledge them towards relevant campaigns. Campaigns that gain enough momentum on the platform will then get backing from Tulipshare’s team who engage with companies on investors’ behalf.

The mechanism overcomes the hurdle usually faced by small-time investors who want to push for change at companies. In the US, investors must hold $25,000 worth of company stock for a year in order to bring forward a shareholder vote. In the UK, votes must be tabled by at least 100 shareholders or those representing 5% of the stock.

Tulipshare users can suggest their own campaigns, which are then reviewed by the startup’s committee. So far Tulipshare has launched campaigns calling for Amazon to improve conditions in its warehouses, for Coca-Cola to make 100% of its bottles from recycled plastic, and calling for JPMorgan to stop investments in fossil fuel.

The startup campaigned for Apple to allow the “right to repair” its devices. The tech giant recently caved on this point and said it will let people buy parts directly to repair iPhone themselves. Campaigners had long called for this change.

“I don’t take credit for this change,” said Argouges. “I don’t know if it’s a coincidence or not.”

Tulipshare has applied for its broker-dealer license in the US. Argouges said American companies were attractive targets because of their size and influence globally.

“Ultimately, if we change them, we change the world,” he said. “Our product is global, it’s just built in London.”

Antoine is a veteran of the dating app industry, having worked at Match.com and Bumble. Prior to Tulipshare, he founded over-50s dating app Lumen.

His new business taps into two trends: the rise of retail investing and the rise of ESG - ethical, social and governance - pressure on companies.

Millions of people experimented with stock trading during the pandemic and many have stuck around. At the same time, companies have faced growing pressure on ethical and green issues in recent years as investors look for portfolios that reflect their values. Alvarez & Marshall this week said the world was experiencing a “golden age” of investor activism, in part due to the rise of ESG.

Tara Reeves, Managing Director at Eurazeo, said: “ESG is at the core of our investment thesis and now through Tulipshare, activists and retail investors alike can have their voices heard in the corporations by investing and using their shareholder rights to promote meaningful change that is long overdue.”

Tulipshare plans to use its new funds to complete its broker-dealer license process in the UK and hire 20 staff in roles like engineering and compliance.

Read More

AJ Bell takes on Freetrade with commission-free investing app

Yahoo Finance

Yahoo Finance